East Midlands property consultancy takes on 2,400-mile fundraising relay challenge

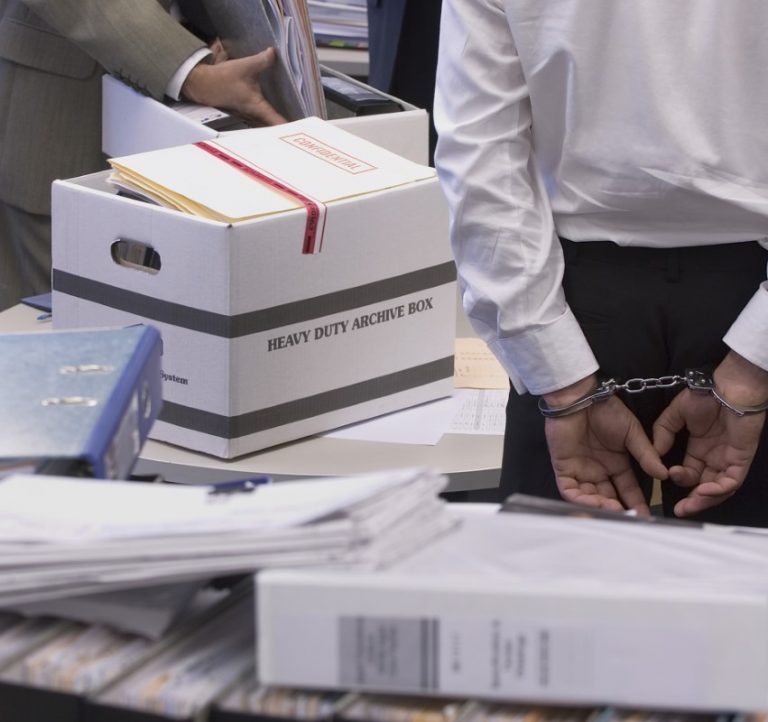

Fraud losses in Derbyshire jump 467% as scam activity spikes in Q1 2025

Derbyshire businesses and residents suffered £1.3 million in scam-related losses during the first quarter of 2025, according to Santander’s latest Scamtracker report—a dramatic 467% increase on the previous quarter.

The report tracks the scale and nature of Authorised Push Payment (APP) scams and other financial fraud incidents. While Kent led in terms of scam volume outside London with 208 recorded cases, Derbyshire followed closely with 104 incidents. Despite fewer cases, Derbyshire tied with Devon for the second-highest monetary losses outside the capital, each reporting £1.3 million lost.

The volume of scam activity in Derbyshire rose by 10% compared to the final quarter of 2024, signalling growing challenges for financial crime prevention in the region. Other counties, including Hampshire and Greater Manchester, also saw significant increases in fraudulent activity.

The data signals a rising threat for firms managing business payments and customer interactions, particularly as APP scams continue to evolve. The findings reinforce the importance of tightening internal controls, staff training, and client verification procedures to mitigate fraud risks.

The report serves as a warning to businesses operating in high-risk regions to remain vigilant as scam tactics become more sophisticated.

Retailers eye bank holiday lift amid shifting commuter and spending trends

Retailers are banking on a sales uplift during the May bank holidays, as 22 million UK workers plan annual leave, according to Virgin Media O2 Business’s Q1 2025 Movers Index. The report combines anonymised mobile network data with national polling to track movement and behaviour patterns across the country.

Retail footfall dropped 8% year-on-year in Q1 2025, continuing a sluggish start to the year marked by a reported 41% increase in retailers experiencing reduced customer spending. To counter this, 55% of retailers plan to offer special deals or events to draw in customers during the upcoming holidays. However, staffing is a concern, with 42% of retailers blocking employee leave over the period and more than half worried about shortages due to domestic travel plans.

Commuter activity has increased, with a 5% rise in travel during the first three months of the year. Office attendance is also rising, with 52% of employees commuting more frequently and 43% of businesses expected to enforce full-time office returns by June. Wednesday remains the busiest day for office presence. Workers are responding positively to these mandates, especially when companies offer new perks and invest in workplace culture.

Consumer spending remains cautious. Nearly half of Brits plan to spend less over the next three months, with many cancelling subscriptions and prioritising value-driven purchases. The decline is most noticeable among middle-aged shoppers, with the 25–54 demographic making significantly fewer trips to retail areas.

Digital convenience continues to influence purchasing habits. A majority of consumers shop via phone or online to find the best deals, while those who still shop in-store rank checkout speed, Wi-Fi availability, and mobile connectivity as their top priorities. Subscription models tied to travel, wellness, and home improvements may offer stronger potential, as these are the main spending categories identified for spring.

The data highlights a shift in how both consumers and businesses are navigating 2025’s economic landscape. Retailers hoping to drive sales will need to align with evolving work patterns, spending priorities, and customer experience expectations.

145-home development near Leicester Forest East likely to proceed

A proposed housing development by Bloor Homes, involving 145 properties on the southern edge of Leicester Forest East, is expected to secure planning approval from Blaby District Council.

The 27-acre site, located south of the A47, is partly made up of a former golf course and farmland. The plan includes demolishing a 19th-century farmhouse to make way for the scheme. The land is already designated for housing under the council’s local plan.

Local parish councils have raised objections, primarily over the impact of an access road onto the busy A47, as well as concerns about strain on local infrastructure such as schools and healthcare services.

Blaby District Council officers have recommended approving the project, citing the site’s sustainable location and good public transport access. They also confirmed that Bloor Homes would be required to make financial contributions to help offset the development’s impact on local services.

The final decision is set to be made at the council meeting on 8 May.

Private school closure signals business pressure from new VAT rules

St George’s Preparatory School in Boston, Lincolnshire, will shut down at the end of the academic year, citing financial strain following the introduction of VAT on private school fees.

The school, rated “outstanding” by Ofsted, is among the first in the independent sector to announce closure directly linked to the government’s new tax policy, which took effect in January. The VAT measure is part of a broader initiative expected to generate £1.8 billion annually by 2029/30, supporting public services, including state education.

In addition to the VAT burden, the school’s operating costs have risen due to increases in employer National Insurance contributions and the National Minimum Wage. The combined financial pressure has led to daily losses that the school describes as unsustainable.

Falling enrollment has also contributed, as fewer families opt for fee-paying education due to the higher cost base.

The decision highlights growing concern within the independent education sector over the impact of fiscal policy changes on private institutions’ viability. Support measures are being arranged for students transitioning to new schools and for staff facing redundancy.

The policy is currently under legal challenge, with critics arguing it may breach human rights and be discriminatory. The government maintains that the primary aim is revenue generation for public investment.

Travis Perkins sells staircase manufacturer

Network Rail selects Henry Boot Construction for low-carbon facility upgrade in North Lincolnshire

Network Rail has appointed Henry Boot Construction to deliver a new low-carbon Maintenance Delivery Unit (MDU) next to Barnetby Station in North Lincolnshire, as part of its push to modernise and decarbonise operational infrastructure.

The scheme includes a two-storey, 9,500 sq ft facility with integrated welfare areas, offices, storage, and support infrastructure such as a service yard, car parking, and road reconfiguration. The design features a timber-framed structure, designed to reduce embodied carbon while offering improved thermal performance and daylight efficiency.

Key sustainability features include rooftop solar panels, triple-glazed windows, air-source heat pumps, and electric vehicle (EV) charging points. These upgrades are funded via Network Rail’s Green Bank and are intended to set a new environmental standard for future MDU developments nationwide.

Henry Boot Construction leads the project as principal contractor, while Ridge provides structural and architectural consultancy. The project is being delivered through the Crown Commercial Service’s CWAS framework and is scheduled for completion by early 2026.

Totally to conduct strategic review as financial performance expectations reduced

A formal review will be conducted at Totally, the provider of healthcare and wellbeing services, of the strategic options available to the group to strengthen its balance sheet as financial performance expectations are reduced at the Derby firm.

The Totally board will consider strategic options including selling one or more of the company’s subsidiaries, receiving strategic investment, or undertaking some other form of comparable corporate action.

The company has appointed Ernst & Young (EY) as its adviser to assist with the strategic review.

The news follows a statement this morning (1 May) on trading, the stepping down of Laurence Goldberg, Chief Financial Officer, from the board of directors, and an historic negligence claim from January 2018 that is expected to be more expensive than anticipated.

The business revealed that is has reduced its financial performance expectations, after announcing on 14 February that it expected to report £85m revenue and £3.5m EBITDA for FY25.

This follows the impact of factors including a slower than expected ramp up of a recent contract win and reduced operating margins as higher margin contracts have unwound, principally NHS111. The company had indicated that it may have been possible to redeploy people/costs associated with this contract within the business, however, this has not been possible.

As the board continues to review the group’s financial performance for FY25, current estimates indicate an EBITDA range of between £0m and £2.0m. In addition, exceptional costs during the period are estimated to amount to £3.8m and there have been other cash costs capitalised on the balance sheet of a further £0.8m. The exceptional costs primarily relate to the closing of the 111 contract with the NHS.

Northampton brewery products provider snapped up

Mansfield marketing academy secures funding for growth

Rolls-Royce hails “strong start to the year,” with all divisions performing well

In a new trading update the Derby firm highlighted that despite uncertainties associated with tariffs and continued supply chain challenges, 2025 guidance of £2.7bn-£2.9bn of underlying operating profit and £2.7bn-£2.9bn of free cash flow remains unchanged.

The company noted that demand for its products and services remains strong across the group.

“We are continuing to strengthen our balance sheet,” Rolls-Royce added, “enabled by a more resilient and growing cash delivery…. We are making good progress with our £1bn share buyback, having completed £138m by the end of March.” The news follows Rolls-Royce submitting its final tender to Great British Nuclear in April.Nottingham car dealership site sold in off-market deal

Winvic announces ‘Beds for Beds’ charity partnership for UKREiiF

Hydrogen propulsion lab set to boost UK clean-tech R&D

Construction is underway on a £5 million hydrogen propulsion systems laboratory at the University of Nottingham’s Jubilee Campus, with completion expected by December 2025.

Delivered by Midlands contractor G F Tomlinson, the facility is designed to support high-power testing of propulsion systems using gaseous hydrogen, ammonia, and other alternative fuels. It will serve key industries including aerospace, automotive, marine, and power generation.

The lab will include advanced testing environments such as cryogenic capabilities and environmental chambers capable of altitude simulation. It will also be connected to the university’s existing Power Electronics and Machines Centre (PEMC), giving researchers access to megawatt-class physical testing infrastructure.

Targeting a BREEAM ‘Very Good’ rating, the lab will feature on-site renewable energy generation through integrated photovoltaic panels. Noise levels during operation will be managed with acoustic doors. The building’s steel frame and cladding are being designed to align with the surrounding campus architecture.

This initiative aligns with broader national goals to advance clean energy technologies and strengthen the UK’s low-carbon industrial base.

Adrian Grocock, managing director of G F Tomlinson, said: “We are proud to be part of this landmark project that will position the University of Nottingham as a regional leader in driving economic growth through green industries and advanced manufacturing. “Our longstanding relationship with the university spans over seven capital projects, including our recent work on the Advanced Manufacturing Building on Derby Road, close to the new hydrogen lab site. This new centre, along with its hydrogen propulsion lab, will support world-leading research and play a key role in advancing the UK’s clean energy goals.” Chris Gerada, professor of electrical machines and lead for strategic research and innovation initiatives at the University of Nottingham, added: “We are proud to continue our long-standing relationship with G F Tomlinson, who are already on site delivering the Central Building refurbishment at the Castle Meadow Campus. “Their experience and expertise in delivering high-quality, innovative projects make them the ideal partner for our new hydrogen propulsion systems lab. This world-class facility and the R&D programmes will deepen our partnership with industries including aerospace, automotive, marine and power generation.”Hydrogen rail freight project targets zero-emissions and UK supply chain growth

A new rail initiative in the East Midlands is exploring hydrogen fuel cell technology to cut emissions in freight transport and strengthen the UK’s industrial supply chain.

Led by the University of Derby in partnership with Clayton Equipment, the pilot project is focused on replacing diesel-powered shunter locomotives with zero-emission fuel cell hybrids. Funded through the East Midlands Investment Zone (EMIZ), the project supports the UK’s wider push towards Net Zero goals and is the first of 15 innovation pilots backed by the newly formed East Midlands Combined County Authority.

The research team has developed a digital twin simulation to model the performance of fuel cell-powered locomotives under different operating scenarios. The model assesses variables such as refuelling, stopping, energy demands, and emission reductions. The goal is to evaluate the feasibility of converting existing diesel-hybrid locomotives into hydrogen-powered systems.

Hydrogen fuel cells, already proven in automotive and passenger rail sectors, offer comparable performance to diesel engines but with zero emissions. Applying this technology to shunting operations could open new commercial opportunities, support low-carbon logistics, and stimulate growth in engineering skills and component manufacturing across the UK.

The project is expected to inform future manufacturing guidelines and enhance the region’s role in green and advanced transport technologies. Based in Derby, a key rail industry hub and the future home of Great British Railways, the project also aims to boost exports and attract investment in local testing and development facilities.

AECOM strengthens UK water capabilities with Allen Gordon acquisition

AECOM has acquired UK-based engineering consultancy Allen Gordon to expand its footprint in the water and energy infrastructure sector. Established in 1971, Allen Gordon brings a strong portfolio of utility and renewable energy clients, which will deepen AECOM’s relationships in these fast-growing markets.

The acquisition aligns with AECOM’s strategic goal to double its global water business within five years. It also comes as the UK anticipates over £250 billion in investment across the water and energy sectors in the next decade—driven by regulatory demands and climate resilience initiatives.

Allen Gordon’s integration is expected to enhance AECOM’s ability to deliver on major frameworks, including the AMP8 regulatory programme set for 2025–2030. AECOM’s Environment, Water and Energy division, launched in 2022, has already supported key national projects such as the Great Grid Upgrade, Southern Water’s Professional Services Framework, and Severn Trent’s flood resilience scheme in Mansfield.

The move further positions AECOM to capitalise on large-scale infrastructure opportunities across the UK and Ireland, with a focus on sustainability, resilience, and regulatory compliance.

125-home development proposed for former Raleigh HQ site in Eastwood

A detailed application has been submitted to Broxtowe Borough Council for a £41 million housing development on the site of Raleigh’s former headquarters in Eastwood, Nottinghamshire.

Developer Homes by Honey is seeking approval for the design, layout, and appearance of 125 residential properties planned for the Church Street location. Outline planning permission was previously granted in January.

The site was vacated by Raleigh in 2024 when the company relocated its head office to Durban House, also in Eastwood.

The proposed development, branded “Raleigh” to reflect the site’s history, includes new vehicle access from Church Street, pedestrian routes from the north, and green spaces integrated throughout the layout.

More than £1 million in financial contributions has been pledged by the developer to support local education, healthcare, and bus infrastructure. The council will issue a final decision on the full application in due course.

L&G adds Nottingham PBSA asset as part of £1bn growth strategy

Legal & General has acquired a 409-bed student accommodation asset in Nottingham for its Institutional Retirement business, continuing its push into the purpose-built student accommodation (PBSA) sector.

The property, located near the University of Nottingham’s new Castle Meadow Campus, was completed in August 2024. It is now in its first academic year of operation and will continue to be managed by Homes for Students under the Prestige Student Living brand.

L&G’s PBSA strategy focuses on recently developed, operational assets with strong sustainability credentials. The Nottingham site meets this brief, holding BREEAM Excellent, WiredScore Platinum, and EPC A certifications.

The deal aligns with L&G’s plan to deploy around £500 million into the PBSA market over the next two years, with a target of managing more than 5,000 beds and building a portfolio exceeding £1 billion.

To support platform growth, L&G has appointed James Brant as Senior Asset Manager. He joins from CRM Students, bringing over a decade of experience across university partnerships and private PBSA operations.

The acquisition adds to L&G’s broader residential portfolio and supports its long-term strategy of delivering institutional-grade rental housing on a larger scale.

Derby Eastern Gateway development set to complete this summer

Three units sold at Derbyshire industrial estate for £1.1m

NG Chartered Surveyors has completed the sale of three industrial units at Erewash Court on the Manners Industrial Estate in Ilkeston, Derbyshire, with the combined value nearing £1.1 million.

Units 2 and 3 were sold on behalf of a landlord by NG director Charlotte Steggles, while Unit 5 was handled separately by surveyor Alicia Lewis for another private client.

The transactions signal continued investor and occupier demand for well-located industrial space in the East Midlands, with Erewash Court drawing notable interest due to its accessibility and specification. The deals reflect ongoing strength in the region’s commercial property market, particularly for SME-targeted industrial units.

The estate remains a key location for regional businesses seeking functional, mid-sized premises with good transport links.