Rigby & Co

Microlise drives growth with two pivotal appointments

UK private sector growth hits one-year high

UK private sector activity reached its strongest level in a year in August, led by growth in the services sector, according to preliminary S&P Global data. The flash UK composite purchasing managers’ index (PMI) rose to 53.0, up from 51.5 in July, signalling expansion across the economy.

Services, which cover finance, real estate, hospitality, and entertainment, saw the largest increase in new work. Firms reported stronger domestic demand and rising overseas sales following a subdued spring. Manufacturing output, by contrast, continued to contract, with the rate of new orders falling sharply.

Employment across the private sector has declined for 11 consecutive months, as companies manage rising operating costs. Input cost inflation reached its highest level since May, driven by increases in food, transport, international shipping, and national insurance contributions. Businesses, particularly in services, have passed on higher costs to customers through increased pricing.

Despite the growth, analysts note that the overall demand environment remains uneven, with ongoing geopolitical uncertainty affecting business confidence. The rebound in services is moderating previous weakness, but challenges in manufacturing and cost pressures continue to shape the broader UK economy.

Profits jump at Chesterfield packaging manufacturer

Robinson plc, the Chesterfield-based packaging manufacturer, has seen profit and revenue rise.

In its interim results for the six months ended 30 June 2025, the business shared how pre-tax profits have jumped to £1.8m, from £700,000 in the same period last year.

Meanwhile, revenue saw a 2% increase to £27.6m, from £27.1m, with sales volumes in line with the first half of 2024.

Alan Raleigh, chairman, said: “The results for the first half of 2025 continue to build on the excellent progress made in 2024.

“Whilst market conditions remain challenging and we continue to experience softness and volatility in demand from some existing customers, we also continue to see new opportunities in our sales pipeline which we expect to see the benefit of in future periods.

“We are delivering on our surplus property disposal agenda, which will reduce indebtedness and create a simpler more streamlined business. We continue to refresh our strategy to identify opportunities and the necessary capabilities for further growth in revenue and profits.

“The Company expects underlying operating profit for the 2025 financial year to be ahead of 2024 and in line with current market expectations. We remain committed in the medium-term to delivering above-market profitable growth and our target of 6-8% underlying operating margin.”

Robinson was formerly a family business with its origins dating back to 1839, and currently employs nearly 400 people.Fresh Italian acquisition for Nottingham’s Phenna Group

New National Highways hub set to boost Derbyshire road operations

South Derbyshire District Council has approved a National Highways facility near the A38/A50 Toyota Roundabout. The compound will centralise winter road treatments, vehicle maintenance, and emergency response operations, employing 50 staff and housing six gritters.

Designed for 24/7 operations, the site will feature offices, a garage, fuel and wash stations, and a large salt storage container. National Highways expects the facility to improve response times for snow clearance, gritting, and other severe weather interventions, ensuring critical routes remain operational within required service windows.

While residents raised concerns over traffic, noise, and round-the-clock activity, planners determined that economic and operational benefits outweigh the impact on nearby properties. The compound is also expected to generate indirect support for local businesses through staff expenditure.

The development reflects a wider trend of strategic investment in road infrastructure, emphasising operational readiness and community support while meeting regulatory and service obligations on key transport networks.

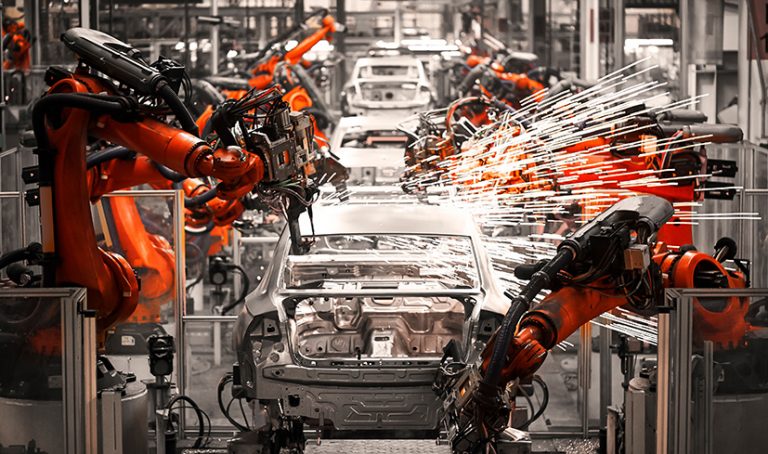

Manufacturing output volumes see sharp fall in three months to August

Developer submits plans for 80 affordable homes in Derbyshire

Wheeldon Brothers Limited has lodged an outline planning application with Amber Valley Borough Council for a residential development west of Crosshill, situated between Codnor and Heanor. The proposal covers 80 homes designed to provide a mix of one- to four-bedroom properties.

Planning documents indicate the scheme is intended to address the local shortfall in affordable housing. The developer frames the project as a response to both regional housing pressures and national policy objectives aimed at increasing the supply of new homes. The submission includes details on the layout and housing mix but remains at the outline stage, meaning final designs, infrastructure plans, and timelines are subject to further approval.

If approved, the development would add to the area’s stock of lower-cost homes, potentially supporting local workforce retention and meeting growing demand from households priced out of the wider market. The council’s planning team will assess the proposal for compliance with local planning policy, infrastructure capacity, and environmental considerations before any permission is granted.

The application signals continued interest from developers in delivering housing projects that align with affordability targets while contributing to regional growth strategies.

Nottingham set to host UK’s first fusion energy prototype

Invest in Nottingham and Marketing Nottingham toured the West Burton site, preparing to become the UK’s first prototype fusion energy plant under STEP Fusion. The project aims to deliver operational fusion energy by 2040.

STEP Fusion is converting the former power station into a hub for advanced clean energy research and development. The programme forms part of the Trent Clean Energy Supercluster and is projected to generate high-skilled employment across construction, engineering, and research sectors.

Local partnerships are central to the project, with organisations working to connect regional businesses to opportunities arising from the fusion programme. STEP Fusion anticipates contributing to Nottinghamshire’s economy through job creation, skills development, and investment attraction, while supporting the UK’s broader clean energy targets.

The West Burton site will play a key role in demonstrating safe, scalable, and sustainable fusion energy. The project is positioned to advance national energy innovation and strengthen the UK’s position in next-generation power technologies.