Mansfield Innovation Centre boosts local economy by more than £1.2m

£20 million Government funding could be a ‘game changer’ for Lincoln

The city council’s Executive are set to discuss how a successful bid for a new railway bridge connecting Skellingthorpe Road to Tritton Road could be a ‘game changer’ Lincoln’s Western Growth Corridor

Lutterworth cyber security solutions company acquires Bracknell firm

Revenue grows at electrical retailer against “particularly challenging market back-drop”

Emmanuel House reveals £2m plans to convert building into 20-bed accommodation to reduce rough sleeping in Nottingham

Loughborough Town Deal confirms £2.5m grant to help build on town’s sporting reputation

- £2.6 million to create a Digital Skills Hub at Loughborough College

- £900,000 to create a Careers and Enterprise Hub in Loughborough’s town centre

- £835,000 to help save Taylor’s Bell Foundry, the last major bell foundry in the UK

- £885,000 to fund towpath improvements alongside the River Soar

- £1.6 million to a creative arts hub at the Generator.

- £1.7 million to support the Bedford Square Gateway Project which has regenerated part of the town centre

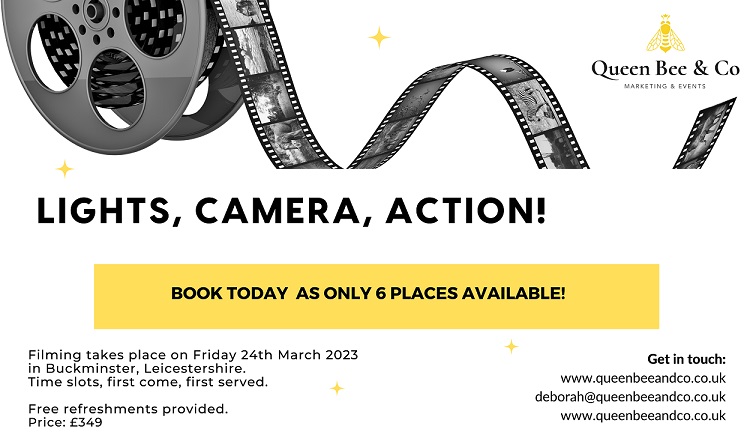

Lights, Camera, Action! Premium-grade fully polished video for your business for just £349

Do you need to submit a Self-Assessment return? By Kelly Goodchild, tax manager at Streets Chartered Accountants

- The self-employed (earning more than £1,000);

- Taxpayers who had £2,500 or more in untaxed income;

- Those with savings or investment income of £10,000 or more before tax;

- Taxpayers who made profits from selling things like shares, a second home or other chargeable assets and need to pay Capital Gains Tax;

- Company directors – unless it was for a non-profit organisation (such as a charity) and you did not get any pay or benefits, like a company car;

- Taxpayers whose income (or that of their partner’s) was over £50,000 and one of you claimed Child Benefit;

- Taxpayers who had income from abroad that they needed to pay tax on;

- Taxpayers who lived abroad and had a UK income;

- Income over £100,000.

- Ensuring all tax allowances and deductions are claimed

- Easing the burden of additional paperwork

- Specialist tax knowledge which can help you minimise or even mitigate fully any tax liability, now or in the future.

University of Nottingham engineers to deliver commercial services following launch of independent business unit

Three-quarters of UK companies hit by labour shortages in last 12 months

- Nearly half (46%) of those who have faced labour shortages in the past 12 months have been unable to meet output demands; 36% made changes to or reduced the products or services they offer, while 26% reduced planned capital investment.

- Nearly three quarters of respondents (72%) said the UK has become a less attractive place to invest/do business in over the past five years.

- Respondents were most likely to see shortages of labour (75%) and access to skills (72%) as threats to labour market competitiveness. Concern about labour costs (59%) has risen on last year and the cost of living (69%) has become a significantly larger threat. Meanwhile, concern about the impact of employment regulation (35%) has been stable.

- Seven in ten respondents (70%) thought access to labour would still be a threat to labour market competitiveness in 5 years’ time.

- In response to labour market shortages: 55% of firms reported that they are investing in training to upskill current employees; 56% are investing in base pay; 45% in improving their Employee Value Proposition; while 40% are investing more in technology/automation.

- When asked what measures government should prioritise to help ease labour shortages, 46% called for the government to introduce incentives to help businesses invest in technology and automation to boost productivity, while 44% wanted government to grant temporary visas for roles that are in obvious shortage.

- A third of respondents (33%) planned higher levels of recruitment for permanent roles over the coming 12 months compared to the previous year, down from 46% last year, while 39% expected the same level of recruitment.

- Nearly half (46%) of respondents whose firms are taking action to support employees on cost of living reported bringing forward or having additional pay reviews, and 36% gave staff one-off bonus payments.

- A third (34%) of respondents reported that their organisation’s approach to the next pay round was best described as ‘giving a general increase below inflation’, significantly higher than previous years; organisations giving a pay increase in line with inflation (29%) is the lowest since 2012.

- Only 7% expected to provide a general pay increase above inflation in their next pay round, the lowest in almost a decade.