Another successful year for the East Midlands Expo

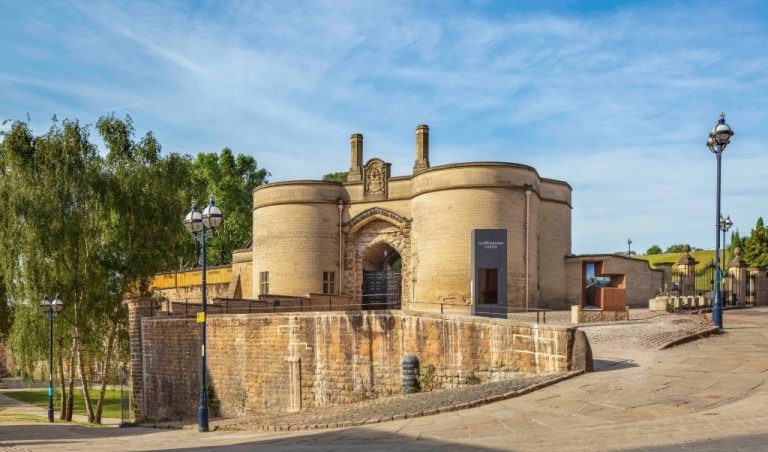

Nottingham Castle closes to visitors as Trust begins process of appointing liquidators

Wilko enters talks for £30m loan

Mobility products manufacturer secures J28 warehouse unit

Commercial Property Partners (CPP) has let a 64,002 sq ft modern warehouse facility at The Nursery in South Normanton to Pride Mobility UK Limited.

The US company, the designer and manufacturer of mobility products, recently acquired the Nottinghamshire-based rise/reclining chair manufacturer Sitting Pretty with a view to relocating its whole operation to accommodate future expansion plans.

Unit 2, which forms part of The Nursery industrial scheme, offered Pride Mobility three times the space of the previous manufacturing site, with circa 85 staff relocating to the new base, which also enjoys easy access to Jct 28 of the M1, only one mile away.

Built in 2006, Unit 2 is a detached steel portal frame unit with 10m clear working height, four dock level loading doors, two level access loading doors, a two storey open plan office with canteen and welfare facilities. Externally, the unit boasts a 40m concrete, fenced and gated yard and circa 80 parking spaces.

Wincobank Way forms part of the South Normanton industrial estate, an established commercial location which has attracted numerous key occupiers including Eurocell, Alloga UK, Radius Systems and GXO Logistics. Road connectivity and access to a local skilled labour market also help to underpin the location as a sought-after manufacturing and logistical base.

Sean Bremner, director at CPP, said: “Staff retention was a key requirement for the tenant and so finding a solution within relative close proximity to their existing premises was important. The company is very brand conscious and Unit 2 represents a high quality building to fit the profile of Pride Mobility UK Limited.

“There was a lot of interest in the facility and we’re delighted to have secured Pride Mobility UK Limited whose expansion ambitions can only be good for the area.”

Stephen Wright, operation director at Pride Mobility UK, said: “Thanks to Sean Bremner, CPP & the owners of the Building. We have been able to move into this building much quicker than we expected, which in turn has given us the space we desperately needed due to the business growing rapidly since acquiring Sitting Pretty back in July 2021.

“The new building gives us the space we need to move the whole operation under one roof, including dispatching goods from South Normanton instead of our Pride Mobility subsidiary in Oxfordshire and more importantly being able to keep all of our existing staff and their wealth of experience rather than having to relocate the business to a different area.

“From January 2023, Sitting Pretty by Pride Mobility Ltd will be running its newly polished, full scale operation out of South Normanton for the foreseeable future.”

Growth for rg+p’s planning division

200 Degrees names Switch Up as charity partner in three-year commitment

East Midlands-based coffee roaster 200 Degrees Coffee has announced its partnership with Nottingham-based Switch Up, as part of a three-year commitment.

The roaster has created a unique Switch Up roast of coffee and brand-new coffee pods, which will be available to order across its 18 coffee shops, with £1 in every kilo roasted going directly to the charity – with a minimum commitment of £10,000 a year.

The speciality grade coffee itself is grown in Guatemala produced exclusively by female farmers, which is unusual in the typical male dominated coffee industry, under the ‘La Morena’ collective group from Volcafe Select. Since they joined the programme, the farmers have raised the quality of their coffee, increased their yields, and, as a consequence, started earning more. In teaching them best practices, their farms are turning out excellent coffee and becoming viable businesses.

Customers can request the Switch Up blend when purchasing bags of coffee in store or online, and on sit in or takeaway drinks during selected times.

Switch Up, which was founded by CEO Marcellus Baz BEM, empowers young people, children and young adults from disadvantaged communities affected by crime and violence to reach their true potential. The charity uses its five-pillar approach to help connect young people with employment, training and education opportunities.

The three-year partnership with 200 Degrees will provide much-needed funding for the charity, enabling its team of mentors to continue to offer their vital support to young people and run its sister organisation the Nottingham School of Boxing.

CEO Rob Darby said: “Life can be challenging and volatile for some young people and the incredible work Marcellus and the Switch Up team do has a direct and positive impact on young lives.

“200 Degrees is a Nottingham born business and it’s important to us to support local organisations and causes. The passion, care and impact of Switch Up is immeasurable and we are humbled and proud to be supporting them.”

200 Degrees is also hosting its annual Swap Shop event, across its 18 coffee shops, on Tuesday 6 December. The coffee roaster is asking customers and members of the public to bring new, unused and unopened hygiene items in exchange for a delicious cup of coffee. These items will then be donated to local charities who need them most, with 200 Degrees’ Nottingham Flying Horse Walk shop gifting its donations to chosen charity Switch Up.

Marcellus Baz, founder and CEO of Switch Up, said: “We are absolutely delighted to be galvanising our partnership with 200 Degrees. The support of 200 Degrees, through their amazing Swap Shop initiative, made a significant difference to the help we could provide to vulnerable families across Nottingham last Christmas.

“This year is set to be even bigger and better through the addition of the donations that will be made through the Switch Up coffee. Purchasing a few bags will make a fantastic Christmas gift or it’s a really great way for local businesses to lend their support to a worthy cause that impacts their city.

“All funds will go towards supporting those struggling with their mental health or at risk of having no food on their table or presents under their tree this Christmas. Unfortunately, with the aftereffects of the pandemic and the cost-of-living crisis still being felt, this will mean that we will be helping more local people than ever before.”

Since its inception in 2013, Switch Up has continued to support over 800 young people at any one time from its boxing gym in St Ann’s, Nottingham, and earlier this year, from a second location in Mansfield. The charity has further plans for expansion, to reach and support more young people and their families.

4 tech upgrades all SBEs must have before 2023

Copley Scientific named Nottinghamshire Business of the Year

Howes Percival strengthens East Mids commercial property team with senior appointment

University appoints OMEETO for property disposals

- Oaklands Manor in Buxton – a former outdoor pursuits centre with 57 acres of woodland which is currently used as a leadership training centre

- Northwood House in Buxton which was originally built as a gentleman’s residence and is steeped in local history which has scope for conversion

- The Harpur Hill Sports Centre in Buxton which is currently part of the Buxton and Leek College

- A commercial retail premises in Leek