Nottingham workflow automation specialist expands further into Asia-Pacific region

Future of Ashby de la Zouch hotel secured as planning permission granted

Midlands space innovation recognised at Farnborough Airshow

Jobs on the line at Derby warehouse

A JD Group spokesperson told the BBC: “We have entered into a period of consultation with colleagues based at our Derby distribution centre.

“This is in relation to a review of the Derby distribution centre. We are doing all we can to look after those colleagues impacted and recognise this may be an unsettling time for them.”

Elsewhere in Derby, it was recently announced that JD will more than double the size of its existing 9,397 sq ft presence at Derbion. Set to open towards the end of this year, the new 20,175 sq ft flagship store will showcase brands including Nike, Adidas, The North Face, Jordan and EA7.

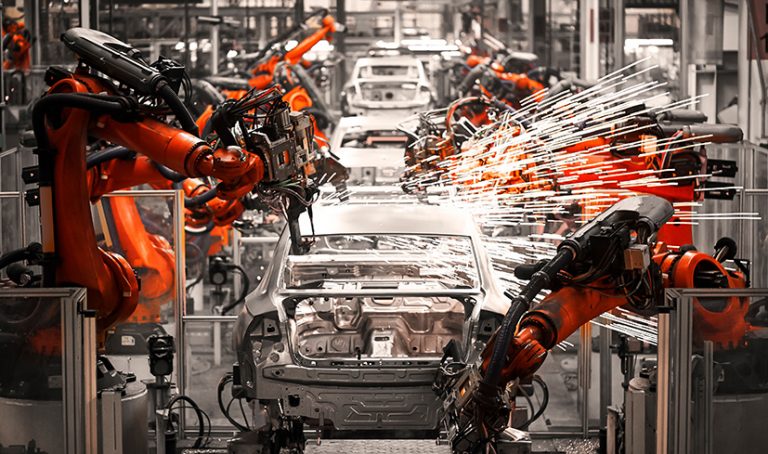

Manufacturing output expectations strongest since 2022

- Output volumes were broadly unchanged in the quarter to July (weighted balance of -3%, from +3% in the three months to June). Firms expect volumes to grow in the next three months (+25%), the strongest expectations since March 2022.

- Output rose in 6 out of 17 sub-sectors, with growth in the motor vehicles & transport equipment, chemicals, mechanical engineering and electrical goods sub-sectors offsetting declines in furniture & upholstery and metal manufacturing sub-sectors.

- Total new orders fell in July, at a similar pace to the previous quarter (balance of -9% from -6% in April). Domestic orders fell through the quarter (-15% from -6%), while the volume of new export orders was broadly unchanged (+3% from -14%). Manufacturers expect total new orders to be essentially unchanged over the next three months.

- Business sentiment fell in July, after rising in April for the first time in nearly three years (balance of -9% from +9% in April). Export optimism for the year was flat after rising last quarter (0% from +6%).

- Investment intentions for the year ahead generally strengthened compared with April. Manufacturers expect to raise investment in product & process innovation (a balance of +18% was the strongest since January 2022, up from +15% in April), in training & retraining (+7%, from +1%), and in plant & machinery (+6%, from +2%). Investment in buildings is set to fall (-11%, from -3%).

- The main constraint on investment was uncertainty about demand (cited by 44% of manufacturers), followed by inadequate net return (35%), a shortage of labour (20%), and a shortage of internal finance (19%). Concerns around the cost of finance have retreated from a 33-year high set in January (excluding the pandemic period) but remain double the long run average (10%).

- Average costs rose rapidly in the quarter to July (balance of +52%, from +39% in April; long-run average of +18%). Costs growth is expected to remain elevated in the quarter to October (+36%).

- Average domestic prices increased over the three months to July (balance of +15%, from +10% in April). Export price inflation also accelerated from April (+22% from +9%, and the fastest pace in over a year). Both domestic and export price growth are expected to slow in the next three months (+2% and +6%, respectively).

- Stocks of work in progress (balance of +4%) rose marginally in the quarter to July, while stocks of finished goods (+2%) and of raw materials (-1%) were broadly stable.

- Manufacturers expect stocks of work in progress (+13%) to rise at the fastest pace in over two years during the next three months, with stocks of raw materials (+7%) and of finished goods (+5%) also set to increase.

- Numbers employed were unchanged in the quarter to July, after falling in April (balance of 0% from -6%). Firms expect numbers employed to rise modestly in the next three months (+16%).