Future of Buxton Brewery secured following pre-pack deal

Topps Tiles sees slip in results

Rob Parker, Chief Executive, said: “Trading conditions in the first half have been challenging in a tile market which is down 20% on 2019. Against this backdrop, we are continuing to take market share, our online pure play businesses are growing strongly and the Group remains in a robust financial position.

“Lead indicators of market activity such as mortgage approvals, consumer confidence and smaller ticket DIY spend are improving, and while we are yet to see this feed through into our customer’s spending patterns, as market leader Topps Group remains well-positioned for recovery.

“Notwithstanding the challenges of current market conditions, we believe that Topps Group has a substantial opportunity to increase sales and profitability over the medium term through our new growth strategy of Mission 365.

“Mission 365 includes the development of new digital platforms for Topps Tiles trade customers; an increase in our addressable market of 75% by entering new product areas adjacent to our core tile specialism; a drive for accelerated growth in B2B markets through a more co-ordinated Group-wide approach; and continued momentum in our high growth online pure play businesses, Pro-Tiler and Tile Warehouse.

“Together these initiatives represent an opportunity to grow sales to £365 million over the medium term, while delivering profit before tax margins in the range of 8-10%.”

Shoe Zone delivers “robust performance”

Revenue at the business grew to £76.5m, up from £75.4m in the same period of the year prior. This was supported by a 19.6% increase in digital revenue, to £17.1m, while store revenue dipped, down 2.8% to £59.4m.

Adjusted profit before tax meanwhile stood unmoved at £2.5m.In a statement to the London Stock Exchange, Shoe Zone said: “Shoe Zone delivered a robust performance in the period against a continuing backdrop of consumer uncertainty and macroeconomic volatility. Total revenues increased by 1.5% having traded out of 27 fewer stores compared to 12 months ago, with digital revenue increasing by 19.6%. The performance further demonstrates the resilience of our business and the success of our ongoing strategy.

“Trading over all channels was positive with total revenues of £76.5m (2023 H1: £75.4m), store revenues were £59.4m (2023 H1: £61.1m – trading out of fewer stores), digital revenues were £17.1m (2023 H1: £14.3m) with strong performance across all online channels with additional growth from our online exclusive range and range extensions.

“Adjusted profit before tax was £2.5m (2023 H1: £2.5m), which is in line with management expectations for the period.

“We ended the period trading out of 309 stores, which is a reduction of 27 compared to 12 months ago and 14 lower compared to last year end. In the first half we closed 29 stores, opened 15 new format stores and refitted 15 Original stores to our new format. In total we are now trading out of 147 Original stores and 162 new format stores. We are actively working to relocate and refit further stores in the second half of the year, together with a number of stores currently in the pipeline, opening before Christmas.”

Transreport partners with East Midlands Airport

Digital marketing agency doubles turnover

Water source heat pump unlocks University of Nottingham net zero ambitions

Blueprint Interiors returns to sponsor Overall Winner at the prestigious East Midlands Bricks Awards 2024

Located in Ashby-de-la-Zouch, they leverage science-backed design principles and certifications, such as the WELL Building Standard, to create environments that nurture a thriving workforce.

Chloe Sproston, Creative Director at Blueprint Interiors, shared: “We’ve been involved in the awards since 2019 either as an award nominee or a sponsor. We continue to be impressed with both the quality of award submissions, but also the event, which attracts the elite of our region’s construction and property professionals.

“This year, we’re particularly excited to sponsor the Overall Winner category, further demonstrating our commitment to showcasing the very best talent in the region’s property and construction industry.”

The East Midlands Bricks Awards, which will take place on Thursday 3rd October, at the Trent Bridge Cricket Ground, recognise development projects and people in commercial and public building across the region – from office, industrial and residential, through to community projects such as leisure schemes, schools and public spaces. We also highlight the work of architects, agencies and those behind large schemes.

Winning one of these awards will add considerably to a company’s or individual’s brand and enhance their commercial reach significantly.

Nominations are now OPEN for East Midlands Business Link’s annual Bricks Awards.

To nominate your (or another) business/development for one of our awards, please click on a category link below or visit this page.

Located in Ashby-de-la-Zouch, they leverage science-backed design principles and certifications, such as the WELL Building Standard, to create environments that nurture a thriving workforce.

Chloe Sproston, Creative Director at Blueprint Interiors, shared: “We’ve been involved in the awards since 2019 either as an award nominee or a sponsor. We continue to be impressed with both the quality of award submissions, but also the event, which attracts the elite of our region’s construction and property professionals.

“This year, we’re particularly excited to sponsor the Overall Winner category, further demonstrating our commitment to showcasing the very best talent in the region’s property and construction industry.”

The East Midlands Bricks Awards, which will take place on Thursday 3rd October, at the Trent Bridge Cricket Ground, recognise development projects and people in commercial and public building across the region – from office, industrial and residential, through to community projects such as leisure schemes, schools and public spaces. We also highlight the work of architects, agencies and those behind large schemes.

Winning one of these awards will add considerably to a company’s or individual’s brand and enhance their commercial reach significantly.

Nominations are now OPEN for East Midlands Business Link’s annual Bricks Awards.

To nominate your (or another) business/development for one of our awards, please click on a category link below or visit this page.

- Most active agent

- Commercial development of the year

- Responsible business of the year

- Residential development of the year

- Developer of the year

- Deal of the year

- Architects of the year

- Excellence in design

- Sustainable development of the year

- Contractor of the year

- Overall winner (this award cannot be entered, with the winner, and recipient of a year of marketing/publicity worth £20,000, selected from those nominated)

Nominations end Thursday 5th September

A highlight in the business calendar, winners will be revealed at a glittering awards ceremony on Thursday 3rd October, at the Trent Bridge Cricket Ground – an evening of celebration and networking with property and construction leaders from across the region.

Tickets can be booked for the 2024 awards event here. Connect with local decision makers over nibbles and complimentary drinks while applauding the outstanding companies and projects in our region.

Attendees will also hear from keynote speaker Paul Southby, partner at Geldards LLP, chair of the Advisory Board to Nottingham Business School, chair of Broadway independent cinema, trustee of Clean Rivers Trust, chair of Nottingham Partners, board member of Marketing Nottingham and Nottinghamshire, and former High Sheriff of Nottinghamshire.

Thanks to our sponsors:

A highlight in the business calendar, winners will be revealed at a glittering awards ceremony on Thursday 3rd October, at the Trent Bridge Cricket Ground – an evening of celebration and networking with property and construction leaders from across the region.

Tickets can be booked for the 2024 awards event here. Connect with local decision makers over nibbles and complimentary drinks while applauding the outstanding companies and projects in our region.

Attendees will also hear from keynote speaker Paul Southby, partner at Geldards LLP, chair of the Advisory Board to Nottingham Business School, chair of Broadway independent cinema, trustee of Clean Rivers Trust, chair of Nottingham Partners, board member of Marketing Nottingham and Nottinghamshire, and former High Sheriff of Nottinghamshire.

Thanks to our sponsors:

To be held at:

Stronger demand conditions in the East Midlands spark April business activity upturn

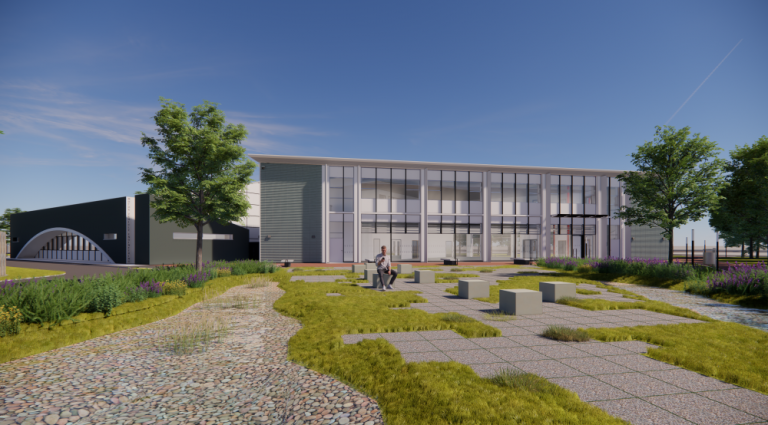

Leicester College gets green light to build new aeronautical skills centre

A reunion with Elvis and Britney in the diary as Derby paralegal prepares to return to Kenya

A Derby paralegal is looking forward to catching up with the lives of dozens of schoolchildren when she returns to Kenya with a group of volunteers from Derby.

Sammi Allen, who works at Smith Partnership in Friar Gate, will head to the east African country at the end of the month on an annual trip organised by the Derby County Community Trust.

The Trust has been arranging the trip since 2012 and has taken more than 500 volunteers to Nakuru, a town based north-west of the capital, Nairobi, over the years.

There, they work with six partner schools based in the town’s slums, giving up their time to help build new facilities at the school or go into the classrooms to teach the children.

Last year mum-of-three Sammi, accompanied by her daughter, Lupita, 19, worked at the Jubilee Academy, which teaches 52 three to eight-year-olds, having travelled to Kenya alongside her Smith Partnership colleagues, Amelia Sutcliffe and Katie Bullimore.

This time, Sammi will be flying the flag for Smith Partnership alone, but she is looking forward to returning to Nakuru and meeting up with the children, teachers and other members of the town’s community.

However, she and Lupita are also looking forward to catching up with three people in particular – siblings Shirleen, Britney and Elvis, who are aged five, 15 and 13 respectively.

She met them last year on Madaraka Day, which is a Kenyan national holiday and the day when pupils can invite their siblings to come into school with them.

One year on, Sammi is looking forward to finding out how Britney, who wants to be a nurse, and Elvis, who dreams one day of being an engineer, are getting on.

But she is also keen to find out how the rest of the school and the town are faring after the area was hit by flash flooding in April this year.

She said: “I heard about the flooding on the news and I’m worried about what I’ll discover when I get there. Forty-two people died in Nakuru and I’ve been thinking about who might be affected and how the school has been affected too.

“Although I don’t know the people there that well, the trip last year has given me an emotional connection, especially with the children. It’s impossible not to care after you’ve visited their school and seen how they live.”

Sammi and Lupita will also travel to Kenya with a whole host of donations for the children, including new school uniforms, shoes, new plates and cups, cooking utensils and even a new toothbrush each.

They have paid for everything by holding a series of fundraising events, including a raffle at Smith Partnership and a quiz night at the Orange Tree bar in George Street, while they also have colouring books and even more clothes, donated by Portway Primary School in Allestree.

Sammi said: “The school is based in the slums and it’s a dangerous place for the children to live. For many of them, the only meal they have is the one they have at school and lots of them come to school on a Monday having not eaten over the weekend.

“I’ve got three children and it’s incredible to see the contrast between their lives and the lives of the children in Nakuru. You can’t help to be impressed and moved by the way they are so friendly and so happy, even though they have so little.

“I’m really excited about going back, because now I’ve been there, I feel I can’t let go. Even when I’m not there I worry about the children as if they’re my own.”

The Derby County Community Trust Rams in Kenya trips are held in partnership with African Adventures, which works to improve sanitation at the schools, build new classrooms or facilities as well as support the teachers in the classroom.

When they’re not at the school, their volunteers will be able to take part in activities including a safari, a visit to the Thompson Falls, a trip to the Equator and a visit to the Giraffe Centre in Nairobi.

Lupita, who is studying a Level 3 apprenticeship in accounting, said: “Going on the trip last year gave me a different perspective on life and has made me realise how much we take for granted, so I’m really looking forward to going out again.

“I’m looking forward to finishing what we started last year with the classrooms and hopefully they will be completed when we’re there so that I can see what the children make of them.”