Major milestone reached at £20m ARK scheme

Plans revealed to transform Nottingham’s Hanson House site into student accommodation

Light Science Technologies renews partnership with global lighting supplier

Derby-based manufacturer Light Science Technologies Holdings has renewed its 12-month distribution framework with Gavita International, a major supplier of horticultural lighting.

The agreement continues to cover the distribution of Gavita’s lighting systems for controlled environment agriculture, including installations across glasshouses, polytunnels, and other indoor growing facilities. It supports Light Science Technologies’ AgTech division, which develops solutions to enhance sustainable food production in response to global food security and climate challenges.

Since the collaboration began in early 2025, the pipeline of potential projects linked to the agreement has more than doubled, rising from around £10 million to over £24 million. The company has already completed international installations under the partnership, including a project in Poland, and is pursuing new opportunities across Europe and other markets.

Light Science Technologies continues to operate through its three divisions: controlled environment agriculture, contract electronics manufacturing, and passive fire protection. The extension of the distribution deal aligns with the firm’s strategy to expand its global reach and strengthen its position in sustainable agriculture technology.

Travis Perkins sees sales rise in third quarter

Travis Perkins has seen revenue rise in its third quarter, as actions taken to sharpen its competitive proposition in the Merchanting segment have improved sales performance.

Group like-for-like sales were up 1.8%, with Merchanting revenue up 1.7%. Trading at Toolstation, meanwhile, was “solid,” with like-for-like revenue growth of 2.3%.The business noted that it continues to make good progress on enhancing cash generation which is further strengthening the group’s balance sheet.

Geoff Drabble, chair of Travis Perkins plc, said: “As we outlined at our half year results, in the third quarter we have consciously focused on building top-line momentum and regaining market share in the Merchanting businesses. I am pleased with how our teams have responded to this challenge with Merchanting returning to revenue growth and our operating performance stabilising.

“In what remains a highly competitive market, we have invested in pricing and targeted promotions and will continue to do so in the near-term. We continue to demonstrate good discipline on capital allocation and overheads which will allow us to reinvest in our proposition and position the Group well as we look forward to Gavin Slark’s arrival as CEO in January.”

Building work starts on national MRI facility at the University of Nottingham

Major redevelopment near Northampton Station set for approval

A significant redevelopment project near Northampton Railway Station is expected to move forward following a recommendation for approval by West Northamptonshire Council’s Strategic Planning Committee.

The proposed scheme, led by Blocwork LLP and Network Rail, outlines plans for a six-storey residential building with up to 280 homes, a five-storey hotel with around 100 rooms, and a six-storey multi-storey car park providing 866 spaces. The project forms part of a wider plan to modernise the station area and improve connections with the town centre.

Initial designs proposed an eight-storey car park with more than 1,100 spaces, but the height and capacity were scaled back to address local traffic and visual concerns. The mixed-use scheme is intended to revitalise an underused site next to the station, offering new housing and hospitality facilities while supporting sustainable transport links.

The development will be reviewed by the Strategic Planning Committee, which is expected to approve the proposal. The project is being positioned as a key step in Northampton’s ongoing regeneration strategy, enhancing the area’s role as a gateway to the town and supporting its long-term economic growth.

Toyota backs new micromobility research in Derbyshire

Toyota will lead a £30.3 million research and development project in Derbyshire to create a lightweight battery electric vehicle aimed at the urban mobility market. The initiative, funded under the UK Government’s DRIVE35 Collaborate programme, includes a £15 million grant from the Department for Business and Trade through the Advanced Propulsion Centre (APC).

The project will focus on validating a small, lightweight electric vehicle in the L6e category, designed to address rising demand for sustainable transport in dense urban areas. Manufacturing and testing will take place at Toyota Manufacturing UK’s Burnaston facility, reinforcing the company’s long-term investment in Britain’s automotive R&D sector.

The vehicle will feature an integrated solar roof, enhanced connectivity, and sustainable lightweight materials intended to support recycling and resource recovery.

The consortium brings together industry and academic partners, including ELM, which specialises in lightweight delivery vehicles; Savcor, leading the development of solar photovoltaic roofs; and the University of Derby, which will research user behaviour and the role of solar energy in micromobility. Toyota Motor Europe will contribute by supporting skills development among the Burnaston team.

Rik Adams, Innovation Delivery Director, The Advanced Propulsion Centre UK, said:

“APC is very proud to be able to support Toyota with this Electric Vehicle (EV) urban mobility project, which embodies much of what DRIVE35 aims to support – innovation, UK competitiveness, productivity, and zero emission vehicles. As an integral part of the UK automotive industry, we are delighted that Toyota is partnering with some of our innovative SME businesses, such as ELM, and our world-class academics from the University of Derby, to deliver a cutting-edge vehicle concept designed, developed, and tested in the UK.”

The collaboration aims to strengthen the UK’s competitiveness in low-carbon vehicle innovation and promote growth across the electric mobility supply chain.

Impact HR Consulting appoints new CEO

Winvic achieves Net Carbonzero certification

Nottingham set for £1.8m active travel investment

Over £1.8 million in external funding is being directed towards improving walking and cycling routes in Nottingham, as part of the East Midlands Combined County Authority’s latest investment in sustainable transport infrastructure.

Nottingham City Council will review plans to formally accept the funding, which includes £1.3 million for the redevelopment of Gregory Boulevard between Mansfield Road and Noel Street. The proposed works would enhance connectivity between the city centre, Sherwood, and nearby educational, leisure, and transport facilities, forming part of a wider active travel network.

The Gregory Boulevard scheme aims to enhance accessibility and safety for pedestrians and cyclists by upgrading crossings, resurfacing roads, and improving pathways. The improvements would reduce future maintenance disruption and provide better access to venues such as the Forest Recreation Ground, the Forest Park & Ride, and the Forest Sport Zone.

An additional £459,814 has already been allocated to explore future walking and cycling schemes across Nottingham and to continue supporting community cycling initiatives in partnership with British Cycling. The ongoing programme has already introduced thousands of residents to cycling, helping increase participation in active travel across the city.

The proposals will be opened to public consultation before construction begins.

Launch your business to new heights with Lincoln College’s Skills Bootcamps

UK spinout investment hits record £3.35bn in 2024

Investment in UK university spinouts reached a record £3.35bn in 2024, marking a 44% rise on the previous year, according to new data from Parkwalk and Beauhurst. The figures highlight renewed investor confidence following a slowdown in 2023, with average equity investment climbing from £4.96m to £7.49m.

Life sciences remained the leading sector for capital raised, particularly in pharmaceuticals and biotechnology, supported by continued interest in research commercialisation. Deep tech, AI, and data infrastructure firms also attracted significant backing, reflecting alignment with national innovation priorities.

Parkwalk emerged as the most active spinout investor during the year, completing 41 deals, or 54 when including transactions through its parent, IP Group.

The report points to a growing reliance on long-term capital and policy stability to sustain momentum in university-linked innovation. Analysts note that while the UK continues to demonstrate global strength in research translation, access to scale-up funding remains a decisive factor for future growth.

UK economy returns to slow growth in August

Shoreditch hub expands Cooper Parry’s national network

Cooper Parry has opened a new London base at Broadwalk House in Shoreditch, extending its network of seven superhubs across the UK. The 17,000-square-foot space on Appold Street houses more than 300 staff, including teams specialising in technology, audit, law, and tax.

The new hub is designed to promote flexible working and closer collaboration between departments. It features multiple meeting rooms, quiet areas, social zones, upgraded technology, and a wellness room. The workspace also includes dedicated sections such as touchdown areas for hybrid workers, a focus zone called the Secret Garden, and a main collaborative area known as the Field of Dreams.

The site was developed in partnership with Office Principles, incorporating findings from a workplace assessment to improve usability and efficiency. Facilities include event space, grab-and-go food options, and additional desks to support hybrid work models.

Cooper Parry’s latest expansion aims to strengthen integration between teams and enhance client service by supporting faster collaboration and knowledge sharing. The Shoreditch location marks a key milestone in the firm’s London growth strategy, underscoring its commitment to modern work environments that cater to the needs of its people and clients.

Steve Leith, Cooper Parry’s regional market leader for London & South and head of tech & high growth, said: “This space is the result of five years of belief, hustle, and momentum. It’s not just an office – it’s a reflection of how we work, how we collaborate, and how we treat each other. From six desks in WeWork to 300+ in Shoreditch, this hub marks a huge moment for CP in London – and sets the stage for everything we’re building next. “It’s also a game-changer for our clients. By bringing our experts together in one space, we’re creating more opportunities to collaborate, challenge thinking, and deliver specialist value. It’s a space that helps our people thrive – and when they do, our clients feel it.”Derbyshire firm backs calls for more women in engineering

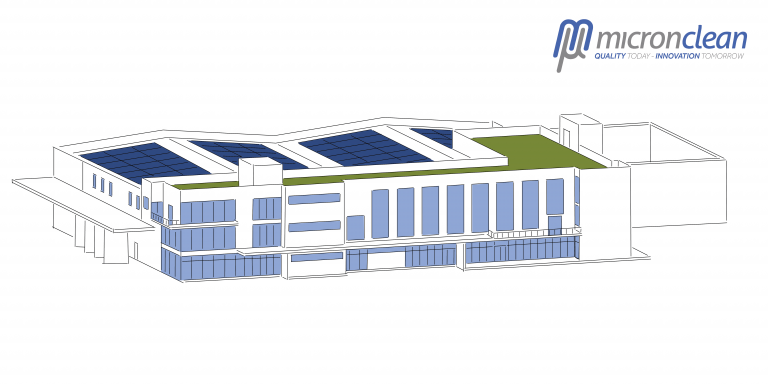

Micronclean begins work on £20m carbon-zero cleanroom laundry campus

Micronclean has started work on what it says is “the world’s first operationally carbon-zero industrial laundry.”

This £20m project is being developed on a newly acquired 20-acre site on the outskirts of Skegness, which will become home to Micronclean’s innovative Cleanroom Campus, an advanced facility designed to shape the future of the company’s UK operations over the next decade.

The campus will be developed in a phased manner to support expansion, innovation, and long-term prosperity for both the company and the community.

Food wholesaler relocates to new HQ

Government gives green light to major Lincolnshire solar farm

The UK government has approved plans for what is set to become the country’s largest solar farm, to be built near Glentworth in Lincolnshire. Covering around 3,000 acres, the Tillbridge Solar project will supply power to approximately 300,000 homes once completed.

Classified as a Nationally Significant Infrastructure Project, the development was approved by the Secretary of State for Energy Security and Net Zero, following a review that concluded the project’s benefits outweigh its local impacts. The decision adds to a growing list of large-scale clean energy projects, marking the seventeenth national approval since mid-2024.

The Tillbridge project is a joint venture between Tribus Clean Energy and Recurrent Energy. It will connect to the National Grid through infrastructure at the Cottam substation in Nottinghamshire.

Lincolnshire has emerged as a focal point for solar expansion, with two other major projects (Gate Burton and Mallard Pass) approved in 2024. Local councils have raised concerns about the cumulative effect of such large developments, while national energy planners view the region as critical to the UK’s renewable capacity goals.

Once operational, Tillbridge Solar will contribute to the government’s wider strategy of reducing dependence on volatile gas markets and accelerating the transition to low-cost renewable energy sources.

Gilson Gray appoints head of residential conveyancing

Boston station redevelopment opens new commercial opportunities

East Midlands Railway is inviting businesses to lease new office spaces within Boston station as part of a £2.8 million redevelopment funded by the Government’s Town Deal initiative.

The project comprises two 12-square-metre units situated near the town centre, designed to provide affordable workspaces for small enterprises, start-ups, and community organisations. Each unit includes access to shared kitchenette and washroom facilities, with meeting space available when required.

The initiative is part of a broader effort to revitalise the station and its surroundings, positioning it as a local hub for business and community activities. The site’s high passenger traffic (over 270,000 journeys made through Boston station last year) adds to its potential as a commercially viable base for tenants seeking visibility and convenience.

East Midlands Railway’s redevelopment aims to attract new ventures to the area while supporting local economic growth through flexible, low-cost leasing options.