Phase one of landmark Skegness Tower Gardens landscape renovations complete

Northampton business raises more than £5,600 in walking challenge for local hospice

Reward your team and showcase achievements at the East Midlands Bricks Awards 2024

- Most active agent

- Commercial development of the year

- Responsible business of the year

- Residential development of the year

- Developer of the year

- Deal of the year

- Architects of the year

- Excellence in design

- Sustainable development of the year

- Contractor of the year

- Overall winner (this award cannot be entered, with the winner, and recipient of a year of marketing/publicity worth £20,000, selected from those nominated for the event’s other categories)

Nominations end Thursday 5th September

Find out who last year’s winners were here.

To be held at:

Family haulage business closes doors after eight decades

Stake snapped up in Lincolnshire offshore wind farm

Output volumes unchanged but expectations remain positive amongst manufacturers

- Output volumes were broadly unchanged in the three months to June after rising in the quarter to May (weighted balance of +3%, from +14% in the three months to May) and were equivalent to the long-run average. Output is expected to rise modestly in the three months to September (+13%).

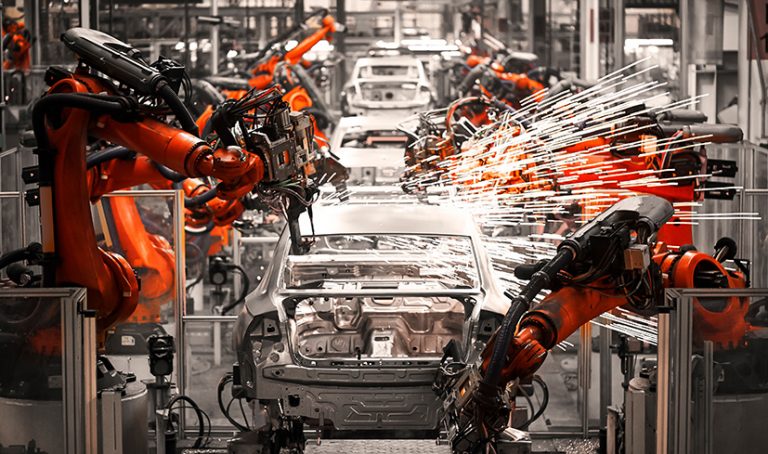

- Output increased in only 4 out of 17 sub-sectors, in the three months to June, with growth in the food, drink & tobacco, motor vehicle & transport sector, and plastics and furniture & upholstery sub-sectors broadly offset by falls elsewhere.

- Total order books were reported as below “normal” in June but improved sharply relative to last month (-18% from -33%). The level of order books remained slightly below the long-run average (-13%).

- Export order books were also seen as below normal and deteriorated relative to last month (-39% from -27%). This was also below the long-run average (-18%) and was the weakest outturn since February 2021.

- Expectations for average selling price inflation accelerated in June (+20%, from +15% in May) – well above the long-run average (+7%).

- Stock adequacy for finished goods were unchanged from June, with a net balance of manufacturers reporting that stocks were “more than adequate” standing at +14%, broadly in line with the long-run average.