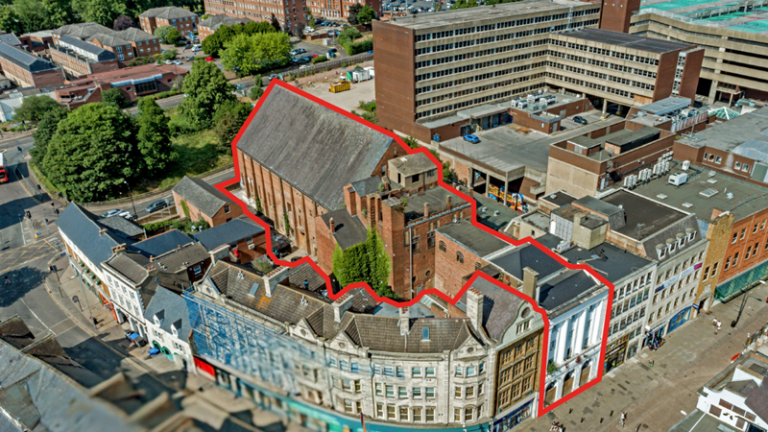

Step forward for Northampton’s Greyfriars regeneration as council completes purchase of iconic Corn Exchange

76% of UK financial services chiefs to increase office attendance in next 12 months

More than three quarters (76%) of financial services leaders across the UK are planning to increase office attendance in the next 12 months, according to new research from KPMG UK.

The survey of 150 leaders working across banking, insurance, asset and wealth management and private equity found that more than a third (37%) of those planning to increase attendance will expect employees to be in the office at least four days a week.

Financial services were a first mover in returning staff to the office post-pandemic, with some of the major investment banks being the first to vocalise a vision for a full office return. However, they also see the value of the hybrid working model, with more than half (58%) of UK financial services leaders saying it is a competitive opportunity for the sector; 20% of these say the opportunity is significant.

A separate study by KPMG into the working preferences of financial services employees found that just 10% want to work in the office full time. Despite differing locational working preferences, all age groups of employees said flexibility around hybrid working is important when choosing a job.

Karim Haji, Global and UK head of financial services at KPMG, said: “There is no one-size fits all approach to this and businesses are still trying to find the hybrid working sweet spot more than two years on from the pandemic.

“Leaders see the commercial value of hybrid working models, particularly when it comes to attracting and retaining talent, but they are still expecting greater office attendance in the coming months to retain collaboration with colleagues and clients. Leaders also have to balance regulatory and risk pressures as part of managing hybrid models, which will be a contributing factor for getting staff back into the office.

“What is important is that companies find the right balance that works for their business and their employees. This will ensure that the sector retains good people and fosters a collaborative, productive culture that is successful and competitive.”

Leaders are planning to track attendance in several ways. Almost 45% plan to monitor attendance through office card swipe systems, followed by 40% using timesheets and just under a third (29%) will install digital cameras.

East Midlands businesses invited to have say on government Industrial Strategy before time runs out

Allscreens Nationwide secures windscreen repairs and replacement deal with Tesco

Chesterfield restaurant & foodservice supplier gobbled up

Warehouse investment sold in Ilkeston

Revenue declines at “distracted” Travis Perkins

Administrators appointed to Nottinghamshire manufacturer

Frasers Group makes push to install Mike Ashley as boohoo CEO

Shirebrook-based Frasers Group has said there is a “leadership crisis” at fashion retailer boohoo, proposing the solution is to make its founder Mike Ashley CEO.

Frasers, which is the largest shareholder in boohoo group, with 27% of the issued share capital, has sent an open letter to the Board calling for a meeting of shareholders to vote on appointing Mike Ashley as a director and CEO, as well as Mike Lennon, a restructuring expert, as a director.

It comes after boohoo announced that John Lyttle would be stepping down as CEO, following five years with the Group, and amidst declining revenue. In its letter, Frasers critiqued the business’s Board, saying it has lost its ability to manage boohoo’s business and investments. In a statement to the London Stock Exchange, Frasers added: “Frasers is requisitioning a general meeting of boohoo to appoint Mr. Mike Ashley as a director and CEO of boohoo and Mr. Mike Lennon as a director of boohoo, to take effect without delay. Frasers firmly believes that these appointments are in the best interests of boohoo, its shareholders and its stakeholders.“The Board appointments proposed by Frasers are now the only way to set a new course for boohoo’s future. Frasers urges boohoo shareholders to vote in favour of its proposals.”

The boohoo Board is in the process of reviewing the content and validity of the requisitions with its advisers.