Unique Vale of Belvoir stables complex sold for residential conversion

Major UK developer will switch on commercial strategy for transformational East Midlands scheme

X-ray specialists see losses widen

Nominations open: East Midlands Bricks Awards 2022

- Most active estate agent

- Commercial development of the year

- Responsible business of the year

- Residential development of the year

- Developer of the year

- Deal of the year

- Architects of the year

- Excellence in design

- Sustainable development of the year

- Contractor of the year

- Overall winner

Book your tickets now

Tickets can now be booked for the awards event – click here to secure yours. The special awards evening and networking event will be held on 15 September 2022 in the Derek Randall Suite at the Trent Bridge County Cricket Club from 4:30pm – 7:30pm. Connect with local decision makers over canapés and complimentary drinks while applauding the outstanding companies and projects in our region. The event will also welcome John Forkin MBE DL, Managing Director at award-winning investment promotion agency Marketing Derby, as keynote speaker.

To be held at:

Nottinghamshire van rental company secures six figure funding to support expansion

New commercial manager for Enrok Construction

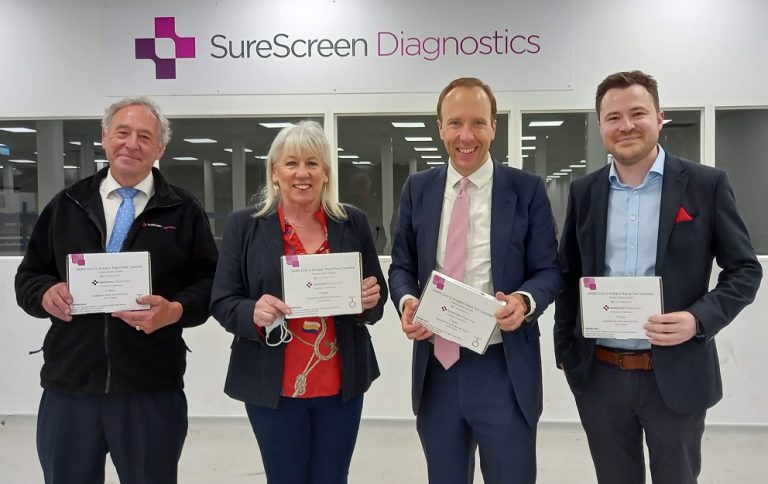

SureScreen Diagnostics gives Matt Hancock a glimpse of the future as lateral flow tests get set for the mainstream

Monthly business insolvencies rise by a third

“Positive momentum” continues at Pendragon

The business’s Motor Division reported an £8.2m increase in operating profit, up from £12.2m in Q1 FY21 to £20.4m in Q1 FY22.

The firm noted that new vehicle supply remained below demand during Q1, and as a result continued to focus on maximising the level of margins achieved per unit. As a result, new gross profit per unit (GPU) at £2,456 was £975 higher than Q1 FY21, more than offsetting volume shortfalls, resulting in new gross profit up 35.4% on a like-for-like basis compared to FY21.

Used vehicles volumes were down 6.7% on a like-for-like basis as supply constraints from lower new car production since 2020 impacted on availability. Used GPU gradually softened during Q1 from levels seen in H2 FY21, but remained higher than Q1 FY21 at £1,767 (Q1 FY21: £1,095). Pendragon said: “The progress previously outlined in respect of our strategy implementation together with group sourcing advantages have helped to underpin this ongoing strong margin performance, which offset volume shortfalls, resulting in used gross profit growth of 47.4% on a like-for-like basis.”

Aftersales revenue and profitability meanwhile grew in the period, while the group’s software business, Pinewood, delivered an operating profit of £2.8m, down from £3.4m in Q1 FY21. Pendragon said this was in line with expectations, driven by increased costs, reflecting investment in resource to support product development and international expansion, together with a return to a more normal level of international travel.

The group’s leasing business, Pendragon Vehicle Management (PVM), recorded growth in operating profit.

Bill Berman, Chief Executive of Pendragon PLC, said: “The positive momentum in the business has continued into the first quarter of this year and I am very pleased with how we have performed.

“The benefits of the work we have done in the past two years to improve our operations, from vehicle sourcing through to online and in store sales practices is evident in our strong trading performance and we have seen good contributions from all parts of the group.

“While we are mindful of the pressures facing our market and our customers, we are confident in our strategy and focused on continuing to deliver profitable growth over the medium term.”

Working women face high levels of burnout despite rise in hybrid working

Council chiefs welcome £5.6m to tackle drug addiction

Manufacturers dissatisfied with the progress of the Government’s Levelling Up agenda

Small firms call for action over disappearance of free cash machines

Investigation reveals Nottingham City Council could have wrongly spent a further £25.759 million of funds

Leasing agents appointed for new 160,800 sq ft warehouse on former Weetabix site in Corby

Dutch logistics giant strikes deal with M&G on 250,000 sq ft unit

783-bed student scheme sold in Nottingham

Ryley Wealth Management expands with acquisition of Lincolnshire firm

Sygnature Discovery acquires Peak Proteins, to strengthen its drug discovery capabilities

Sales up at Light Science Technologies while profits slip

Meanwhile the company posted pre-tax losses of £2.35m, which it says reflects the cost of the AIM admission process and investment in the CEA division.

In October, the business announced its flotation on the London Stock Exchange AIM market, successfully raising gross proceeds for the company of £5m.Simon Deacon, CEO of Light Science Technologies Holdings plc, said: “This was a pivotal period for the company, with the fundraise and admission to AIM providing the foundations for the next stage of our growth trajectory. Having further invested in and developed both operating divisions, we are extremely excited by the opportunities afforded to us.

“Moving forward the group will focus on further expanding its network of strategic partnerships with both major industry players globally, leading academic institutions and bringing experts into our growing team. In our CEM division, we predict there to be no change in the increased demand for electronics. As a result of this and our forward order book, we have begun a programme of investment to automate further production lines to win larger contracts in sensor and medical markets.

“In the CEA division we will continue to build on our contracts and sales pipeline, and expand into new markets in lighting, sensors and automated crop production and management systems, with an aspiration to enter the European and US market over the medium- to long-term. In doing so, we intend to strategically expand our facilities specifically in laboratory R&D at our new planned premises in 2023.”