- Raj Raithatha, NBV Enterprise Solutions: Business Planning, your roadmap to success

- Barry Taylor, Laugh Therapy UK: March to WELLth: Happiness, Play and Laughter for Wellbeing and Business Success

- John Morley, i-Sourcer: Using LinkedIn to grow your business, what worked for me and the benefits of advertising online

- Gau Naik, Exemplas: Accessing the Right Money at the Right Time

New business owners don’t need to go it alone, says Leicestershire Growth Hub

Lincolnshire timber firm to be sold

Frasers Group to buy bike retailer’s brand and intellectual property

202,000 sq ft of new space completes at St. Modwen Park Derby

St. Modwen Logistics has completed four new logistics units totalling 202,000 sq ft at St. Modwen Park Derby. An additional 147,000 sq ft pre-let unit is also due to be completed this Spring as part of this second phase of development.

This latest c.£60 million phase of the Park’s development adds to the existing first phase of 300,000 sq ft completed at the Park. The four new units, ranging in size from 27,000-82,000 sq ft, have been built to St. Modwen Logistics’ ‘Swan Standard’ of sustainable construction, achieving BREEAM ‘Excellent’ accreditation and an EPC A+ rating.

St. Modwen Logistics has already secured a diverse mix of occupiers at St. Modwen Park Derby.

German heat pump manufacturer Vaillant occupies a 131,000 sq ft unit, whilst Swedish medical technology company Getinge has also established a new Global Centre of Excellence for Chemistry within a 79,000 sq ft building which also acts as its UK headquarters.

In October 2023, St. Modwen Logistics also announced that it has leased a c.40,000 sq ft unit to global automotive company Kia for use as a cutting-edge new training academy for the next generation of Kia employees.

Robert Richardson, Development Director at St. Modwen Logistics, said: “St. Modwen Park Derby has already attracted a variety of blue-chip industrial and logistics occupiers, contributing to its reputation as a national hub for training and research for the manufacturing, healthcare and automotive industries.

“This latest phase of development, which will more than double the Park’s industrial and logistics floorspace, provides occupiers of all sizes the opportunity to benefit from the scheme’s thriving business ecosystem, exceptional sustainability features and commanding location in one of the UK’s most in-demand logistics markets.”

25,000ft² of space adjoining the A38 at Junction 28 of the M1 sold

Pace of AI adoption means Government and education system have to catch-up fast, say small firms

- 46% not having the knowledge to use it correctly.

- 31% their ability to manage security risks.

- 24% the impact of deepfakes.

- 20% the abuse of their IP rights.

- 12% whether it will reduce the long-term viability of their business.

- Make it illegal to use deepfakes with the intent to cause commercial damage, with legal recourse available for victims.

- Request the Law Commission conduct a review into the use of AI and how it relates to IP, and how best to update existing laws to make it clear that copyright can only sit with a human author.

- Broaden the remit of Ofcom so it regulates cloud infrastructure in the same way as utility providers, ensuring cloud infrastructure remains affordable.

- Creating a GCSE and A-Level qualification in applied computing, that focuses on the practical use of AI.

- Specific new programmes to help make small business owners make the best possible use of AI in their business, including to better assess training and to make sure take-up of new technology is supported.

New Government railway funding needs to do more to respond to East Midlands’ needs, warns Chamber

Chesterfield plant company secures £400,000 asset finance package to support growth

Paragon Bank’s SME Lending Division has supported Chesterfield-based plant company SH Plant Ltd to purchase two trucks through an asset finance funding solution of £400,000. The company has purchased two Volvo articulated dump trucks through an asset finance package of £400,000 to support its growing business, adding to its fleet of existing vehicles. Of the two vehicles purchased, one of the articulated dump trucks was bought at auction, with the finance agreed with Paragon Bank before the auction took place. This enabled SH Plant to finalise the deal with the auction house on the day and collect it in less than a week. The second vehicle was purchased directly from Volvo, via Paragon Bank. SH Plant is a family-run business in Chesterfield operating in the quarrying industry. It specialises in rock extraction, soil stripping, hauling, and restoration works. The company was founded by company Director, Terry McGrael, who has over 40 years’ experience in the industry. Terry works alongside his wife, Hazel, and daughter Rosie to manage the day-to-day running of the business. This deal was led on behalf of Paragon’s SME Lending division by Todd Auger, Business Development Manager who works in the Vendor team, headed by Terry Lloyd.

SH Plant Limited Managing Director, Terry McGrael said: “It’s been great to work with Todd and the Paragon team for the purchase of our two new Volvo articulated dump trucks that will help us to expand our business operations.

“We’re pleased that we were able to source the vehicles from two different suppliers, one direct from Volvo and the other via auction, and still work with Paragon to fund both.”

Paragon Bank SME Lending Division Business Development Manager Todd Auger added: “It’s been a pleasure to work with Terry again, we’ve had a relationship with SH Plant Limited since 2021 and have helped the company to acquire various types of machinery and vehicles to support its expansion over the years. “At Paragon we can offer flexibility when it comes to the method of purchase, therefore we were thrilled to be able to support Terry to purchase one of the vehicles at auction, helping him to agree the funds before the auction took place.”

M&A report reveals Midlands ‘significantly outperformed’ other UK regions in 2023

Despite deal volume declining across the UK, the Midlands ‘significantly outperformed’ other regions, according to Experian’s 2023 UK and Ireland (UK&I) M&A Review.

Although the Midlands saw a 7% year-on-year decline in deal numbers, it performed better than other UK regions, which all experienced steeper declines from 2022 to 2023. National deal activity overall declined by 12% during a challenging year for market conditions, however a connection to the Midlands was found in approximately 15% of all UK transactions.

Despite the widespread decline in deal volume, advisers PKF rose three ranks to become the 5th most active dealmaking team in the Midlands and a further six places in the national rankings to become the 7th most active in the UK. PKF completed 103 eligible deals, with the Midlands division and mid-market specialists PKF Smith Cooper securing 22 of those deals with a combined value of £277m.

Darren Hodson, Corporate Finance Partner, said: “93% of our transactions involved Midlands businesses, clearly demonstrating that Midlands-based companies remain attractive to investors.

“In addition to fuelling M&A activity on home soil, we completed a number of cross-border deals, drawing on our global reach and access to international purchasers.

“We are in the midst of ambitious expansion plans for our advisory team and are actively recruiting. We have been growing team numbers to prepare for anticipated increased deal activity in 2024-25 and also seeking to expand our financial due diligence services where we feel there is significant demand for our quality of service.

“We are currently seeing high levels of M&A interest in the technology and renewables sectors and we are optimistic that dealmaking levels in the Midlands and UK will recover from 2023 levels, as uncertainties around inflation, interest rates and political and macro concerns subside, especially with alternate funders and increasing PE activity supporting the market in 2024.”

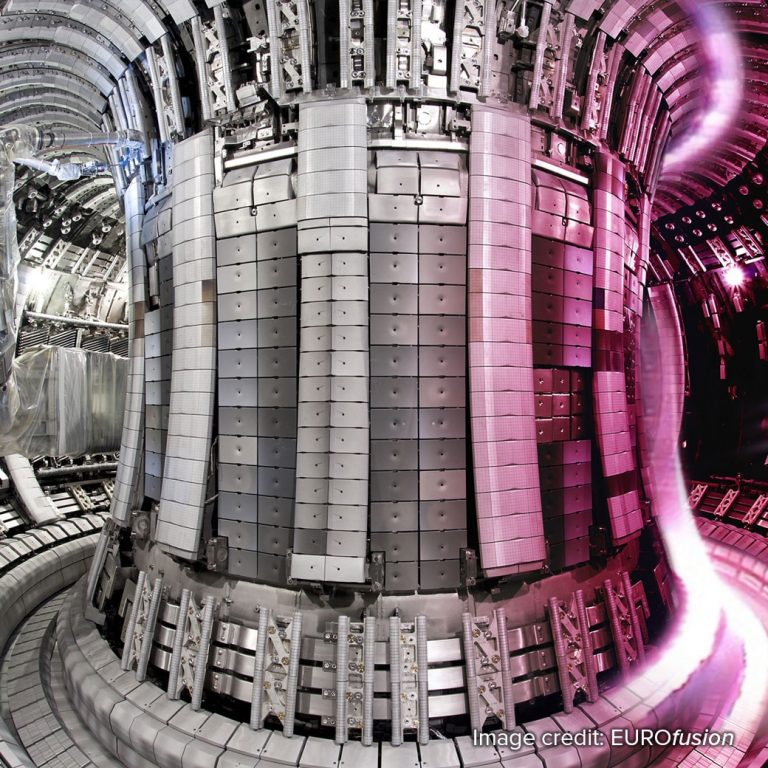

Firms offered chance to learn about fusion energy at West Burton

- the environment, innovation and climate change resilience

- health and wellbeing

- an inclusive economy

- identity/distinctiveness, taking into consideration culture and heritage.