Samworth Brothers agrees £150m credit facility linked to sustainability

Lincolnshire Housing Partnership secures £30m ESG-linked revolving credit facility

Aggregate Industries wins award for carbon-cutting concrete

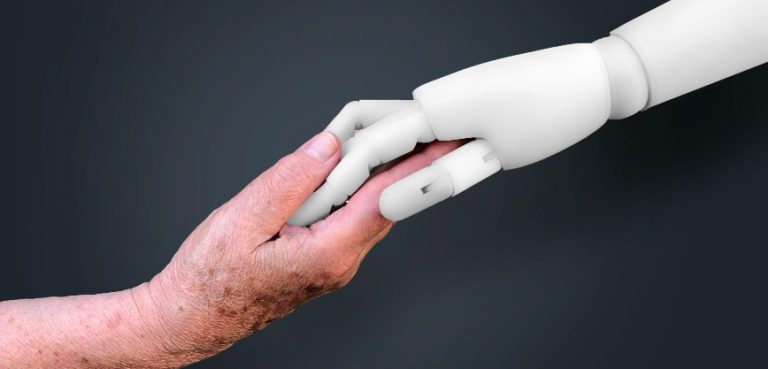

Loughborough University gets involved with ‘frailty aid’ robotic technology

A friendly robotic service for preventative care amongst frail older adults is to be developed as part of a new collaborative project involving Loughborough University.

Funded by UKRI, the I’M-ACTIVE project will combine emergent technologies to assess home-based tasks, identify weaknesses, and provide tailored motivation for an active lifestyle.

NHS England estimates that 3% of over-65s are severely frail and another 12% are moderately frail, totalling around 1.8 million people in the UK.

The incidence and prevalence of frailty are having a profound impact on all aspects of the UK economy and society.

The project aims to reduce the impact of frailty in the UK care and health system by analysing the benefits and limitations of emerging robotic and sensor technologies for older adults and engaging with policymakers, practitioners, carers, and potential users to co-produce a new service.

Professor Massimiliano Zecca, Loughborough University’s lead and an expert in healthcare technology in the School of Mechanical, Electrical and Manufacturing Engineering, says the research is “essential to reduce the burden on healthcare systems”.

His team will be responsible for the development of measurement tools that will allow for frailty to be assessed.

Professor Zecca said: “We are facing the dual challenge of accurately measuring functional and cognitive parameters in the home environment, which is the truest reflection of an older person’s abilities, and also developing a system that users will be willing to have in their homes. This entails designing and developing a user-friendly system that satisfies their needs and preferences.

“We are confident that the results of I’M-ACTIVE will pave the way for new intervention options that can help frail elderly individuals maintain an active lifestyle and improve their social and emotional wellbeing.”

Revenue rises at Intercede

Mather Jamie joins sponsor line up for East Midlands Bricks Awards 2023

“We were delighted to win, and since then have witnessed first-hand the benefits of raising our brand profile through this awards platform. It was a natural progression for us to sponsor the ‘Deal of the Year’ as this will help to promote our services to an elite audience of landowners, property developers and building contractors.”

The awards, which will take place on Thursday 28 September at the Trent Bridge Cricket Ground, celebrate the outstanding work of those shaping the landscape of our region, recognising development projects and people in commercial and public building across the East Midlands – from offices, industrial and residential, through to community projects such as leisure schemes and schools.

Nominations are now OPEN for East Midlands Business Link’s annual Bricks Awards.

To nominate your (or another) business/development for one of our awards, please click on a category link below or visit this page.

“We were delighted to win, and since then have witnessed first-hand the benefits of raising our brand profile through this awards platform. It was a natural progression for us to sponsor the ‘Deal of the Year’ as this will help to promote our services to an elite audience of landowners, property developers and building contractors.”

The awards, which will take place on Thursday 28 September at the Trent Bridge Cricket Ground, celebrate the outstanding work of those shaping the landscape of our region, recognising development projects and people in commercial and public building across the East Midlands – from offices, industrial and residential, through to community projects such as leisure schemes and schools.

Nominations are now OPEN for East Midlands Business Link’s annual Bricks Awards.

To nominate your (or another) business/development for one of our awards, please click on a category link below or visit this page.

- Most active estate agent

- Commercial development of the year

- Responsible business of the year

- Residential development of the year

- Developer of the year

- Deal of the year

- Architects of the year

- Excellence in design

- Sustainable development of the year

- Contractor of the year

- Overall winner

Book your tickets now

Tickets can now be booked for the awards event – click here to secure yours. The special awards evening and networking event will be held on Thursday 28 September 2023 in the Derek Randall Suite at the Trent Bridge County Cricket Club from 4:30pm – 7:30pm. Connect with local decision makers over canapés and complimentary drinks while applauding the outstanding companies and projects in our region, and hear from Mike Denby, Director of Inward Investment and Place Marketing at Leicester City Council, our keynote speaker. Dress code is standard business attire. Thanks to our sponsors:

To be held at:

To be held at:

How to grow your company’s YouTube channel

Planning Inspectorate accepts application for Hinckley National Rail Freight Interchange despite council concerns

East Midlands business activity grows further amid quicker rise in new orders

The headline NatWest East Midlands PMI® Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – posted 51.2 in March, little-changed from 51.1 in February.

Although signalling only a marginal expansion in business activity that was slower than the UK average, the rise in output was the fastest in ten months. Where survey respondents noted an increase in activity, this was attributed to stronger client demand and a faster rise in new business.

Private sector firms across the East Midlands registered a second successive monthly increase in new orders in March. The upturn in new business was reportedly linked to stronger demand and greater client activity. Although only marginal, the rate of growth was the fastest for a year. That said, the pace of expansion was below the UK average and among the slowest of the 12 monitored UK regions (faster than only Yorkshire & Humber and the North West).

Private sector firms in the East Midlands signalled a stronger degree of confidence in the outlook for output over the coming year during March. The level of optimism picked up to the highest in over a year and was slightly greater than the UK average. Positive sentiment across the region was linked to hopes of increased client demand, investment in new product development and diversification.

March data indicated a renewed fall in employment across the East Midlands private sector. The decrease in workforce numbers followed back-to-back expansions seen in the opening two months of 2023. Although only fractional, the decline in staffing numbers was attributed to the non-replacement of voluntary leavers amid cost-cutting initiatives.

The slight contraction in employment contrasted with a stabilisation in headcounts seen across the UK as a whole.

East Midlands firms recorded a sixth successive monthly decline in incomplete business at the end of the first quarter. The rate of contraction quickened slightly and was solid overall. Of the 12 monitored UK regions, only Wales registered a sharper drop in backlogs of work. Subdued demand conditions in recent months meant companies had sufficient capacity to process incoming new work.

East Midlands companies noted a further softening in the rate of input cost inflation during March. Although still marked, the pace of increase was the slowest since February 2021 and much weaker than those seen throughout 2022. Nonetheless, the historically elevated rise in operating expenses was linked to greater material and utility costs, alongside increased wage bills.

Of the 12 monitored UK regions, only the North East and London registered steeper upticks in input prices.

March data signalled a sharp increase in output charges at East Midlands private sector firms. Companies commonly mentioned the pass-through of higher costs to clients as driving inflation. That said, the rate of increase in selling prices eased for the fourth month running and was the softest since February 2021. At the UK level, only the East of England recorded a slower rise in output charges.

Rashel Chowdhury, NatWest Midlands and East Regional Board, said: “Companies in the East Midlands registered another monthly expansion in activity in March, thereby ending the first quarter on a more positive note. New business rose at a quicker pace, as client demand reportedly strengthened.

“Nonetheless, historically subdued demand conditions and further marked hikes in operating expenses led firms to cut their workforce numbers. Cost-cutting initiatives were put in place as many noted sufficient capacity to work through incoming business. “On a more positive note, inflationary pressures softened again. Rates of input cost and output charge inflation eased to the slowest for over two years, as some material prices moderated. “Despite muted demand conditions and still challenging rates of inflation, firms’ confidence in the outlook for output reached the strongest for over a year. East Midlands firms were broadly in agreement with their counterparts across the UK as a whole, who also recorded more upbeat expectations.”IT services company snaps up Derby firm

Final sale completed at Forbes Park

Manufacturer of variable speed drives secures £2.5m investment

Revenues 20% ahead of prior year at Van Elle

Full year revenue up 10% at Dr. Martens

Flint Bishop gears up for further growth with senior appointment

Second phase of building work in full swing at Derby Market Hall

The highly anticipated Derby Market Hall refurbishment has commenced its second phase of work, making drastic internal and external improvements.

The Victorian Market Hall on Tennant Street is set to become a vibrant retail and leisure destination, linking the Derbion shopping centre and St Peter’s Quarter to the Cathedral Quarter and the Becketwell regeneration scheme. When complete, the refurbished Market Hall will pay homage to its heritage while evolving to meet modern needs and consumer demand.

A vital part of this next phase is to develop the public space at Osnabruck Square, a key entrance to the Grade II listed building, as well as reinstating the north entrance.

The refurbishment is being led by Wates Group, which is working in collaboration with Derby City Council. The project team is made up of specialists operating within the region, including Lathams Architects, structural engineers Rodgers Leask, and M&E consultants Clancy.

Lisa Cunningham, preconstruction director at Wates Construction, said: “The Market Hall will play a vital role in creating a thriving cultural heart in Derby and we’re pleased to support this project to restore and transform such a unique building. With the roof restoration completed, this next phase will begin to show substantial improvements to the interiors and strengthen the exteriors to ensure the building has a long life.

“This next phase will see further external work, including re-instating the two original northern entrances to the Market Hall, which will replace the current single entrance and allow a direct line of sight through the Guildhall colonnade. As well as making the building more inviting and accessible, this will also avoid any potential bottlenecks from increased footfall.

“Elsewhere on the building exterior, we will work to widen external escape doors, strip and renew the metal roof to its 1980s extension and replace the brickwork to the southern elevation arrangement with fully glazed window openings to create an active frontage with greater visibility.”

The Guildhall Yard will also be enhanced to resurface the existing tarmac and the entire courtyard will be re-paved following the demolition of the existing 1980s stair and lift tower.

Internal works will focus on the new flexible market hall space featuring free-standing mobile stalls to create an accessible space for events and activities such as food and music festivals. To accommodate a high-quality food and drink offer, the balcony will have a bottle bar and an emphasis will be placed on street food but with the flexibility to adapt to future trends.

Further work in this phase includes refurbishments made to the first-floor shops, new durable flooring, improved back-of-house storage, improvements to fire safety, and new WC facilities. A new, grand central staircase is also proposed to the north of the Market Hall, replacing an existing stairwell and removing any potential for anti-social behaviour.

This grand staircase will reflect the position and form of the original 1864 stair, connecting to the balcony in a contemporary, light and inviting route. It will feature a glass balustrade designed to contrast with, yet complement, the historic metal balustrade across the balcony.

Councillor Matthew Eyre, cabinet member for Community Development, Place and Tourism at Derby City Council, said: “Our aim is to turn the Market Hall into a key destination which incorporates the best of traditional and modern markets and that contributes to the vibrancy of the city centre while still celebrating the key features of the historic building.

“We’re excited to see this next phase come together and with the help of our project team, we’ll be able to reach our ambitious plans to transform one of the city’s most prominent buildings and increase the economic, social and cultural value of Derby.”

The designs also include sustainable focused upgrades such as on-site energy generation through solar thermal and PV panels, battery storage, combined heat and power, and disposal of food waste through anaerobic digestion.

Wates was appointed via SCAPE’s Major Works framework. The second phase of development is set to complete at the end of 2024.

76 jobs saved as manufacturer sold following group’s slip into administration

Edward Williams and Ross Connock of PwC have been appointed joint administrators of Concord Limited, BAS Castings Limited and HI Quality Steel Castings Limited.

The Group operated two casting foundries in Pinxton, Nottinghamshire (BAS) and Whittington Moor, Chesterfield (HIQ) which manufacture and supply high integrity iron and steel castings worldwide. At the time of the administrators’ appointment, on 30 March 2023, BAS had 78 employees and HIQ had 76.

The Group’s growth and financial stability has been impacted by a legacy defined benefit pension scheme which it was no longer able to support given a period of underperformance arising from Covid-19 and more recently by rising energy costs and inflation.

Despite extensive work around options, the pension trustee has recently made the difficult decision to wind the scheme up. The directors therefore concluded that the businesses could not continue to trade as a going concern and had little alternative other than to place the Group into administration.

Following their appointments, the joint administrators undertook an accelerated process of limited trading and completion of work in progress where possible alongside rapidly exploring any interest in a sale of the businesses and assets.

This has resulted in a sale of all the business and assets of HIQ which has preserved all 76 jobs to Chesterfield Metal Technologies Limited (a subsidiary of William Cook Holdings Limited) on 6 April. Unfortunately the limited interest in BAS has resulted in 59 redundancies being announced at the same date, with a small number of employees (18) retained to assist the administrators.

Eddie Williams, joint administrator, said: “I am pleased that our significant efforts since appointment have been able to save so many jobs at HIQ in a sector already experiencing a number of economic challenges. However it is very disappointing that having exhausted all options around a sale or funding, we have no alternative other than to announce this level of redundancies at BAS.

“We understand that this is a very difficult time for the employees and we will be providing support to the employees impacted over the coming weeks.”

Chris Seymour, William Cook, said: “We are delighted that we’ve managed to work with the joint administrators to complete the purchase of the majority of HIQ’s business and assets. We now look forward to stabilising the business, utilising the strength and depth from across the rest of the William Cook group and working with HIQ’s employees who will be key to future growth and profitability.”