Mather Jamie welcomes graduate commercial surveyor

Melton Building Society appoints Non Executive Director

Work starts on next phases of sustainable Nottingham housing development

East Midlands Combined County Authority approves £175m in funding to improve roads and public transport

- Derby City Council will receive funding for several key projects, including the A52/A52T Spondon Interchange to allow better traffic flow and support active travel initiatives, making it easier and safer for pedestrians and cyclists.

- Nottingham City Council will focus on improving major roads for walking and cycling, as well as upgrading real-time parking information systems.

- Derbyshire County Council will invest in repairing roads and works to help prevent landslips, particularly on key routes.

- Nottinghamshire County Council will focus on maintaining and upgrading its roads, along with planning for future transport projects.

- £66 million for City Region Sustainable Transport Settlements 2 (CRSTS2): This funding will support road repairs, improvements to highways, and projects to make walking, cycling, and public transport easier.

- £21 million for Bus Service Improvement Plans (BSIP): This funding will be used to make bus services more reliable, affordable, and accessible across the East Midlands.

- £75 million for Highways Maintenance Block: EMCCA will receive this funding, £22m of which is extra money the region is getting because it has a Mayoral Combined Authority. This will go on road repairs in 2025/26.

- £12.86 million for Integrated Transport Block Funding: EMCCA is expecting this funding to deliver activities across the local transport network.

- £7.27 million for Active Travel Fund: The region has been awarded this funding to improve walking, wheeling and cycling and infrastructure.

Loughborough University to drive business innovation at Leicester Innovation Festival

Loughborough University will play a key role in the 2025 Leicester Innovation Festival (LIF), hosting events to strengthen local business growth through innovation, research, and collaboration. The festival, organised by the Business Gateway Growth Hub, runs from 31 March to 4 April and brings together public, private, and academic partners to support businesses in Leicester and Leicestershire.

One of the university’s key events, held online on 2 April, will focus on adopting digital technology in manufacturing. Led by Dr Kate Broadhurst from Loughborough Business School, the session will present findings from the £4.4 million InterAct programme, which explored the human impact of new technologies in the sector. The event will offer practical strategies for businesses integrating digital solutions into their operations.

On the same day, the university will co-host a business engagement event at Harborough Innovation Centre, showcasing opportunities for companies to collaborate with local universities. The session will cover industry placements, graduate recruitment, consultancy, and Innovate UK-funded Knowledge Transfer Partnerships, which help businesses access academic expertise to drive innovation.

A Clean Tech networking event will occur on 4 April at Loughborough University Science and Enterprise Park. Organised by the LUinc. team, the event will connect Clean Tech entrepreneurs with investors, mentors, and industry professionals through networking sessions, tech talks, and startup introductions.

Other organisations involved in LIF 2025 include De Montfort University, the University of Leicester, Innovate UK, the British Business Bank, and Charnwood Campus. All events are free to attend.

Sale of Nottingham’s Broad Marsh development site to be discussed, with purchaser ready to take on council’s vision

Forterra reports “resilient” 2024 performance

Forterra, the manufacturer of clay and concrete building products, has reported a “resilient performance” in 2024, as challenging market conditions continued.

According to full year results, revenue was flat year-on-year, with a double digit increase in the second half relative to both the prior year and first half of 2024. Statutory pre-tax profit, meanwhile, grew to £24.8m from £17.1m. Forterra noted that 2024 UK brick industry despatches were up 2% compared with 2023, with fourth quarter despatches 20% ahead of the corresponding period. Total UK brick consumption, however, remains 30% behind 2022 levels.Neil Ash, Chief Executive Officer, said: “2024 saw the continuation of the challenging market conditions we have witnessed over the last two years, though the second half saw an improving position.

“Our focus has been on the areas we can control and delivered a resilient performance by successfully aligning our production to demand and returning the Group to a position of strong cash generation.

“We also continued to make good progress with our £140m strategic capital investment programme at Desford, Wilnecote and Accrington, which is now nearing completion.

“Trading in the first two months of 2025 has continued the positive trends seen in the final quarter of 2024, with our brick despatches 17% ahead of the prior year. We are currently concluding our customer pricing discussions and expect to deliver necessary price increases to offset cost inflation.

“We continue to take encouragement from the Government’s ambition to materially increase housebuilding but remain wary of the challenges in delivering this. During 2025, we anticipate some recovery in our markets, whilst remaining mindful of the wider macroeconomic conditions.

“Following our significant strategic investment in increased manufacturing capacity, the Group remains well placed as its key markets recover.”

East Midlands economy continues to toughen with hike in demand for insolvency advice

Leicester law firm expands Development team

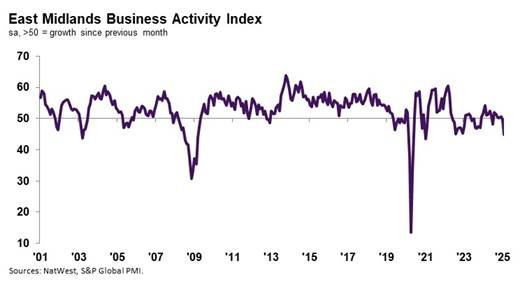

February sees deepening downturn in East Midlands private sector

Alliance Healthcare restructuring puts 490 jobs at risk

Alliance Healthcare plans to close two distribution centres and downsize a third, placing up to 490 jobs at risk. The company intends to shut sites in Nottingham and Hinckley while cutting 110 roles at its South Normanton facility. Operations will be consolidated into a new logistics hub in Birmingham, set to open in 2026.

The restructuring is part of an effort to modernise distribution, as some existing sites are considered outdated and costly to upgrade. The Usdaw trade union, representing workers at the Nottingham site, has confirmed consultations will begin soon to assess the impact and challenge the business case.

UK insolvency activity surges while business start-ups stall

Insolvency-related activity across the UK rose sharply in February, with Yorkshire and the Humber recording a 39% increase, according to data from R3, the UK’s insolvency and restructuring trade body. The East Midlands (79%) and South West (77%) saw the most significant jumps, while Northern Ireland was the only region to see a decline (-38%).

The data from Creditsafe, includes liquidator and administrator appointments and creditors’ meetings. Meanwhile, new business start-ups remained stagnant, rising just 0.2% in Yorkshire and the Humber—the only English region to see growth. Scotland recorded the highest start-up increase at 9%, while Northern Ireland and Wales also saw slight gains.

Quickline launches career portal to boost job skills in Yorkshire and Lincolnshire

Quickline has introduced a virtual work experience portal to help young people and job seekers in Yorkshire and Lincolnshire explore career paths and develop essential skills. Created in partnership with Engaging Education, the free platform provides industry insights in engineering, HR, marketing, and data analysis.

The initiative, launched during National Careers Week (3-8 March), is designed for students aged 13 to 19 and is also available to job seekers aged 19+ in South Yorkshire through job centres and community organisations.

The portal features real-world advice from professionals, interactive challenges, and quizzes. It is part of Quickline’s social value commitment under Project Gigabit, the UK government’s programme to expand high-speed broadband in underserved areas.

Government rejects £750m rail freight hub over infrastructure concerns

The UK government has rejected plans for a £750 million rail freight hub in Leicestershire, citing infrastructure and road safety concerns.

Developer Tritax Symmetry proposed the Hinckley National Rail Freight Interchange (HNRFI) on 662 acres of farmland between Hinckley and Leicester, claiming it would create over 8,000 jobs. However, Transport Secretary Heidi Alexander ruled that the project’s potential negative impacts outweighed its benefits.

The decision was based on concerns that increased lorry traffic would overwhelm M69 junctions, pose safety risks in Sapcote, and disrupt local transport with 775-metre-long trains at the Narborough level crossing. Leicestershire County Council and local MPs, who opposed the project, welcomed the decision, arguing the plan lacked adequate infrastructure support.

Tritax Symmetry expressed disappointment and is seeking legal advice on potential next steps.

Quartet of approvals for Hockley Developments

Leicester and Derby lead UK cities for commercial property investment

Leicester and Derby have emerged as top UK cities for commercial property investment in 2025, according to a survey by the Alan Boswell Group. The study ranked 31 major cities based on business closure rates, crime levels, retail sales performance, and rateable property values.

Leicester secured the top spot with a score of 7.06/10, benefiting from retail sales reaching 100.3% of 2019 levels and a modest 3.79% increase in rateable value over five years. The city also reported low crime rates, with only six shoplifting cases and around one non-residential burglary per 1,000 businesses, making it an attractive location for investors.

Derby ranked third with a score of 6.99/10, supported by strong retail sales at 102% of 2019 levels and a low non-residential burglary rate of one per 1,000 businesses. The city’s commercial property market appears stable, with a lower level of empty premises relief (£193,291 per 1,000 businesses) compared to Leicester (£261,469 per 1,000 businesses), suggesting higher occupancy rates.

Both cities offer a favourable environment for commercial property investment, with steady demand and low business closure rates contributing to their strong rankings.