A Nottingham-based drug discovery services provider has accelerated its growth after completing its second acquisition in the space of a year.

Sygnature Discovery, which is housed at Nottingham’s pioneering BioCity, has purchased Glasgow-based research institute SB Drug Discovery, bolstering each firm’s market leading capabilities. The contract builds on Sygnature’s acquisition of Peak Proteins in April 2022, following investment from Five Arrows Principal Investments, the European corporate private equity arm of Rothschild & Co, in June 2020.

Sygnature Discovery’s CEO, Dr Simon Hurst, said: “The acquisition of SB Drug Discovery is a great addition to the services Sygnature Discovery offers its customers on our journey to become the world’s leading drug discovery partner.

“This is an exciting step forward, forming a strong partnership with a like-minded company that complements Sygnature’s existing services.”

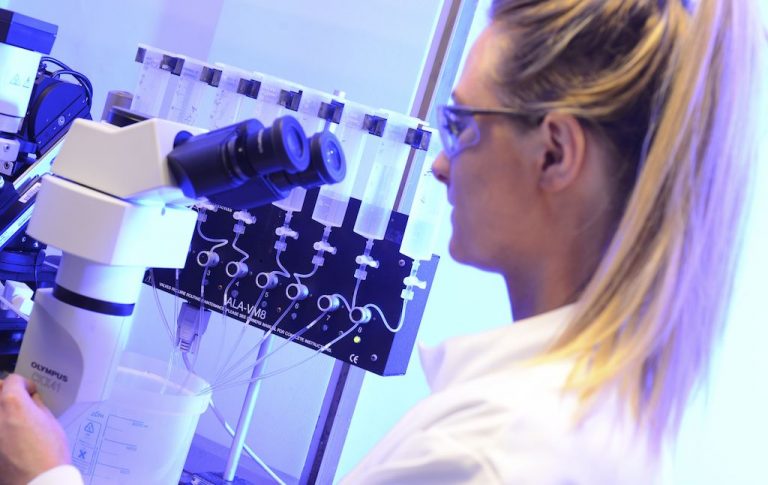

SG Drug Discovery is a world leading provider of ion channel and receptor drug discovery research, delivering cell line generation and compound screening solutions in neuroscience and other therapeutic indications.

Its newest formation under Sygnature will see both firms work together to stimulate growth in the drug discovery field, with further investment and service capability planned by SG Drug Discovery in the coming months.

SG Drug Discovery scientific director, Dr Ian McPhee, said: “Having previously collaborated with Sygnature Discovery to access our ion channel expertise, it became apparent to them that our breadth of capabilities reached far beyond ion channel electrophysiology, to areas including cell line generation, screening and inflammation.

“Our company values and goals fit perfectly and we are delighted to become an integral part of the Sygnature Group.”

The acquisition of SG Drug Discovery by Sygnature is its fifth in five years, with previous purchases including RenaSci in 2018 as well as Alderley Oncology and XenoGesis in 2020. The business employs over 600 people, with facilities in Alderley Park and Macclesfield.

Deloitte in Nottingham provided corporate finance advice to Sygnature Discovery with a team led by David Jones, Nick Carr and Logan Mantle. David added: “We are delighted to have helped the Sygnature team complete the successful acquisition of SB Drug Discovery. This is the third acquisition we have supported Sygnature with as the business has grown and expanded its service and geographic footprint.”