- Bulwell Bogs: The Bulwell Bogs area will be fully refreshed with a new planting and landscape design, including a high-quality play offer to cater for all ages. It will see renewal and expansion of the splash park and introduction of a refreshments kiosk with toilet and changing facilities to make the park a great place to visit – particularly in summer months. Lighting and CCTV will also be upgraded

- Market place: Existing market equipment will be replaced with a flexible mix of stalls, along with better access to electrical power on site, allowing flexibility in attracting both new and existing vendors

- Bus station public toilets: The existing bus station toilets will be rebuilt and modernised

- Wider public realm refurbishment: Paving will be renewed across the pedestrianised areas of the town centre along with new seating and street trees. Connections will be improved between the Market Place and the Bogs area to bring these separate parts of the town centre together

Updated proposals shared for £20m Bulwell town centre improvements

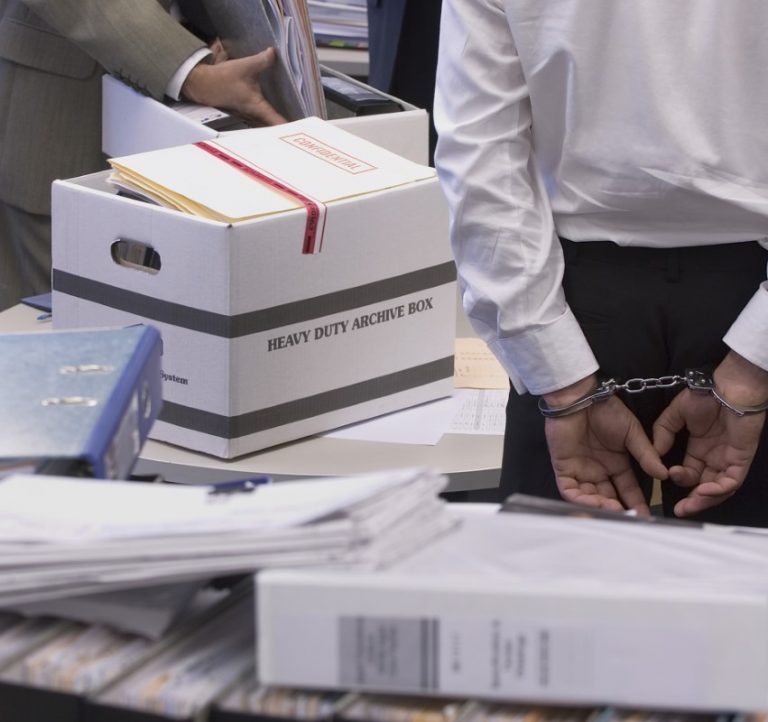

Hospitals offer resignation scheme to cut back-office workforce

University Hospitals of Northamptonshire (UHN), which manages Northampton General Hospital and Kettering General Hospital, has launched a Mutually Agreed Resignation Scheme (MARS) in an effort to reduce staffing levels without resorting to compulsory redundancies.

The scheme, which opened this week, targets corporate, administrative, and support roles. Patient-facing clinical staff are not included in the offer. Under MARS, employees can apply to resign in exchange for a severance payment. Unlike standard voluntary redundancy, the process does not require formal consultation.

UHN stated the approach aims to manage staffing reductions in a structured and voluntary way. However, unions have raised concerns about the impact on workloads and patient services if significant numbers of staff leave. NHS guidelines stipulate that such schemes must be time-limited, typically no longer than three months.

While not guaranteeing avoidance of future layoffs, UHN is using MARS as a first step to restructure and streamline operations.

Solar energy project near Heckington moves to next approval stage

The proposed Beacon Fen Energy Park, a large-scale solar and battery storage development located 2.5 km north of Heckington, is advancing to the pre-examination phase after the UK Planning Inspectorate accepted its Development Consent Order (DCO) application.

The project, led by renewable energy firm Low Carbon, aims to deliver approximately 400 megawatts of electricity through ground-mounted solar panels, with an additional 600 megawatts of battery storage capacity. It is intended to support the UK Government’s target of reaching 70 gigawatts of solar power by 2035.

Now in the pre-examination stage, the scheme will undergo a formal six-month review in 2025, involving written submissions and public hearings. Businesses and stakeholders can register to participate in the process through the Planning Inspectorate’s platform.

If granted consent, construction could begin as early as 2027. The project is positioned to contribute to the UK’s net zero ambitions while strengthening long-term energy security through increased renewable generation and storage infrastructure.

Lincolnshire elder care charity shuts down amid ongoing financial strain

Age UK Lindsey, a long-established charity supporting older adults in Lincolnshire, will cease operations this week due to sustained financial pressure. The closure affects services provided across West Lindsey, East Lindsey, and North Lincolnshire.

The organisation cited a combination of long-term funding shortfalls, rising operational costs—including increases in National Insurance contributions and the national minimum wage—and lingering economic fallout from the Covid-19 pandemic and cost-of-living crisis.

While Age UK Lindsey is shutting down, related services in the region will continue through Age UK Lincoln and South Lincolnshire, which is working to absorb affected clients and coordinate future support.

This closure underscores a broader trend within the UK voluntary sector. According to the Charity Commission, financial pressures have reduced public donations significantly since 2020, even as demand for services has tripled. Many organisations are facing difficult decisions, including closures and mergers, as funding fails to keep pace with growing needs.

Cooper Parry makes thirteenth deal in two years

Reward Funding expands Midlands team

Ariel Plastics makes pivotal appointment

East Midlands property consultancy takes on 2,400-mile fundraising relay challenge

Fraud losses in Derbyshire jump 467% as scam activity spikes in Q1 2025

Derbyshire businesses and residents suffered £1.3 million in scam-related losses during the first quarter of 2025, according to Santander’s latest Scamtracker report—a dramatic 467% increase on the previous quarter.

The report tracks the scale and nature of Authorised Push Payment (APP) scams and other financial fraud incidents. While Kent led in terms of scam volume outside London with 208 recorded cases, Derbyshire followed closely with 104 incidents. Despite fewer cases, Derbyshire tied with Devon for the second-highest monetary losses outside the capital, each reporting £1.3 million lost.

The volume of scam activity in Derbyshire rose by 10% compared to the final quarter of 2024, signalling growing challenges for financial crime prevention in the region. Other counties, including Hampshire and Greater Manchester, also saw significant increases in fraudulent activity.

The data signals a rising threat for firms managing business payments and customer interactions, particularly as APP scams continue to evolve. The findings reinforce the importance of tightening internal controls, staff training, and client verification procedures to mitigate fraud risks.

The report serves as a warning to businesses operating in high-risk regions to remain vigilant as scam tactics become more sophisticated.

Retailers eye bank holiday lift amid shifting commuter and spending trends

Retailers are banking on a sales uplift during the May bank holidays, as 22 million UK workers plan annual leave, according to Virgin Media O2 Business’s Q1 2025 Movers Index. The report combines anonymised mobile network data with national polling to track movement and behaviour patterns across the country.

Retail footfall dropped 8% year-on-year in Q1 2025, continuing a sluggish start to the year marked by a reported 41% increase in retailers experiencing reduced customer spending. To counter this, 55% of retailers plan to offer special deals or events to draw in customers during the upcoming holidays. However, staffing is a concern, with 42% of retailers blocking employee leave over the period and more than half worried about shortages due to domestic travel plans.

Commuter activity has increased, with a 5% rise in travel during the first three months of the year. Office attendance is also rising, with 52% of employees commuting more frequently and 43% of businesses expected to enforce full-time office returns by June. Wednesday remains the busiest day for office presence. Workers are responding positively to these mandates, especially when companies offer new perks and invest in workplace culture.

Consumer spending remains cautious. Nearly half of Brits plan to spend less over the next three months, with many cancelling subscriptions and prioritising value-driven purchases. The decline is most noticeable among middle-aged shoppers, with the 25–54 demographic making significantly fewer trips to retail areas.

Digital convenience continues to influence purchasing habits. A majority of consumers shop via phone or online to find the best deals, while those who still shop in-store rank checkout speed, Wi-Fi availability, and mobile connectivity as their top priorities. Subscription models tied to travel, wellness, and home improvements may offer stronger potential, as these are the main spending categories identified for spring.

The data highlights a shift in how both consumers and businesses are navigating 2025’s economic landscape. Retailers hoping to drive sales will need to align with evolving work patterns, spending priorities, and customer experience expectations.