Launch your business to new heights with Lincoln College’s Skills Bootcamps

UK spinout investment hits record £3.35bn in 2024

Investment in UK university spinouts reached a record £3.35bn in 2024, marking a 44% rise on the previous year, according to new data from Parkwalk and Beauhurst. The figures highlight renewed investor confidence following a slowdown in 2023, with average equity investment climbing from £4.96m to £7.49m.

Life sciences remained the leading sector for capital raised, particularly in pharmaceuticals and biotechnology, supported by continued interest in research commercialisation. Deep tech, AI, and data infrastructure firms also attracted significant backing, reflecting alignment with national innovation priorities.

Parkwalk emerged as the most active spinout investor during the year, completing 41 deals, or 54 when including transactions through its parent, IP Group.

The report points to a growing reliance on long-term capital and policy stability to sustain momentum in university-linked innovation. Analysts note that while the UK continues to demonstrate global strength in research translation, access to scale-up funding remains a decisive factor for future growth.

UK economy returns to slow growth in August

Shoreditch hub expands Cooper Parry’s national network

Cooper Parry has opened a new London base at Broadwalk House in Shoreditch, extending its network of seven superhubs across the UK. The 17,000-square-foot space on Appold Street houses more than 300 staff, including teams specialising in technology, audit, law, and tax.

The new hub is designed to promote flexible working and closer collaboration between departments. It features multiple meeting rooms, quiet areas, social zones, upgraded technology, and a wellness room. The workspace also includes dedicated sections such as touchdown areas for hybrid workers, a focus zone called the Secret Garden, and a main collaborative area known as the Field of Dreams.

The site was developed in partnership with Office Principles, incorporating findings from a workplace assessment to improve usability and efficiency. Facilities include event space, grab-and-go food options, and additional desks to support hybrid work models.

Cooper Parry’s latest expansion aims to strengthen integration between teams and enhance client service by supporting faster collaboration and knowledge sharing. The Shoreditch location marks a key milestone in the firm’s London growth strategy, underscoring its commitment to modern work environments that cater to the needs of its people and clients.

Steve Leith, Cooper Parry’s regional market leader for London & South and head of tech & high growth, said: “This space is the result of five years of belief, hustle, and momentum. It’s not just an office – it’s a reflection of how we work, how we collaborate, and how we treat each other. From six desks in WeWork to 300+ in Shoreditch, this hub marks a huge moment for CP in London – and sets the stage for everything we’re building next. “It’s also a game-changer for our clients. By bringing our experts together in one space, we’re creating more opportunities to collaborate, challenge thinking, and deliver specialist value. It’s a space that helps our people thrive – and when they do, our clients feel it.”Derbyshire firm backs calls for more women in engineering

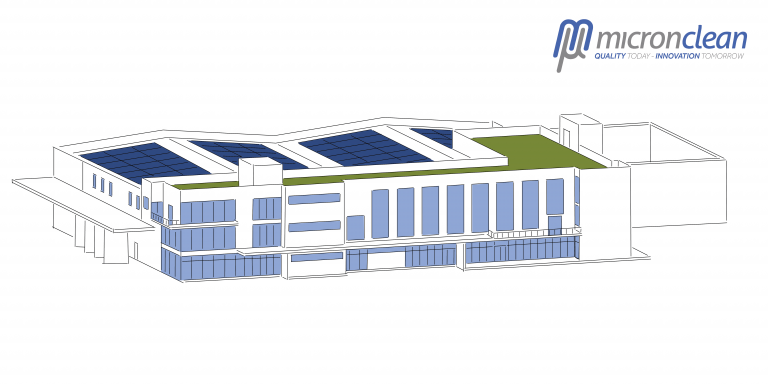

Micronclean begins work on £20m carbon-zero cleanroom laundry campus

Micronclean has started work on what it says is “the world’s first operationally carbon-zero industrial laundry.”

This £20m project is being developed on a newly acquired 20-acre site on the outskirts of Skegness, which will become home to Micronclean’s innovative Cleanroom Campus, an advanced facility designed to shape the future of the company’s UK operations over the next decade.

The campus will be developed in a phased manner to support expansion, innovation, and long-term prosperity for both the company and the community.

Food wholesaler relocates to new HQ

Government gives green light to major Lincolnshire solar farm

The UK government has approved plans for what is set to become the country’s largest solar farm, to be built near Glentworth in Lincolnshire. Covering around 3,000 acres, the Tillbridge Solar project will supply power to approximately 300,000 homes once completed.

Classified as a Nationally Significant Infrastructure Project, the development was approved by the Secretary of State for Energy Security and Net Zero, following a review that concluded the project’s benefits outweigh its local impacts. The decision adds to a growing list of large-scale clean energy projects, marking the seventeenth national approval since mid-2024.

The Tillbridge project is a joint venture between Tribus Clean Energy and Recurrent Energy. It will connect to the National Grid through infrastructure at the Cottam substation in Nottinghamshire.

Lincolnshire has emerged as a focal point for solar expansion, with two other major projects (Gate Burton and Mallard Pass) approved in 2024. Local councils have raised concerns about the cumulative effect of such large developments, while national energy planners view the region as critical to the UK’s renewable capacity goals.

Once operational, Tillbridge Solar will contribute to the government’s wider strategy of reducing dependence on volatile gas markets and accelerating the transition to low-cost renewable energy sources.

Gilson Gray appoints head of residential conveyancing

Boston station redevelopment opens new commercial opportunities

East Midlands Railway is inviting businesses to lease new office spaces within Boston station as part of a £2.8 million redevelopment funded by the Government’s Town Deal initiative.

The project comprises two 12-square-metre units situated near the town centre, designed to provide affordable workspaces for small enterprises, start-ups, and community organisations. Each unit includes access to shared kitchenette and washroom facilities, with meeting space available when required.

The initiative is part of a broader effort to revitalise the station and its surroundings, positioning it as a local hub for business and community activities. The site’s high passenger traffic (over 270,000 journeys made through Boston station last year) adds to its potential as a commercially viable base for tenants seeking visibility and convenience.

East Midlands Railway’s redevelopment aims to attract new ventures to the area while supporting local economic growth through flexible, low-cost leasing options.