Housebuilder breaks ground on Ruddington development

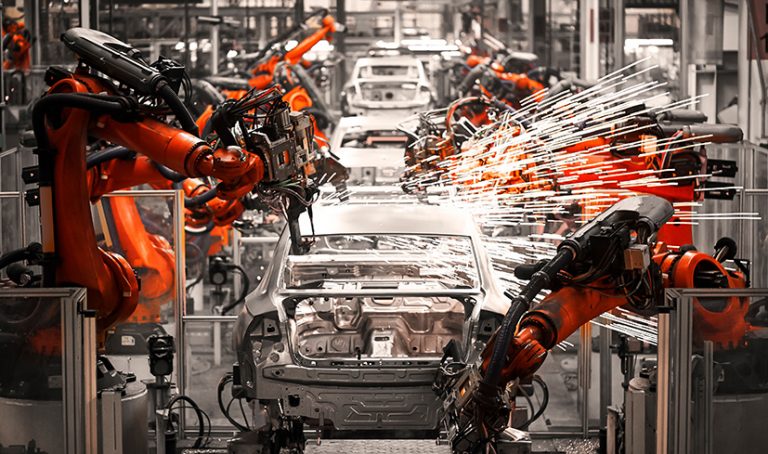

Toyota launches Derbyshire-based circular factory for vehicle recycling

Toyota Motor Europe (TME) has announced the launch of its first Toyota Circular Factory (TCF) at its Burnaston plant in Derbyshire. The facility aims to maximise recycling, repurposing, and remanufacturing of end-of-life vehicles. It will begin operations in the third quarter of this year and serve as a model for future sites across Europe.

The TCF will focus on three areas: reintroducing reusable parts into the market, remanufacturing commodity items such as batteries and wheels, and recycling raw materials like copper, aluminium, steel, and plastic for use in new vehicle production.

TME expects the UK facility to process 10,000 vehicles annually, recovering 120,000 parts, 300 tonnes of high-purity plastic, and 8,200 tonnes of steel. The company plans to expand similar operations across Europe and collaborate with other organisations on circular economy initiatives.

Toyota aims to achieve complete carbon neutrality by 2040 and reduce CO2 emissions across its European product line-up by 100% by 2035. The TCF initiative supports these goals by cutting vehicle manufacturing and material use emissions.

Lagan Homes acquires land for 112-home project in Nottinghamshire

Lagan Homes has purchased eight acres at Fairham, a mixed-use development in Nottinghamshire by Clowes Developments. The developer has submitted a reserved matters planning application to Rushcliffe Borough Council for 112 homes, with 10% designated as affordable housing.

Founded in 1985, Lagan Homes operates across England, Northern Ireland, and the Republic of Ireland. The Fairham project is part of the broader development to create a sustainable new community.

Angus Johnson, Senior Land Manager at Lagan Homes, said: “We are excited to be part of the transformative development in Fairham, contributing to the creation of a vibrant and sustainable new community. “Our vision is to build thoughtfully designed homes that meet the diverse needs of the community, ensuring a mix of properties that offer style, comfort, and functionality. With 10% of our homes designated as affordable housing, we remain dedicated to providing opportunities for people to access high-quality housing in the area.”InstaVolt expands UK EV charging network with new hubs

As part of its nationwide expansion, InstaVolt has added new ultra-rapid EV charging hubs in Skegness, Liverpool, and Kettering.

The Skegness site on Parade Street features six 160kW chargers near Skegness Beach, Starbucks, and Travelodge. In Liverpool, two 160kW chargers have been installed at McDonald’s Ellesmere Port. Kettering now hosts a 12-charger ultra-rapid hub, with an on-site Costa Coffee planned.

With over 1,900 chargers already in operation, InstaVolt aims to reach 11,000 by 2030.

Government re-confirms £20m funding for Kirkby regeneration

The UK government has re-confirmed £20 million in funding for Kirkby as part of a national investment programme supporting 75 areas. The funding will contribute to the Kirkby Neighbourhood Plan, guiding local improvements over the next decade.

The Kirkby Town Board previously drafted an investment plan after consulting businesses and residents. However, submission was delayed due to a government review of the funding programme. Updates to funding criteria now allow for a broader range of projects, and the Board will reassess the plan before submitting it later this year.

Capacity funding has been provided to support planning and project development, with implementation scheduled to begin in April 2026. Recent regeneration efforts in the area include the new Planetarium and Science Discovery Centre at Sherwood Observatory and expanded leisure facilities at Kings Mill Reservoir.

Local officials welcomed the funding confirmation, highlighting its role in supporting long-term economic growth and infrastructure improvements for businesses and residents.

North Northamptonshire Council clears nearly £600,000 in unrecoverable debts

North Northamptonshire Council (NNC) has approved the write-off of £589,959.61 in unpaid business rates and council tax, citing the debts as irrecoverable. The decision, made by the council’s executive panel, covers nine accounts linked to businesses that have gone into administration, liquidation, or been dissolved.

The largest single debt, £233,300.13, was from a business that entered liquidation. Confidential council documents indicate further recovery efforts would not be cost-effective.

Claire Edwards, NNC’s Executive Director of Finance, stated that while the council aims to maximise revenue collection, some debts must be written off when recovery is no longer feasible. The Conservative-led administration approved the measure at its latest committee meeting.

North Lincolnshire mandates solar panels for all new buildings

North Lincolnshire Council has announced that all new homes and industrial units must be built with solar panels under a new local plan. The policy, included in the council’s draft local plan, was approved at a Cabinet meeting on 17 March.

The measure aims to increase renewable energy generation while reducing reliance on large-scale solar farms, which the council says take up valuable farmland.

Once implemented, developers must integrate solar panels into all new construction projects to secure planning permission. The council has installed solar panels on schools and public buildings as part of its sustainability efforts.

UK government plans regulatory overhaul to cut business costs

According to a statement from His Majesty’s Treasury, the UK government is preparing to streamline regulations in an effort to reduce administrative costs for businesses by 25%. Chancellor Rachel Reeves will meet with regulators on Monday to outline the plan, which includes consolidating regulatory bodies, simplifying environmental rules for major projects, and cutting down on extensive guidance, such as requirements for bat habitat protection.

The reforms align with 60 agreed measures to improve the business environment, including accelerating the approval of new medicines and easing mortgage lending rules. The initiative follows Prime Minister Keir Starmer’s commitment to reform what he described as the UK’s “overcautious, flabby state,” including plans to dissolve certain regulatory bodies.

Labour’s strategy aims to stimulate economic growth after years of stagnation. However, recent polls indicate public scepticism, with 48% of Britons expressing dissatisfaction with the government’s performance and 49% believing its economic policies will have a negative impact. The UK economy shrank by 0.1% in early 2024, following slight growth in the preceding months.

Mortgage Advice Bureau achieves “strong financial growth”

Mortgage Advice Bureau (MAB), a mortgage network and broker, “achieved strong financial growth in 2024,“ as revenue and profit rose.

According to the Derby firm’s final results for the year ended 31 December 2024, revenue reached £266.5m – up 11.3% from £239.5m in 2023.

Adjusted profit before tax, meanwhile, was up 38% to £32m, from £23.2m in 2023.

The business also saw gross mortgage completions grow 3.9% to £26.1bn.

Following the strong results, MAB is now evaluating a potential transition to the Main Market of the London Stock Exchange.Peter Brodnicki, founder and Chief Executive, said: “MAB achieved strong financial growth in 2024 and, by doing so, maintained its long track record of outperformance and market share growth in all market conditions.

“Strategic spend on technology and digital marketing continued to increase, supporting our plans to deliver a higher level of sustainable growth and futureproof our operations. Aligning our business model to evolving customer preferences for research, advice and seamless transactions will enable advisers to access more potential customers and retain an increasing number of existing ones.

“In February, we hosted a Capital Markets Day, during which my team and I set out MAB’s vision to become our customers’ leading financial partner through life’s key moments and demonstrated the significant progress we have made in adapting and evolving our business model to achieve a far wider consumer reach, drive greater lead flows, and increase productivity, efficiency, and margins.

“MAB has been listed on AIM for just over a decade. During that time, we have built a market-leading, specialist network for mortgage advisers while returning over £125m in dividends to shareholders – greater than our market capitalisation at IPO. The Board is now evaluating the potential transition to the Main Market of the London Stock Exchange, which should provide access to a broader investor base and further enhance the Group’s market profile.

“2025 has begun strongly and in line with expectations, with many AR firms anticipating growth in adviser numbers this year while maintaining a focus on increasing profitability through higher productivity. We also have the opportunity to scale our invested businesses and build upon the impressive adviser productivity levels they are already achieving to deliver strong and sustainable shareholder returns over the long term.”

Revenue and profit rise at Yü Group

Yü Group, the independent supplier of gas and electricity, and meter asset owner and installer of smart meters, to the UK corporate sector, has seen revenue and profit rise in its final audited results for the year to 31 December 2024.

Revenue reached £645.5m, up from £460m in 2023, as a result of strong organic growth in delivered volume of energy. Profit before tax, meanwhile, increased to £44.5m, from £39.7m.

Bobby Kalar, Chief Executive Officer, said: “The team and I continue to focus on delivering our strategy, which has delivered another new set of record results, with further strong growth in revenue, profit and cash terms.

“I’m particularly pleased that this is our 6th year of profit growth, and we have taken revenue from £81m in 2018 to £646m in 2024. This growth is set to continue, although at a slower pace in percentage terms due to the larger base.

“Our disciplined approach to growth and the focus on our core target market remains, and our smart metering business is starting to bear considerable fruits.

“Whilst softened commodity markets provide a lower revenue per customer, our 78% growth in delivered energy volume demonstrates the opportunity being taken. We continue to grow market share, nearly doubling year-on-year to 2.7%, and we have a huge addressable market available and are set-up to scale.

“Our smart metering business continues to perform well. I’m really pleased and proud that from standstill in 2023 we now have a fully functioning engineering capability across the Country, with our own training centre and a highly skilled and driven management team. I’m very much looking forward to guiding this business as it develops further.

“We are again increasing our dividend payment, which has increased by 50% in year, reflecting our progressive dividend policy and confidence in the future with over £1 billion of forward revenue already contracted.

“On behalf of my hard-working colleagues and my fellow shareholders, I remain disappointed by the disconnect between our business performance and our market rating. Notwithstanding this, we remain focused on the continued growth of our business.

“I am privileged to lead such a fantastic team and would like to thank them for helping to deliver such fantastic results! My team is stronger than ever, and I remain committed to ensuring we provide the environment for them to develop their careers alongside the Group’s continued development.”

The business has made a strong start to 2025, with new record monthly revenue achieved in January.