Midlands PE-backed mid-market businesses saw average 51% EBITDA growth over three years

Inflation comes in lower than expected for February

Alpesh Paleja, Lead Economist, CBI, said: “Inflation is heading in the right direction, and should fall below the Bank of England’s 2% target sometime in the Spring. However, the path beyond this is likely to be bumpy: shifting base effects mean that it will likely rise back above 2% later in the year, before settling down more sustainably.

“While the Bank of England are likely to look through these ups and downs, they will still want to see more definitive movement on domestic price pressures before committing to cutting interest rates.”

Revenue and profits slip at Eurocell

Darren Waters, Chief Executive of Eurocell plc, said: “The trends reported at our half year results in September continued for the remainder of 2023, with some further modest weakening in our key markets. Against this challenging backdrop, we are pleased to report profits for the year in line with expectations and strong cash flow generation.

“We took early and decisive action on costs in response to lower volumes and have continued to focus on efficient working capital management, driving a good cash flow performance. Whilst the near-term outlook for our markets remains challenging, these actions leave us well placed to benefit from a market recovery when it comes.

“Our review of strategy is now complete and I am very pleased with the outcome. Looking ahead, we have identified a clear pathway to building a £500m revenue business, generating a 10% operating margin over a five-year period, built around four pillars; Customer Growth, Business Effectiveness, People First and ESG Leadership.

“This is an ambitious vision, but when we aggregate the growth opportunities, and apply a degree of sensitivity, we believe it is an achievable target, with the potential to create significant shareholder value.”

Over 160 new energy-efficient homes to be built in Bolsover

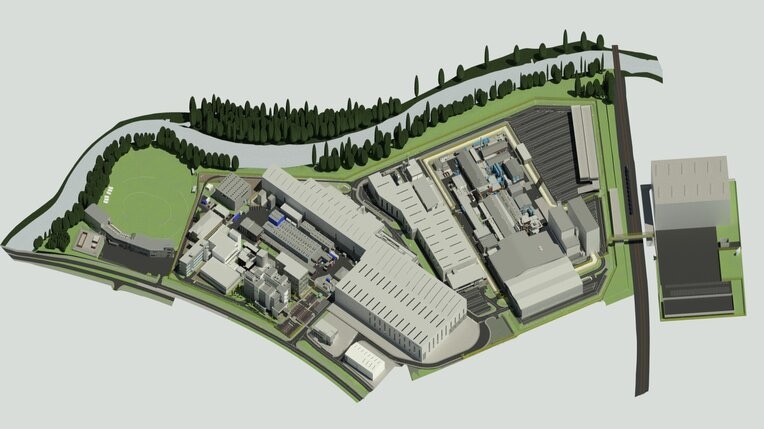

Rolls-Royce selects design partner in key milestone for expansion of Raynesway site

Rolls-Royce Submarines Infrastructure Director Terry Meighan said: “AUKUS won’t be delivered by one or two companies. It will take strong partnerships across the whole supply chain to meet the increased demands for the critical work we do. Selecting WSP as our design partner is the start of our journey to meeting the demands placed on us.

Oliver Curlett, Head of Defence & Security at WSP, said: “WSP is proud to be partnering with Rolls-Royce to design optimised, resilient and complex critical infrastructure which enables ongoing delivery of its world-leading capability to customers, both now and into the future.

Wellingborough automotive firm acquired

Revenue rises while pre-tax profits slip at Mortgage Advice Bureau

Mortgage Advice Bureau has seen revenue rise and pre-tax profits dip in its final results for the year ended 31 December 2023.

Revenue grew to £239.5m, up from £230.8m in 2022, while statutory profit-before tax slipped to £16.2m from £17.4m, and adjusted profit before tax decreased to £23.2m from £27.2m. During the year, market share of new mortgage lending was up 11% to 8.3%, though gross mortgage completions were down 8% to £25.1bn and gross new mortgage completions were down 21% to £18.6bn.Peter Brodnicki, Chief Executive, said: “Against a very challenging backdrop in 2023, MAB continued its exceptional track record of outperformance and market share growth in all market conditions.

“Despite the severe market downturn, we continued our investment across the entire business and remained resolutely focused on long-term growth. Our proposition for growth focused mortgage and protection firms is outstanding, underpinned by best-in-class technology, lead generation and infrastructure, and our aim is to continue to further increase MAB’s differentiation versus our competitors and grow market share and profitability.

“2024 has started well, with both purchase and re-financing activity having picked up significantly. We believe this signals the early stages of a market recovery that builds towards a catch-up year in 2025, with pent-up demand continuing to be released as consumer confidence and affordability increase.

“Although we expect organic adviser growth to start building some momentum again in H2 as our AR firms gain more confidence in the sustainability of the recovery, recruitment activity in terms of new AR firms is exceptionally strong, reflecting the significant strides we have made in terms of our technology and lead generation developments, as well as how we have engaged with and supported our partner firms with the introduction and integration of Consumer Duty.

“Following an exceptionally strong year for our most mature investment First Mortgage, strong progress has been made in terms of efficiencies and lead sources in all our other AR investments, with adviser productivity in these firms being significantly higher than our average across the Group. We expect a record performance from our investments this year and believe the portfolio will contribute to accelerated Group profit growth over the medium term.”

Yü Group delivers another set of record breaking results

Yü Group, the independent supplier of gas and electricity to the UK corporate sector, has reported “significant growth” in revenue and profitability for 2023.

According to final audited results for the year to 31 December 2023, revenue grew to £460m, up from £278.6m in 2022, following strong sales bookings.

Profit before tax, meanwhile, increased to £39.7m, from £5.8m in 2022.Bobby Kalar, Chief Executive Officer, said: “It’s been an extraordinary year and I’m very pleased with our strong performance, delivering another record breaking set of results.

“We have a strong forward order book which continues to build into 2024, and with this high degree of predictability, I remain confident in delivering another strong performance and continuing to deliver further shareholder value in 2024 and beyond.

“We’ve made significant strategic and operational progress. I’m very excited by the capability of Yü Smart and the value it creates for the Group. We have a transformational new commodity trading agreement with Shell, and all the foundations and digital-led systems in place to ensure continued growth.

“We are increasing our dividend payment to reward our loyal investors and we look forward to providing further growth in shareholder distributions.

“I’m grateful to the Board who continue to deliver the right blend of challenge and encouragement to me and my team.”