Major demolition works underway as regeneration of Northampton’s town centre gathers pace

Sandyford enters East Midlands with Derbyshire industrial estate purchase

Sandyford Properties has acquired Salcombe Road Industrial Estate in Alfreton, Derbyshire, marking its first investment in the East Midlands. The 35,300 sq ft multi-let estate comprises 16 units ranging from 1,550 sq ft to 3,100 sq ft.

The estate was purchased at auction for £2.5 million from Derbyshire County Council, which had owned the property since its original development. It generates a gross rental income of £203,114 annually, with potential to increase in line with market trends. The units feature steel portal frame construction, brick and block elevations, high eaves, roller shutters, and a large forecourt with dedicated parking.

Sandyford plans refurbishment and proactive asset management across the estate. Salcombe Road Industrial Estate benefits from direct access to the M1 motorway and strong connectivity to Derby, Nottingha,m and Mansfield.

The acquisition extends Sandyford’s portfolio beyond Staffordshire and Cheshire and positions the company for further growth in the region. FHP acted as advisor and will manage lettings, while Hill Dickinson provided legal counsel.

Double letting for event production specialist in Castle Donington

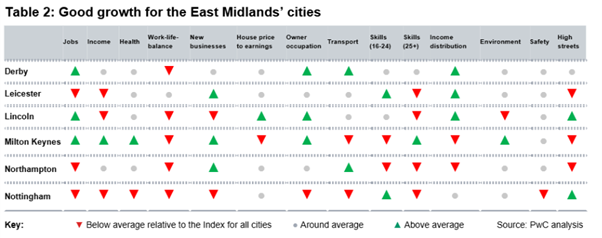

East Midlands has emerging employment hub shows PwC Good Growth for Cities Index

The six Good Growth Cities in the East Midlands generally performed below the national average when measured against public priorities.

Rankings in the Index are as follows:

The six Good Growth Cities in the East Midlands generally performed below the national average when measured against public priorities.

Rankings in the Index are as follows:

- Lincoln: ranked 20th (24th last year)

- Derby: ranked 24th (23rd last year)

- Leicester: ranked 32nd (20th last year)

- Northampton: ranked 36th (39th last year)

- Nottingham: ranked 40th (25th last year)

Gi Group helps 50% of candidates secure new roles in seven days

Gi Group UK, part of Gi Group Holding, has helped 50% of unemployed and redundant candidates in the East Midlands secure new roles within a week of first contact.

The region recorded an unemployment rate of five percent from March to May 2025, the third highest in the UK. Candidates have been connected with employers across manufacturing, logistics, industrial, pharmaceutical, engineering, and automotive sectors, supporting workforce continuity during periods of job transition.

Working alongside its sister brand, INTOO UK & Ireland, Gi Group provides career coaching, financial guidance, CV development, and outplacement services. Redundancy is viewed as an opportunity for upskilling, enabling individuals to transition into new roles with confidence.

From Nottingham, Gi Group engages with a network of 25 local businesses. Across the UK, it employs around 240 staff in 69 locations, supporting over 1,000 clients.

Expansion in East Midlands business activity accelerates to fastest since February 2024

Acquisitive Phenna Group expands presence in Europe

Transpennine Route Upgrade adds financial wellbeing support for workforce

Transpennine Route Upgrade (TRU), the multi-billion-pound railway programme connecting Manchester, Huddersfield, Leeds and York, has partnered with Northampton’s Commsave Credit Union to offer financial wellbeing support to its workforce.

The initiative provides TRU staff with access to ethical savings accounts, affordable loans, and financial education resources. Employees can participate in workshops, webinars, and use the Commsave Educates app for budgeting and money management guidance.

The partnership forms part of TRU’s broader employee benefits strategy, recognising the long-term nature of the project, with some staff engaged for up to ten years. By supporting financial resilience, the programme aims to maintain focus and stability among employees while delivering a major infrastructure upgrade on time and on budget.

Commsave Credit Union, a UK-based not-for-profit co-operative, specialises in providing members with secure savings, responsible credit, and financial literacy resources. The collaboration marks a strategic move to integrate workforce wellbeing into the delivery of complex infrastructure projects and could serve as a model for the wider construction and transport sectors.

Expand your network at the East Midlands Bricks Awards 2025

Tickets for the East Midlands Bricks Awards 2025 can be booked here.

Complementary drinks and nibbles will be served on arrival. Dress code is standard business dress.With the shortlist now announced, see who the finalists are here.

The East Midlands Bricks Awards 2025

What: The East Midlands Bricks Awards 2025 When: Thursday 2nd October (4.30pm – 7.30pm) Where: Derek Randall Suite, Trent Bridge Cricket Ground, Nottingham Keynote speaker: Councillor Nadine Peatfield – Leader of Derby City Council, Cabinet Member for City Centre, Regeneration, Strategy and Policy, and Deputy Mayor of the East Midlands Tickets: Available here Dress code: Standard business attire Don’t miss this opportunity to connect with property and construction professionals while applauding the exceptional companies and projects in the region. Thanks to our sponsors:

To be held at: