‘It’s wonderful’, says Chesterfield woman named amongst UK’s most impressive businesswomen

Leicester wealth management company sees growth despite “complex macroeconomic backdrop”

Ian Mattioli MBE, Chief Executive Officer, said: “The first six months of this financial year saw the Group deliver improved organic growth despite the complex macroeconomic backdrop that persisted throughout the period.

“Our priority remains the delivery of profitable organic growth and we are pleased to report further progress towards our medium-term strategic goals, with revenue of £59.1m up 8% on the equivalent period last year (1H23: £54.9m) driven by positive performance across our pensions advice and administration, employee benefits and investment management operating segments.

“The success of our new business initiatives, combined with our expanding product range and the strength of existing client referrals resulted in organic revenue growth of 4% despite a 0.4% reduction in the value of total client assets to £15.2bn.

“The Group’s improved organic growth resulted from a combination of clients’ demand for advice and proactive communication by advisers, with a 13% increase in the value of new clients on boarded in the first half versus the equivalent period last year.

“The Group’s strong, integrated business model facilitates multiple engagement points in providing a holistic service to our clients and to generate multiple revenue streams to facilitate future revenue growth.

“The combination of improved organic growth, positive contributions from recent acquisitions and continued cost management delivered 10% growth in adjusted EBITDA to £16.5m (1H23: £15.0m).

“Profit before tax was up 60% to £7.6m (1H23: £4.8m), in part due to reduced deferred consideration payments recognised as remuneration expense under IFRS 3 of £2.5m (1H23: £3.9m) and lower acquisition-related costs of £0.3m (1H23: £0.5m), while adjusted profit before tax was up 15% to £15.6m (1H23: £13.5m) after adding back acquisition-related costs, platform project costs, deferred consideration recognised as an expense and amortisation of acquired intangible assets of £4.2m (1H23: £3.9m).

“We believe the benefits of operating a responsibly integrated business allows us to secure great client outcomes while delivering strong, sustainable shareholder returns over the long term. The Board remains committed to a progressive dividend, while maintaining an appropriate level of dividend cover. Accordingly, the Board is pleased to announce an interim dividend of 9.0p per share (1H23: 8.8p) up 2.3%, demonstrating our desire to deliver value to shareholders.

“The first half of the financial year has seen the Group deliver a resilient trading performance against a complex macroeconomic backdrop. We plan to build on this position, advancing our key strategic initiatives: new business generation, investing in our adviser academy training programmes, developing our investment proposition, developing new products and services, reviewing our processes, and investing in technology to deliver operational efficiencies and growth through the integration of strategic acquisitions.

“Our trading outlook for the year remains in line with management’s expectations and we believe the Group remains well-positioned to take advantage of the growth opportunities in the UK wealth market and deliver sustainable returns for our stakeholders.”

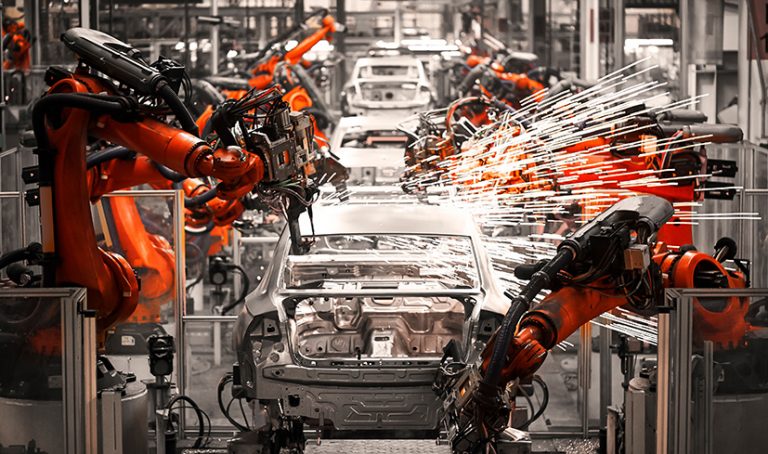

Output volumes unchanged, while demand uncertainty and finance costs weigh on manufacturers’ investment plans

- Business sentiment was unchanged in the three months to January after deteriorating sharply last quarter (balance of -2% from -17% in October). Export optimism also fell, at a slower pace than in the three months to October (-7% from -22% in October).

- Output volumes were broadly unchanged in the quarter to January (balance of +1% from +2% in October) but are expected to rise modestly over the next three months (+8%).

- Orders or sales were the most commonly cited factor likely to limit output in the next three months (65% from 64% in October).

- The share of firms citing a shortage of materials or components was broadly stable (25% from 26% in October).

- The share citing a shortage of skilled labour as a likely constraint on output fell (to 28% from 36% in October) but stands well above the long run average (18%).

- The share citing credit or finance as a likely limit on output was broadly unchanged through the quarter (11% from 9% in October, matching the joint highest figure since October 2009, excluding the pandemic period).

- Total new orders fell slightly in the three months to January (balance of -2% from +1% in October) and are expected to grow marginally in the next three months (+6%). Export orders fell sharply (-16% from 0% in October) and are expected to fall again in the next three months (-10%).

- Growth in average costs per unit of output accelerated in the quarter to January, ending six consecutive quarters of slowing cost growth (balance of +43% from +30% in October). Costs are expected to rise at a similar pace over the next three months (+41%).

- Domestic selling prices were unchanged (balance of +1%, from +7% in October). Export prices were also unchanged in the quarter (+3% from 0% in October). Domestic selling prices are expected to rise next quarter (+14%), and export selling prices are expected to remain unchanged (+3%).

- Numbers employed increased at a modest pace in the quarter to January (+8% from -7%). SMEs expect headcounts to be unchanged in the next three months (0%).

- Investment intentions for the year ahead were mixed. SME manufacturers expect to increase investment in training & retraining (+7% from +6%) and product & process innovation is expected to be unchanged (+2% from +3%). But investment in tangible assets such as buildings (-22%, unchanged from October) and plant & machinery (-12%, from -10%) is expected to fall.

- The main constraint on investment was uncertainty about demand (cited by 53% of firms), followed by labour shortages (24%). Financing constraints on investment have risen to multi-decade highs with the cost of finance (23%, its highest since January 1991, excluding the pandemic) and a shortage of internal finance (also 23%, at its highest since October 2013, again excluding the pandemic period) standing well above their long-run averages.

EMR urges HGV drivers to know their vehicle’s height after last year saw 54 bridge strikes across its network

- Going off the line of route, including under diversion

- Operating ‘not in service’ and taking a shortcut

- Insufficient route knowledge returning a vehicle to the depot for maintenance

- Those normally drive a single-deck vehicle taking a double-deck vehicle on a single-deck route