Wednesday, November 5, 2025

The Chair of Governors from Nottingham College has been recognised in HM The King’s Birthday Honours List 2024.

Carole Thorogood, who has been Chair since 2017, has been recognised as Medallist of the Order of the British Empire, in acknowledgement of her services within further education (FE) over the last 18 years.

During her tenure at Nottingham College and before then as Chair of Central College Nottingham, Carole has steered transformational change, overcome an extraordinarily challenging financial landscape for the college and delivered education improvement to benefit Nottingham and beyond.

This has culminated in the delivery of the flagship £58m City Hub in the centre of Nottingham, one of the largest investments of its kind for any further education college in the country. City Hub houses a 200-seat theatre, a gourmet training restaurant and state-of-the-art classrooms and learning facilities for students.

Today, Nottingham College is the only FE college serving the city, with around 21,000 learners enrolling every year. An award-winning education institution, the college prides itself on its responsiveness to the educational and training needs of the region, to ensure students are equipped with the skills and attributes that will enable them to make a positive contribution to the economy and society at large.

Carole said: “This is an absolute honour and of course a complete surprise. During my time at Nottingham College I have been supported by countless colleagues who have shared my passion for the city, for its young people and for the transformational power of further education. This award is testament to the collective impact of those individuals.

“Together, over the last few years, we have steered the college through some choppy waters and have secured its future as a high-performing, first choice education provider for Nottingham, that people can rightly be proud of.

“I’m truly thrilled to have been included in this year’s HM The King’s Birthday Honours List and I draw a huge sense of pride knowing that I have played my part in a much larger ensemble cast, throughout the last 18 years, who have led the charge for further education in this city. I’ve loved every minute of it!”

Janet Smith, CEO and Principal at Nottingham College, said: “Carole is an outstanding Chair of Governors, and this award is testament to her leadership and dedication to the people of Nottingham who choose to study, train and work here.

“Our ambition for Nottingham College is to be recognised as an outstanding provider of choice for education and skills training, and to know that we have the influence and support of our exceptional Chair and Governing Board underpins this goal.

“We are absolutely delighted for Carole and offer our congratulations and thanks for her many years of service to Nottingham College – and we hope many more years to come.”

A Derby golf day held to raise money to fund Europe’s challenge in this summer’s Cairns Cup competition has helped send the team off in style – after generous players chipped in with £15,000.

The corporate event, which took place at Morley Hayes, was organised to help with the travel and accommodation costs to ensure 16 players from across the continent can line up against a USA team when the Cup tees off next month.

The Cairns Cup is disability golf’s premier matchplay event and resembles the Ryder Cup, with a three day event with a four-ball, foursomes and singles rounds, contested by golfers with a range of disabilities, including paralysis, cerebral palsy and Parkinson’s.

Among those who will line up in the Cup is vice-captain Kris Aves, who lost the use of his legs when he was struck by a van driven by a terrorist in London in 2017, and James Gallagher, who has cerebral palsy.

Both Kris and James were also present and playing alongside the golfers at the event, which was organised and sponsored by Derbyshire firms Purpose Media and S O’Brien Heating Solutions.

They invited firms across the East Midlands to take part in a day’s worth of golf, ending with a charity auction which added a few more 0’s to the final total.

Matt Wheatcroft, managing director of Purpose Media, said: “Our target for the event was £10,000 so everyone delighted that we smashed that and raised such an incredible amount of money.

“Kris gave a very compelling speech during the prize-giving and was out and about on the course, while James was running a putting competition, so everyone got to see what they could do and learn more about disabled golf and the Cairns Cup.

“I’ve been involved with the Cairns Cup for nearly 10 years now and I want to help them. I’ve had two horrendous injuries in the past and so I understand where these guys are and how important being able to play sport is.”

Stephen O’Brien, managing director of S O’Brien Heating Solutions, added: “We had a cracking day, we got a lot of positive feedback and £15,000 raised for the Cairns Cup is not to be sniffed at.

“Kris was fantastic, he knows that his story helps to promote disabled golf and raise awareness of the Cairns Cup. He was a big golfer before his accident and it’s helped him to get back to where he needs to be mentally.

“I think we all understand how sport and getting out into the fresh air helps us with our mental health and he was a great example of that.”

The Cairns Cup takes place Cherry Creek Golf Club in Detroit at the end of July, where the European team will be looking to avenge their defeat from when the Cup was last contested at the Shire Golf Club two years ago.

The Dains Group has acquired Condies Chartered Accountants in a move that underscores their commitment to the Scottish market.

Condies has offices in Dunfermline, Edinburgh and Dundee and has grown consistently in recent years, driven by a commitment to investment in technology and an experienced and dedicated team.

Pauline Hogg, Managing Partner at Condies, said: “Joining forces with Dains Group is a fantastic opportunity for our team and clients. We are excited about the synergies this partnership will bring and the enhanced capabilities we can offer. Our clients will benefit from the extensive resources and expertise of the Dains Group, while still receiving the personalised service they value.”

Graeme Bryson, Managing Partner of Dains Scotland, added: “This acquisition represents a significant step in our growth strategy, allowing us to extend our reach in Scotland and leverage the exceptional talent at Condies. Together, we are well-positioned to offer an even broader range of services to our clients. I am looking forward to working with Pauline as joint Managing Partner of Dains Scotland.”

“We are proud to welcome Condies to the Dains family,” said Richard McNeilly, CEO of Dains Group. “Extending the incredible work done by Graeme Bryson and the Dains Scotland business is a fantastic opportunity. Pauline and the team at Condies are the blueprint for the perfect acquisition with a total focus on client support backed up by exceptional talent. Working in parallel with the Group, the team are in an amazing position to offer an even broader range of services to our clients.”

Luke Kingston, Managing Partner at Horizon Capital, said “This is another example of an excellent addition to the Dains group, and we are delighted to have supported Richard and the team on this acquisition. With group revenues now over £70m it is clear that Dains is one of the leading operators in its sector.”

Dains were advised by DSW (financial and tax due diligence), Forward Corporate Finance (Financial Modelling), Deloitte (Tax structuring) and CMS (Legal). Condies were advised by Curle Stewart (Legal).

FHP have finalised on the remaining two units at Beeston’s Evelyn Street Industrial Estate, Southwest of Nottingham City Centre.

Both units comprise circa 5,500ft² of clear span warehouse / industrial space benefitting from office and ancillary areas. In order to achieve an attractive rental figure and set a new headline rent throughout Evelyn Street Industrial Estate, FHP’s client carried out a refurbishment to secure a rental of £8.00 per ft².

Initial interest in the units was slower than anticipated, FHP noted, although over time it was evident that the desire and need for circa 5,000ft² units had shifted and increased, generating a number of enquiries leading to several offers brought forward on both units.

Mission Room Ltd and Vaunt Design Ltd are the latest occupiers to secure a unit on Evelyn Street, with a further deal being agreed by joint agents CPP, Sean Bremner, for Unit 37.

Amy Howard, surveyor at FHP Property Consultants, said: “It was a great result to get both of these deals over the line for our client. After a slow start with interest, it was certainly challenging, but this quickly changed with an increase in enquiries and all three units going under offer within two months of each other.

“Securing a new headline rent for the site was also a positive for our client and further

highlights the industrial market rental tones rising due to limited stock availability. Secondary industrial units of this size bracket are achieving £8.00 to £8.50 per ft², it is evident there is limited availability of units within this size range as demand still continues to be on the rise.

“Both Vaunt Design Ltd and Mission Room Ltd worked with our client from initial discussions and developed a landlord-tenant relationship which is key to driving deals across the line. It was a delight to work alongside both tenants and I wish them all the best in their future endeavours.”

Sean Bremner, director at CPP, said: “Great to see Evelyn Street back to 100% occupancy. Working alongside FHP, we advised our clients on the essential refurbishment works and they have been rewarded for their investment. Enquiry levels got stronger with multiple

parties pressing to secure the final unit, reinforcing the growth in the rental tone. A fantastic result for the estate.”

Entrepreneur Dean Jackson, whose innovative technology has helped some of the world’s greatest Olympians win gold medals, is picking up a gong of his own after being awarded an MBE in the King’s birthday honours.

Dean is the founder and owner of global triathlon and cycling brand HUUB, whose products have been worn by athletes including the Brownlee Brothers, Sir Jason Kenney and David Weir as well as countless amateur competitors.

Now Dean, who left Noel Baker School with just two O-Levels, will be heading to Buckingham Palace later in the year to pick up an MBE for his services to business and innovation.

But even Dean admits to suffering from imposter syndrome, initially believing the letter informing him of the honour to be an elaborate hoax.

He said: “I found myself checking the phone number on the letter, I even sniffed the paper it was written on, because I couldn’t actually believe it could be true.

“I am incredibly proud, humbled and excited – I’m just a normal bloke from Derby who is working in his passion and loves making athletes faster and better. This is recognition for the amazingly smart people I get to work with every day, who help me create some exciting products.

“I have always wanted to make my family and parents proud and I know this will have surpassed all their expectations. My mother passed away last October, and I hope she’s looking down as gobsmacked as I am.”

Dean famously launched HUUB from his kitchen table creating pioneering technology to measure active drag and create performance-enhancing products for swimmers, runners and cyclists.

The company, which has a Queen’s Award for innovation and two patents for its technology, has collaborated with experts and world-class athletes to create products for sporting participants of all ages and abilities.

In addition, Dean has also worked closely with athletes including Olympic gold medalists Alex Yee, Georgia Taylor Brown and Jess Learmonth, two-times triathlon world champion Helen Jenkins and he has supported world record attempts by local athlete Leigh Timmis.

Throughout his career with HUUB, Dean has been a dedicated champion of Derby, helping to bring events to the city such as the Jenson Button Trust Triathlon and the annual Brownlee Foundation Triathlon which is enjoyed by 1,200 key stage two school pupils.

Dean also launched Derby City Cycling – the city’s first road cycling team – and the HUUB Wattbike squad made up of multiple national and world champions, world tour riders and UCI World Cup winners. With the rest of the HUUB team he has supported the Derby 10k and a host of comic and sport relief events.

He added: “It’s not bad for a lad from Alvaston – who probably had a collection of neurodiversities that allowed him to see the world in a more creative way.

“My younger self wouldn’t believe I’m getting an MBE and going to Buckingham Palace. I’d love to put my arm round that young lad and tell him that while he may not have a string of qualifications it’s how he sees and interprets the world that will make him shine.

“My family are the greatest believers in me and my customers are my greatest supporters. Thank you to my family and especially my wife Angela and the amazing team of people at Huub – none of this would have been possible without them.”

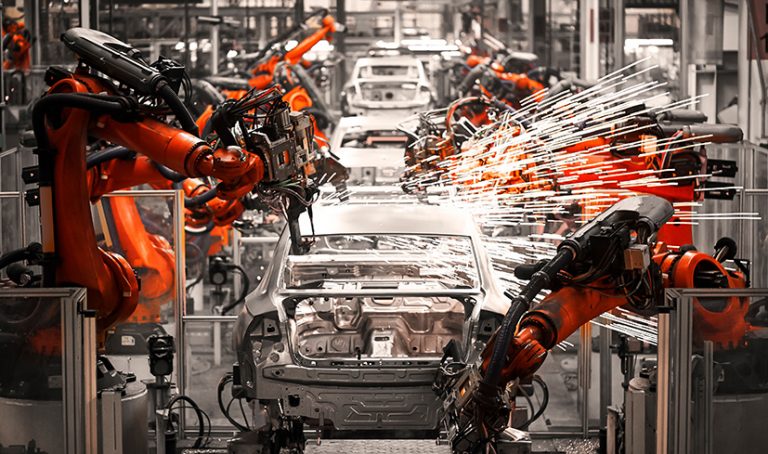

East Midlands manufacturers are seeing a much stronger picture as they enter the second half of the year with business confidence increasing and the sector forecast to outpace the economy overall in 2024.

The findings come in the Q2 Manufacturing Outlook survey published by Make UK. According to the survey, both output and orders have picked up substantially compared to the first quarter and are set to strengthen in the next three months in line with the national picture.

The East Midlands in particular is set to benefit from increased production in the automotive and food and drink sectors which have a strong presence in the region. This better picture is translating into increased recruitment intentions with job prospects especially strong compared to historical levels.

Business confidence has also risen to equal the highest level recorded since the survey started measuring the indicator in 2014. The only previous occasion it reached the current level was during the immediate post covid rebound.

The survey also asked companies to list their top three priorities for the next Government. More than two thirds of manufacturers (69.1%) said delivering an industrial strategy was the top priority, more than half (54.2%) said strengthening EU/UK relations, while almost half (44%) said reducing the business tax burden. This was followed by investment in national infrastructure (31.5%) and reforming the Apprentice Levy (24.1%).

Make UK is forecasting that manufacturing will grow by 1.2% in 2024 but moderate to 0.8% in 2025. GDP will grow by 0.9% in 2024 and 2% in 2025.

Chris Corkan, Region Director for the Midlands at Make UK, said: “After the economic and political shocks of the last few years there is now strong confidence among manufacturers in the East Midlands. At long last, companies can see concrete signs of growth and a much better economic outlook ahead.

“With prices cooling and, potential cuts in interest rates to come, the next Government must capitalise on this scenario by delivering a modern, long term industrial strategy which goes beyond the 2030s and has cross Government support.”

Clowes together with their lead contractor, Roe Developments have achieved practical completion at plot 10B and 3A at Dove Valley Park, Foston as part of the multi-million-pound property deal with Hines.

Dove Valley Park’s site owners, Clowes Developments instructed Roe Developments to build 10B (152,466 sq ft) and 3B (110,292 sq ft) stand-alone units as part of the 1.36 million sq ft portfolio with global real estate investment, development and property manager, Hines.

10B unit sits on the southern side of the business park whilst 3A is located on the northern side next to GXO.

The brand-new commercial units were designed by IMA architects and comprise of single storey warehouse with office and welfare space split over two floors at the front of the building. The units benefit from a large secure yard with level-access loading bays and docks.

Both plots have considerable onsite parking facilities with disabled bays and EV charging stations. Warehouse roofs were designed to carry photo voltaic panels subject to the occupier’s requirements. Additionally, these units have floor to ceiling double glazed in the warehouse area and 10% roof lights, creating a brighter environment for warehouse workers.

Marc Freeman, Director at Clowes Developments (UK) Ltd, said: “Clowes are pleased to deliver the last two units for Hines’ growing portfolio in the East Midlands and now look forward to delivering the ‘final phase’ of development at Dove Valley Park.

“Clowes together with IMA Architects have recently submitted a planning application to South Derbyshire District Council for the 35.29-acre site creating over half a million square feet of employment space for B2, B8, with ancillary E(g) use. Four units of varying sizes will be created to meet market demand for quality industrial space, along with the necessary associated hard and soft landscaping, car parking and infrastructure.

“In addition, a new Innovation Centre will be created that will serve as a central hub for all businesses in the local vicinity. The aim is to draw people together and provide spaces for gatherings, along with informal meeting space and access to external areas. The Innovation Centre will also serve as a space for start-up businesses to begin and has been developed in consultation with The University of Derby.”

Data driven technology company Connected Data has appointed Charlie Horner as Head of Data.

Connected Data is opening up and transforming access to vital market data, to improve the way debt is managed by organisations.

As Connected Data expands its data partner network and further integrates them into its services, Charlie will play a key role in evolving and accelerating this work.

Charlie brings with him over 30 years of experience in senior data industry roles that have focused on the effective use of data and analytics to deliver positive outcomes for organisations across various sectors and their customers.

This includes 10 years with the debt management specialist TDX Group (an Equifax company), focusing on the use of data and analytics to help creditors benchmark and improve their collections and recoveries strategies and operations.

In this role, Charlie was instrumental in enabling some of the UK’s major creditors across various sectors make improvements in their debt management activities that led to £millions worth of positive opportunities.

With a specific focus on collections and recoveries, Charlie has also provided strategic and technology advisory and delivery services across clients’ credit management lifecycles for the enforcement market integrator, Just (Part of the Arum Group).

With over 17 years at Experian, the global data and technology company in various analytical, product development and client management roles, Charlie has helped organisations maximise the use of Experian products and services, and achieve significant improvement to their business performance.

On his decision to join the Connected Data team, Charlie said: “I have spent over 30 years applying data and analytics to debt management, so I recognise the immense value that the effective use of data and analytics across the customer lifecycle can bring, specifically when it comes to achieving more positive outcomes for both organisations and their customers too.

“My new role with the Connected Data team will allow me to continue to champion the intelligent use of data to help companies prevent, reduce and resolve customer debt.

“I am very excited to be joining a team of experts that have worked across some of the biggest organisations in the credit industry and a company that is driving real improvements in the way debt is managed with its approach, enabling organisations to more easily contract, acquire, deploy and optimise data from multiple data sources into debt management processes.”

Commenting on Charlie’s appointment, Anthony Sumner, Director of Data and Analytics at Connected Data, said: “The Connected Data vision is to drive true data enablement of customer and debt management processes across all industries, so that organisations can better understand, identify, support and resolve debt issues with their customers.

“Charlie not only brings incredible knowledge in data and analytics, but a reputation with customers and suppliers alike of someone who is driven by doing the right thing and driving positive outcomes for customers and their end consumers. We are delighted to have him join the Connected Data team.”

Businesses in Kimberley interested in applying for the latest Round of Business Booster Grants can now apply online.

The Kimberley Levelling Up Business Booster scheme allows businesses to apply for up to £5,000 to help businesses attract people back into the town centre.

The scheme is part of the Kimberley Means Business Levelling Up project, and follows on from the first two Rounds where over £350,000 has been distributed to local businesses.

The purpose of the scheme is to support local businesses and to enhance the aesthetic appeal of Kimberley, for both residents and visitors, developing people’s pride in the town and attracting footfall in the town centre.

Ryan Dawson, Head of Planning and Economic Development, said: “We’re pleased to be able to announce a third round of grants available for businesses in Kimberley which will help support our local businesses to thrive.

“It’s been great to see how businesses have benefitted from our previous rounds of funding, so we are keen to receive applications from even more businesses in this round with their fresh ideas.’’

Harborough District Council has approved further details in the planning application for the new prison at Gartree, near Market Harborough.

Councillors approved proposals for the appearance and layout of the new prison submitted by the Ministry of Justice (MOJ) at Planning Committee on Tuesday 11 June 2024.

The committee also agreed to delegate authority to a designated council officer to approve planning conditions relating to specific issues including drainage and environmental considerations.

These will be discharged in agreement with the Planning Committee Chairman and following receipt of the necessary technical approvals from the expert technical organisations as needed.

In April 2022, Harborough District Council’s planning committee refused the outline application. An appeal from the Ministry of Justice against the decision was received in June 2022.

On Wednesday 15 November 2023 the government announced The Secretary of State’s decision that the Appeal from the MOJ should be allowed and outline permission should be granted, subject to conditions.

The MOJ is expected to start work on site later this year.

Plans for a controversial new logistics hub at St Johns, Enderby, which residents have fought against, have been approved.

Previously receiving refusal last year, the application from the Drummond Estate, now revised, includes plans for warehouses, offices, and gatehouses.

While many elements of the application remain from prior proposals, a planned training centre has now been omitted and replaced by industrial units.

Residents had been concerned about the loss of green space, one of the last between the village and Leicester, the effect on the road network and wildlife.

Public comments on the application saw 2,660 objections made of the 2,699 received.

The vision is for the site to accommodate four logistics buildings and three general industrial buildings.

Refurbishment works have begun to transform the Central Building at the University of Nottingham’s new Castle Meadow Campus.

Delivered by Midlands contractor, G F Tomlinson, the refurbishment works will breathe new life into the Central Building, which sits on the site of the former HMRC offices, helping to establish the campus as a social and commercial hub for the university.

The Castle Meadow Campus is a zone for entrepreneurship and innovation in the city centre, with a sustainability strategy implemented by the university that assesses each development to ensure carbon neutral targets are being met. Encompassing seven buildings, it features state-of-the-art facilities for its community of students, academics, and industry partners.

The Grade II listed Central Building is undergoing extensive renovation works including the complex replacement of the tensile fabric roof to ensure a future proof building, and the addition of a new mezzanine at first floor level offering views of the roof through a large, glazed roof light at its centre.

A new welcome reception area will provide unobstructed views from the entrance into the heart of the building. Alongside this, a new bistro café with kitchen facilities, study spaces and external seating will provide a social space accommodating over 200 visitors.

The new HV power sub stations are now under construction, with trench ducting between the neighbouring buildings being created and new power supplies being installed. Restoration works to the listed concrete slabs are underway, with specialist contractors carefully removing years of paint and debris, bringing the structure back to its original state.

The replacement of the roof is an extensively technical process due to its intricate design. As the build is a predominantly steel framed structure supported by tensile fabric and tensioned steel cables, it’s fundamental that each fabric panel is dismantled in sequence, to preserve the building and protect the fragile and vulnerable elements.

Structural temporary works will be implemented to support this process taking place over a 20-week period.

G F Tomlinson have a long-standing relationship with the University of Nottingham. Previous schemes delivered by the contractor include the Advanced Manufacturing Building at the Jubilee Campus, along with the Biodiscovery Institute and the East Midlands Conference Centre refurbishment at the University Park Campus. With extensive experience of refurbishing Listed buildings, G F Tomlinson also delivered the multi-million redevelopment of the Nottingham Castle.

As part of their commitment to provide added social value throughout the project, G F Tomlinson have already donated 10 dual side benches from the former changing rooms of the building to local football club, Pelican Colts. Year 10 students from Lees Brook Academy, Bemrose School and Minster School have been provided with work experience placements, working alongside the project team to gain valuable on-site skills and experience, helping them to scope out careers in construction.

Managing Director, Adrian Grocock, said: “We’re pleased to be building on our long-standing working relationship with the University of Nottingham to bring this landmark Central Building at Castle Meadow Campus to fruition. The team has worked extensively to plan intricate works for the unique building and roof design, drawing upon our specialisms and expertise.

“The city centre campus is a shining example of how the city can retrofit existing buildings to create sustainable modern facilities, and the Central Building works will maximise the current building’s potential to become a landmark social and commercial city hub.”

Director of Estates and Facilities at the University of Nottingham, Gary Moss, said: “Creating inclusive, sustainable environments is at the heart of our campus development programme.

“This great work with G F Tomlinson, who share these values, will enable the reimagined Central Building to become a welcoming, vibrant landmark at the heart of our new Castle Meadow Campus. With work well underway, including the complex roof replacement, we’re thrilled to be on track for a Spring 2025 opening of our new city centre campus hub.”

Evolve Estates, part of M Core, has acquired a portfolio of retail units in

Northampton as part of its continued strategic growth.

The deal includes 15-27 and 27/29 on Abington Street, the main road linking the

east of Northampton town centre with the Market Square, and 9/15 and 1-13

Wood Street. Units are let to established occupiers such as Waterstones, Barclays

Bank, Bodycare, Holland & Barrett, and Superdrug.

Evolve Estates acquired the units for an undisclosed sum as part of its proactive

acquisition drive in shopping parades, centres and retail parks across the UK.

Joe O’Keefe, Co-Founder at Evolve Estates, said: “This is an exciting and logical

addition to our portfolio, we already own and manage the Grosvenor shopping

Centre which has proved to be a great success.

“This continuity of ownership is great news for the community and local shoppers to the area, aiming to create spaces where businesses can grow and provide the community with further services and retail opportunities.”

Agents acting on behalf of Evolve were Tim Lloyd at Cited, Gregg Goodman as

the solicitor at Clarke Willmott. The vendor’s solicitor was Mishcon de Reya LLP.

East Midlands-based law firm Rothera Bray has made nine promotions across a range of key practice areas, including the elevation of two professionals to partner and four individuals to senior associate roles across four office locations.

Notable among the promotions are Ann Farnill, previously a Senior Associate Solicitor in wills and probate, and Emily Weston, formerly a Senior Associate Solicitor in conveyancing, who have been promoted to partner.

Four colleagues have also been promoted to senior associate: Transport Barrister Olivia Maginn, based at the firm’s Nottingham office, Conveyancing Associates Julekha Nathani and Kiran Phagura, based at the firm’s Leicester office, and Wills and Probate Associate Eleanor Robinson, based at the firm’s West Bridgford office.

Additionally, Family Law Solicitor Charley Kelly, Conveyancing Solicitor Tina Rana, and Wills and Probate Solicitor Aleksandra Cebula, who is based at Rothera Bray’s Beeston office, have been recognised with promotions to associate positions.

Christina Yardley, CEO of Rothera Bray, said: “It is fantastic to be able to recognise and reward the invaluable contribution our people make to the firm and our clients.

“These promotions highlight not only the dedication and excellence demonstrated by each individual but also the firm’s commitment to investing in its people, nurturing talent and fostering growth within its ranks.”

Mansfield-based Deanestor, one of the UK’s leading furniture and fitout specialists, has released its latest financial results for the year ending December 2023 which show a £3m increase in turnover to £22.4m and a record order intake of over £30m.

Forward orders have increased by more than £3m to over £30m compared to the same period last year for projects to be delivered through to the end of 2025.

Turnover rose by £3m in 2023, up from £19.2m in the previous year and again with a healthy operating profit. Net assets in the same period increased by £1.5m.

Projects have been delivered and awarded across diverse market sectors – healthcare, education, student living and build-to-rent – for the manufacture and installation of fitted furniture, bespoke kitchens and specialist joinery, and with a high level of repeat business from tier one contractors and major residential property developers.

William Tonkinson, CEO of Deanestor, said, “This latest set of figures demonstrates strong and sustainable growth for the business across multiple sectors. We have an exceptionally healthy project pipeline and are anticipating an increase in turnover to £24m by the end of 2024.”

“Our financial performance is testament to the hard work of our teams in the East Midlands and in Fife – from design and estimating to manufacturing and work on site – who help our clients achieve the balance between first class fitout services, fitted furniture of the highest quality, and project delivery to the required budget and programme.”

“Quality and longevity are vitally important for fitting out retained assets – from hospitals that are operational 24/7 to co-living apartments that require strong tenant appeal, long-term.”

In Scotland, Deanestor continues to perform well from its regional headquarters in Fife, particularly in the education sector. Current projects include Deanestor’s 13th school furniture and fitout project for Robertson Construction – a £3.8m contract for the new East End Community Campus in Dundee.

Contracts nearing completion in the build-to-rent residential sector include a contract worth around £2.5m to provide 399 bespoke, high specification kitchens for Winvic Construction at New Garden Square in Birmingham – Deanestor’s third project for Moda Living.

Also in the co-living sector, Deanestor has just been awarded a contract for more than 100 kitchens for a multi-tenure project in the EdCity development in London’s White City, working once again with Bowmer + Kirkland.

Hospital fitout contracts totalling £4m have also been secured, the largest of which is a project worth more than £1m for Integrated Health Projects (IHP) – a joint venture between VINCI and Sir Robert McAlpine, to fit out two 54-bed adult mental health facilities at Kingsway Hospital in Derby and in the grounds of Chesterfield Royal Hospital.

Deanestor’s latest major project in the student living sector is a £2m contract to fit out the bedrooms, studio and communal kitchens for a 550-bed scheme.

Nottingham-based students, budding entrepreneurs and local companies can get free help to take their business to the next level with mentoring and support from Oxford Business College.

The college has launched the Oxford Business Innovation and Incubation Centre (OxBIIC), which will support growing businesses with mentoring, workshops and product development sessions.

Fifty businesses – including 39 students and 11 local companies – are taking part in the first intake, and will receive one hour of mentoring every fortnight. Businesses could get up to three years of free mentoring.

The mentoring is being offered at the Oxford Business College campus on Carlton Road in Nottingham, as well as the campuses in Oxford, West London and Slough.

The business experts leading the mentoring have more than 45 years of experience taking companies from inception to IPO and in sectors including manufacturing, retail, food tech and wholesale.

Tech entrepreneur and investor Bryony Tinn-Disbury took a food tech company through three rounds of investment and created an incubator for MedTech entrepreneurs.

Simoni Wong has more than 20 years’ experience at C-suite level and successfully executed two IPOs.

Students, budding entrepreneurs and local businesses can apply to be part of the OxBIIC programme by emailing oxbiic@oxfordbusinesscollege.ac.uk

Mr Sarwar Khawaja, Chairman of the Executive Board of Oxford Business College, said: “The Oxford Business Innovation and Incubation Centre is another way that we are setting our students up to succeed in business. We are also giving back to the local community, and helping turn business ideas into success stories.

“Many Oxford Business College students are born entrepreneurs, and we love to support them as they launch and grow their own businesses. We are delighted to see that 50 firms have already signed up.

“Our flexible courses make it possible for students to hold down a job while studying, making us the perfect place for mature learners and those who want a new career.”

Lincolnshire-headquartered global airfield and runway specialist Jointline has made its largest investment since the establishment of the 37-year-old business, to enhance its runway grooving capabilities.

The £1m of new plant and machinery will help drive sustained growth for the privately-owned company, which currently has 120 employees.

Gary Massey, Managing Director of Jointline, said: “The current demand for runway refurbishment and development is the highest it’s been for the past decade. In order for us to fulfil the demand from existing domestic customers – while expanding our overseas operations – we have deployed company funds to purchase multiple new sets of specialist plant and machinery.

“We have also invested in the training and development of long-serving employees and increased our skilled workforce by 20% to 120 employees. This is setting us apart from our competitors, while keeping the team and our customers safe as we carry out grooving assignments on live airfields. I am proud to be leading a business that is set up for the future and able to continue to grow sustainably and profitably.”

Jointline’s investment in the expansion of its grooving division includes the purchase of five ride-on pavement groovers, a bespoke 30-ft articulated trailer and two 44-tonne DAF XF Super Space tractor units. The firm has also invested in the remanufacture of its 30,000-litre capacity water tanker, which has additional safety features, Chapter 8 requirements, and full 360-camera coverage.

Hospitality workers on precarious contracts are most likely to experience workplace sexual harassment, according to a new report.

The report reveals how a combination of precarious contracts, sexualisation of service work and the workforce’s demographics have contributed to making hospitality workers more vulnerable to workplace sexual harassment.

Dr Bob Jeffrey, lead author of the research from Sheffield Hallam University, said: “We’ve all seen the headlines over the last year about issues of sexual harassment in the fast-food industry. Our research helps to explain why it’s such a problem, not just in fast-food, but across the hospitality sector.

“Part of the reason for this is the hospitality industry having the largest percentage of zero-hour contracts, which makes it too easy for perpetrators in positions of authority to cut the hours of those who try and speak out.”

Researchers interviewed hospitality workers as part of a wider study on low paid and precarious work. Sexual harassment and unwanted sexual attention were mentioned by a significant number of interviewees.

The report highlights how the hospitality workforce is disproportionately young, female, from a minoritised background, on zero hours contracts and on the lowest rates of pay.

All of which make them more vulnerable to sexual harm, with workers on precarious contracts 60 per cent more likely to report being a victim of sexual harassment, and women generally reporting sexual harassment rates twice as high as men.

Findings showed that several of the women interviewed were harassed by their manager or supervisor, who used their position of authority and responsibility for their working patterns to harass them and control their working lives.

Forvis Mazars, a global professional services network, has appointed Mitesh Thakrar as an audit partner in the East Midlands.

Following the recent launch of Forvis Mazars, the newest top 10 global professional services network, Mitesh joins the firm at a period of great opportunity in the East Midlands. He will also be joining an expanding local partnership team following the appointments of Andy Hickson, Claire Cowen and Mark Surridge last September.

In his new role Mitesh, who has spent his entire career in the East Midlands and specialises in working with privately owned businesses, will be responsible for further strengthening the audit practice and supporting the firm as it continues to grow its client base in the region.

Mitesh joins Forvis Mazars following a strong financial reporting period in the East Midlands. This has seen the team expand by 10% over the last year and income rise to in excess of £40m across the region. Mitesh joins the firm from Azets, where he was a partner and regional head of audit (East Midlands).

Steve English, office managing partner for Forvis Mazars across the East Midlands, said: “Mitesh brings over a decade’s experience of working in audit and serving clients across the East Midlands.

“His insights into the local market will be invaluable as we look to continue to grow our presence and offering in the region. Mitesh’s dedication to his clients and to audit quality mean he will be a fantastic addition to the team and we look forward to welcoming him.”

Activewear retailer, Lucy Locket Loves has entered voluntary liquidation, owing just under £900,000.

It follows supply chain issues, warehouse floods that caused downtime and lost stock, rising import costs that impacted margins, and the cost of living crisis hitting revenue.

The Dronfield-based business was also affected by a change from monthly to quarterly rent payments for its warehouse, which it was unable to meet.

Founder Lucy Arnold said: “Firstly, I want to apologise to everyone impacted by this, especially our customers and the LLL Team. Despite everyone’s hard work, the challenges of the past 18 months were overwhelming, leading us to enter voluntary liquidation on May 28, 2024.

“Supply chain issues, warehouse floods that caused downtime and lost stock, rising import costs that slashed our margins, and the ongoing cost of living crisis hit our revenue hard and disrupted our operations. These essentially made our traditional business model obsolete.

“In December 2023, we managed to negotiate monthly rent payments for our warehouse, but by May 2024, the owners insisted on reverting to full quarterly payments, which we couldn’t meet. This led to their abrupt decision to take control of our warehouse on May 10th with no notice, disrupting our operations and leaving us without working capital.

“Facing no operational ability and mounting financial obligations, we made the difficult decision to enter voluntary liquidation.

“This has been incredibly distressing, particularly for our team, who were reluctantly made redundant. We deeply regret the impact on our staff and their families and I can never say sorry enough for how abruptly this happened. This has personally been the most upsetting part of this process.”

The business aims to relaunch the Locket Loves website in Summer with a new look, operational hub, and new leggings designs.

In 2020, Arnold was included in Forbes’ 30 Under 30 list.