SEV has joined the sponsor line up for the

East Midlands Bricks Awards 2025, backing the Overall Winner award!

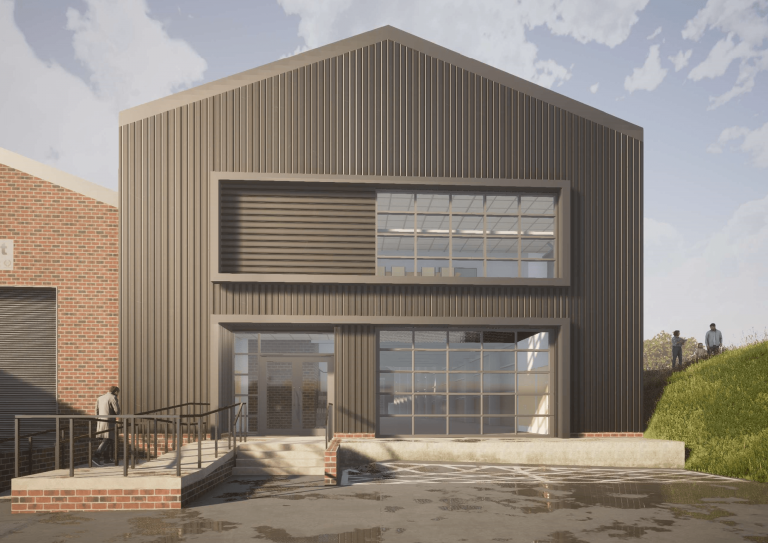

SEV is a leading bespoke joinery manufacturer based in Nottingham, delivering exceptional craftsmanship and tailored solutions to the commercial, retail and residential sectors across the UK. Established in 1997, the business has built a strong reputation for quality, reliability, and collaborative working, making it a trusted partner for designers, contractors, and developers alike.

Operating from its modern manufacturing facility, SEV offers a full end-to-end service — from design support and technical detailing through to precision manufacturing, finishing, and installation. Highly skilled craftsmen and project managers work closely with clients to bring your creative concepts to life, whether it’s a flagship retail fit-out, executive apartments, or high-specification residential joinery.

Speaking with Business Link, Gary Pearce, Managing Director at SEV, said: “We’re proud to be sponsoring the East Midlands Bricks Awards 2025. As a company committed to supporting sustainable growth and delivering innovative energy and infrastructure solutions, SEV is excited to celebrate the organisations and individuals shaping the future of the East Midlands’ built environment.

“The Bricks Awards are a fantastic platform to recognise the remarkable work happening across the region — from transformative developments to outstanding community projects. We’re particularly looking forward to connecting with like-minded professionals and celebrating the ingenuity and impact of this year’s finalists.

“We encourage businesses of all sizes to enter and showcase their achievements. Whether you’re driving regeneration, delivering infrastructure, or pioneering sustainability, this is your moment to be recognised.”

The East Midlands Bricks Awards, which will take place on

Thursday 2nd October at Nottingham’s famous

Trent Bridge Cricket Ground, celebrates the successes of property and construction companies in Derbyshire, Nottinghamshire, Leicestershire, Lincolnshire, and Northamptonshire.

Recognising those behind the changing landscape of the East Midlands, the occasion highlights development projects, businesses, and people in commercial and public building across the region – from office, industrial and residential schemes, through to community projects such as leisure schemes and schools. It also toasts the work of architects, agencies, and those behind large schemes.

Welcoming almost 150 professionals, nominating a company or project for the awards is a great way to showcase your successes, recognise your team’s efforts, bolster morale, and reach our audience of over 60,000 business readers, while also offering a chance to connect with respected professionals. It’s

completely free to enter and making the top three finalists in your category also wins you

free tickets to the event.

To make a nomination for the East Midlands Bricks Awards 2025, please click here.

Supporting imagery, video, documents, or links to these, can be sent to

bricks@blmgroup.co.uk. Video nomination pitches are also welcome as an alternative or companion to written entries.

Categories include:

All finalists will have the chance to take home the Overall Winner award, which this year comes with a

grand prize of a year of marketing/publicity worth £20,000, with the opportunity to split or gift the marketing to a charity of your choice.

Nominations will close on Friday 15th August.

New for this year, all entrants will also have the opportunity to be featured on our dedicated

nominee showcase on the East Midlands Business Link website, providing space for marketing your achievements. Upon submitting a nomination, we will get in touch for any information, imagery, and video nominees would like to be featured on their showcase page.

The East Midlands Bricks Awards 2025

What: The East Midlands Bricks Awards 2025

When: Thursday 2nd October (4.30pm – 7.30pm)

Where: Derek Randall Suite,

Trent Bridge Cricket Ground, Nottingham

Keynote speaker: Councillor Nadine Peatfield – Leader of Derby City Council, Cabinet Member for City Centre, Regeneration, Strategy and Policy, and Deputy Mayor of the East Midlands

Tickets: Available

here

Dress code: Standard business attire

Thanks to our sponsors:

To be held at:

With a limited number of sponsorship opportunities remaining, please contact Angie Cooper at

a.cooper@blmgroup.co.uk to learn more if you are interested in becoming an East Midlands Bricks Awards 2025 sponsor.

Operating from its modern manufacturing facility, SEV offers a full end-to-end service — from design support and technical detailing through to precision manufacturing, finishing, and installation. Highly skilled craftsmen and project managers work closely with clients to bring your creative concepts to life, whether it’s a flagship retail fit-out, executive apartments, or high-specification residential joinery.

Speaking with Business Link, Gary Pearce, Managing Director at SEV, said: “We’re proud to be sponsoring the East Midlands Bricks Awards 2025. As a company committed to supporting sustainable growth and delivering innovative energy and infrastructure solutions, SEV is excited to celebrate the organisations and individuals shaping the future of the East Midlands’ built environment.

“The Bricks Awards are a fantastic platform to recognise the remarkable work happening across the region — from transformative developments to outstanding community projects. We’re particularly looking forward to connecting with like-minded professionals and celebrating the ingenuity and impact of this year’s finalists.

“We encourage businesses of all sizes to enter and showcase their achievements. Whether you’re driving regeneration, delivering infrastructure, or pioneering sustainability, this is your moment to be recognised.”

The East Midlands Bricks Awards, which will take place on Thursday 2nd October at Nottingham’s famous Trent Bridge Cricket Ground, celebrates the successes of property and construction companies in Derbyshire, Nottinghamshire, Leicestershire, Lincolnshire, and Northamptonshire.

Recognising those behind the changing landscape of the East Midlands, the occasion highlights development projects, businesses, and people in commercial and public building across the region – from office, industrial and residential schemes, through to community projects such as leisure schemes and schools. It also toasts the work of architects, agencies, and those behind large schemes.

Welcoming almost 150 professionals, nominating a company or project for the awards is a great way to showcase your successes, recognise your team’s efforts, bolster morale, and reach our audience of over 60,000 business readers, while also offering a chance to connect with respected professionals. It’s

Operating from its modern manufacturing facility, SEV offers a full end-to-end service — from design support and technical detailing through to precision manufacturing, finishing, and installation. Highly skilled craftsmen and project managers work closely with clients to bring your creative concepts to life, whether it’s a flagship retail fit-out, executive apartments, or high-specification residential joinery.

Speaking with Business Link, Gary Pearce, Managing Director at SEV, said: “We’re proud to be sponsoring the East Midlands Bricks Awards 2025. As a company committed to supporting sustainable growth and delivering innovative energy and infrastructure solutions, SEV is excited to celebrate the organisations and individuals shaping the future of the East Midlands’ built environment.

“The Bricks Awards are a fantastic platform to recognise the remarkable work happening across the region — from transformative developments to outstanding community projects. We’re particularly looking forward to connecting with like-minded professionals and celebrating the ingenuity and impact of this year’s finalists.

“We encourage businesses of all sizes to enter and showcase their achievements. Whether you’re driving regeneration, delivering infrastructure, or pioneering sustainability, this is your moment to be recognised.”

The East Midlands Bricks Awards, which will take place on Thursday 2nd October at Nottingham’s famous Trent Bridge Cricket Ground, celebrates the successes of property and construction companies in Derbyshire, Nottinghamshire, Leicestershire, Lincolnshire, and Northamptonshire.

Recognising those behind the changing landscape of the East Midlands, the occasion highlights development projects, businesses, and people in commercial and public building across the region – from office, industrial and residential schemes, through to community projects such as leisure schemes and schools. It also toasts the work of architects, agencies, and those behind large schemes.

Welcoming almost 150 professionals, nominating a company or project for the awards is a great way to showcase your successes, recognise your team’s efforts, bolster morale, and reach our audience of over 60,000 business readers, while also offering a chance to connect with respected professionals. It’s

With a limited number of sponsorship opportunities remaining, please contact Angie Cooper at

With a limited number of sponsorship opportunities remaining, please contact Angie Cooper at