Leicester and Leicestershire Enterprise Partnership (LLEP) and De Montfort University Leicester (DMU) will collaborate in extending a project to improve digital skills across Leicester and Leicestershire.

DMU has been commissioned to lead the LLEP’s Digital Skills Partnership (DSP) in delivery of the latest phase of its Digital Leicestershire project.

The University will utilise its experience to support the project vision of bringing people and organisations together to increase digital skills.

Digital Leicestershire has three areas of focus:

-

Upskilling digital skills of local small businesses

-

Increasing digital inclusion

-

Developing educational pathways.

The £90,000 project is the second phase of an original LLEP project which commenced during the pandemic to increase online inclusion as residents were locked down.

Many services moved online as a consequence of the pandemic, yet ONS data showed that more than 11% of the East Midlands population were non-internet users and 9% had no digital skills at all.

The new-look DSP will serve as a single portal for small businesses to access digital expertise and technical training. It will also signpost courses varying levels and lengths, as well as working to facilitate inclusion through device, skills and connectivity.

It comes after the first phase of Digital Leicestershire saw the LLEP Skills Advisory Panel (SAP) allocate £300,000 towards addressing Digital Poverty in February 2021 as part of the local Covid recovery response.

Local partners and voluntary groups were consulted about how the money should be used, with skills, connectivity, and availability of devices identified as areas of particular need.

Seven projects were funded – providing recycled devices, laptop lending, and digital buddy schemes – with the aim of supporting more than 1,200 disadvantaged people.

DMU has now been commissioned to take forward a second phase, using repurposed Growing Places Fund (GPF) money to deliver further inclusion activities including:

-

Getting more community organisations accessing free data

-

Supporting equipment recycling and lending schemes

-

Working with partners to access hard-to-reach groups

-

Engaging more businesses through Corporate Social Responsibility plans

-

Increasing use of online learning resources

-

Seeking additional funding for a digital skills strategy for schools.

Activities under the two-year project will continue to be conducted under the Digital Leicestershire brand.

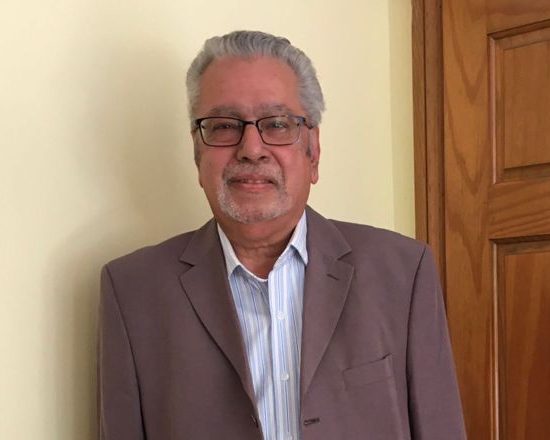

Andy Reed OBE, LLEP co-chair, said: “Inclusion is a core pillar of our regional economic growth strategy and the speed of the move to digital during the pandemic left some in our communities behind.

“Addressing that gap will help to grow our region; the Good Things Foundation has estimated that every £1 invested in digital inclusion could see a return of £9.47 for the economy.”

Research for Phase 2 showed that more than 20,000 roles requiring specialist IT skills were advertised in Leicestershire over a 12-month period. By developing local skills, the project can help to provide a workforce needed by employers.

Helen Donnellan, PVC Regional Business and Innovation, DMU, said: “Digital inclusion is a real issue in Leicester and DMU has been involved in support work for many years with the city’s communities.

“We know that employers struggle to find people with digital skills and the knock-on effect this has on their ability to grow and thrive.

“This valuable work will help address this, helping people not only to gain sought-after skills but to get them into jobs.”

The DSP engages with more than 70 local individuals across the groups, with direction and thought leadership provided by LLEP digital skills ambassador Amit Sinha.

Amit, also chief technology officer for SME and Scale at Microsoft, said: “Digital skills are vital for the future economy and the LLEP partnership with DMU will provide people in our region with not only the basic skills needed for everyday life but also the technical skills required by the employers and industries of tomorrow.”