Multi-million-pound apartment project takes another step forward in Nottingham

Rushton Hickman adds to Agency Department

Construction begins on new Sharphill Community Centre

East Midlands Investment Zone marks first year of activity

- Outline planning permission being granted and initial work starting on industrial and warehouse developments on the 20-hectare Hartington Commerce Park site.

- The University of Nottingham creating innovation roadmaps and supporting 15 cutting-edge projects testing innovative products and processes for the green economy and advanced manufacturing.

- The University of Derby shaping a skills pipeline to connect local people to high-value careers.

- Enabling works at the Derbyshire Rail Industry Innovation Vehicle (DRIIVe) to support the region’s growing rail cluster.

- Feasibility work on a second Nuclear Skills Academy at Infinity Park Derby.

Actons takes home Law Firm of the Year at LawNet Awards

Melton’s Stockyard redevelopment rescheduled to 2026

The redevelopment of Melton’s Stockyard, the food and events hub at the town’s Cattle Market, will now begin in July 2026 following a project review by Melton Borough Council.

Originally planned to start in spring 2025, the delay follows the completion of the planning phase and adjustments to accommodate ongoing events and design updates. The revised timeline aims to minimise disruption for existing traders and ensure alignment with major events such as the Artisan Cheese Fair and NBA Beef Expo, both scheduled for May next year.

Cllr Pip Allnatt, Leader of Melton Borough Council stated that “We’re pleased to confirm that the Stockyard project continues to move forward, with the planning phase now complete and the focus shifting to preconstruction and operator engagement. Construction is scheduled to begin in July 2026, following two of Melton’s flagship events in May – The Artisan Cheese Fair and the NBA Beef EXPO – both of which showcase the town’s proud agricultural and food heritage and reinforce its identity as the Rural Capital of Food.”

The project forms part of the £22.95 million Rural Innovation in Action scheme, a joint initiative between Melton Borough and Rutland County Councils backed by UK Government funding.

Once complete, the redevelopment will introduce four new buildings and an expanded events space designed to enhance the site’s role as a regional centre for food production, enterprise, and tourism. The project is projected to create 110 permanent jobs and attract an estimated 50,000 additional visitors annually.

The Stockyard currently houses several local food and drink businesses, including Round Corner Brewery and Feast and the Furious smokehouse, alongside weekly and specialist markets.

Phenna Group completes 20th deal of 2025 with acquisition of BCA Concepts

Practical completion achieved at Greggs’ new national distribution centre

Goodwin forecasts £71m pre-tax profit as defence demand drives growth

Engineering group Goodwin plc expects to double its pre-tax profit in the financial year ending 30 April 2026, projecting earnings of more than £71 million compared to £35.5 million in 2025.

The company attributed the growth to its strong order book, valued at around £365 million, and increased visibility across several defence and nuclear programmes that have not yet been included in its confirmed pipeline. All divisions contributed to the group’s performance, though profitability and growth varied across its business units.

Goodwin noted that its newly developed Polyimide Division is expected to start contributing to earnings in the next financial year.

The board expressed confidence in the group’s ongoing expansion, citing consistent product quality and a solid pipeline of long-term contracts as key drivers.

In its leadership update, the firm announced the appointment of Adam Deeth as finance director and Anthony Thomas as director, effective 28 October 2025. Deeth, who joined Goodwin in 2022, previously served as group chief accountant, while Thomas, who joined in 2019, has been group general counsel since 2021.

Founded in the 19th century, Goodwin remains one of the UK’s longest-standing engineering firms with operations spanning foundry, mechanical, and materials engineering.

Next increases profit guidance as sales exceed expectations

Sales overperformed in both the UK and overseas, with UK sales up 5.4% versus last year (lower than the 7.6% growth Next achieved in the first half, but ahead of guidance of 1.9%). Overseas sales were up 38.8% on last year (ahead of the 28.1% growth achieved in the first half, and exceeding guidance of 19.4%).

Looking to its fourth quarter, Next is increasing its guidance for full price sales from +4.5% to +7%, adding a further £36m of full price sales to the business’s forecast. The increase in sales in Q3, along with improved sales guidance for Q4, has seen Next uplift full year guidance for profit before tax by £30m to £1.135bn.Unimetals Recycling files second administration notice amid ongoing investment talks

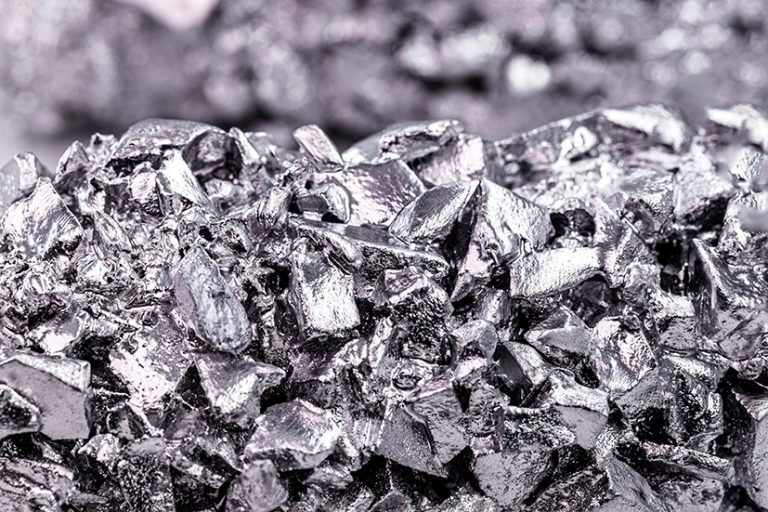

Unimetals Recycling (UK) Ltd, a major player in the nation’s metal recycling and processing sector, has filed a second notice of intention to appoint administrators. The move provides the company with additional time to secure funding as it continues its search for new investment.

Headquartered in Stratford-upon-Avon, the business had previously lodged its first notice earlier this month after failing to raise the capital needed to finalise a £195 million deal to acquire Sims Metals UK. Its primary investor has since withdrawn from the funding process, delaying progress toward completion.

Unimetals is continuing formal discussions with potential financiers after reporting strong interest from multiple parties. The company said the extra period granted by the second filing will allow it to pursue a binding agreement aimed at stabilising operations and ensuring the continuity of its business relationships across employees, suppliers, and customers.

East Midlands take-up growth dominates Big Box market for Avison Young

Center Parcs chief corporate officer appointed CBI East Midlands Council chair

Stepnell reports steady growth and plans for expansion

Stepnell has recorded its fifth consecutive year of profit, with turnover rising to £112 million and expected to reach £140 million in the current financial year. The construction firm attributes this sustained performance to disciplined sector targeting, regional expansion, and its participation in framework projects.

The company recently established a new regional base in Liverpool to strengthen its presence across the North West. It has also benefited from high levels of repeat business and selective bidding, supported by several senior appointments and refined governance processes designed to manage risks in a volatile construction market.

Stepnell has increased its investment in directly owned plant, helping to reduce operational costs and improve delivery efficiency. Its cash reserves have also grown due to stronger financial management, including tighter payment controls and account closures.

Tom Wakeford, chief executive at Stepnell, said:

“I am really pleased with where Stepnell is. We are ambitious and are currently focusing on setting longer term plans for the business. The organisation is in a strong position heading into 2026, with 96% of its planned revenue being secured by August.”

The release of its year-end accounts provides Stepnell an opportunity to take stock of its position, Tom added.

“We can rightly be proud of Stepnell’s performance over the most recent reporting period. This ever-improving position is indicative of our ongoing focus in making sure we are the right construction partner for each new scheme we take on, and our experience has shown that the earlier we are engaged on a project, the greater the probability the scheme will be a success for both us and our client.

“We’re proud to say that more than three-quarters of our work is with repeat clients where our previous projects have exceeded their expectations, a key driver being our ongoing focus on delivering excellent engagement.”

These results mark Stepnell’s first full year of trading since its demerger in September 2025, which transferred the business to Wakeford and his family. The company remains focused on steady expansion, improved profitability, and maintaining financial resilience as it moves into the next financial cycle.

Ilkeston leisure club placed on the market for new ownership

A major sports and leisure venue in Ilkeston, Derbyshire, has been put up for sale, marking a new chapter for one of the town’s most established fitness destinations.

The Manor, a long-standing health and racquet club, is being marketed by business property adviser Christie & Co. The site features international-standard squash courts, a multi-level gym, a dance and martial arts studio, a lounge bar, treatment rooms, and a fully equipped catering kitchen. It also includes a function space frequently used for events, parties, and weddings.

Located centrally in Ilkeston, the club operates on a membership model, with pay-as-you-go access available. It has served as a community hub for sport and fitness for nearly two decades.

Owned and operated by the Hayden family since 2007, The Manor is now being offered for sale as the family turns its attention to other ventures. The listing provides an opportunity for investors or leisure operators to build on the existing facilities or introduce new offerings, such as padel courts, subject to planning approval.

Gabriela Williams at Christie & Co commented, “This is a very exciting prospect which we expect to appeal to a wide range of potential buyers. It would be fantastic to see the building and the value it brings to the community thrive under new ownership.

“The club would be a great addition to an independent health and fitness operator’s portfolio, or a fantastic opportunity for a new start-up business. We encourage interested parties to get in touch with us.”

Christie & Co is inviting offers for the property’s long ground lease.

Rolls-Royce SMR signs key collaboration agreement

£175m decline in R&D tax relief claims by Midlands SMEs

Curve Theatre reports record year with £18.5m turnover

Leicester’s Curve Theatre has reported its most successful financial year to date, achieving an annual turnover of £18.5 million for 2024/25.

Between April 2024 and March 2025, more than 265,000 tickets were sold for performances at the venue. The programme included Made at Curve productions such as My Fair Lady, The Mountaintop and Fantastic Foxes, alongside national tours including Tina – The Tina Turner Musical and My Son’s a Queer (But What Can You Do?). The theatre also staged 132 accessible performances, including BSL-interpreted, captioned, and relaxed sessions.

Curve’s reach extended beyond Leicester, with its productions touring over 107 cities and drawing more than two million ticket sales. The year also marked the launch of the Kinky Boots UK and Ireland tour and the return of A Chorus Line, which completed a sell-out season at Sadler’s Wells.

As a registered charity, Curve raised over £1 million through donations, grants and sponsorship. Its creative engagement programmes attracted 27,500 participants, with more than 350 school groups attending performances. Around 1,000 artists participated in development programmes, supported by 1,220 hours of in-kind rehearsal space.

Speaking about the results, Curve’s Chief Executive Chris Stafford and Artistic Director Nikolai Foster said:

“We are immensely proud to report on another terrific year for our theatre — the most successful since we opened our doors in 2008. Not only did attendance reach an all-time high for audiences here in Leicester, but working in partnership with other theatres and commercial producers we were able to fly the flag for Curve around the UK and internationally, reaching over 2 million people.

Curve would not be the place it is today without the people who make it happen, and these outstanding results are a testament to the incredible team at Curve and the talents of our wonderful freelance colleagues. As always huge thanks to the support from our fantastic audiences, donors, sponsors, and our principal funders Arts Council England and Leicester City Council.

Whilst we are delighted to share such positive news, like most theatres we are operating in an ever-more challenging environment, with rising costs continuing to affect our operations. We urgently need to build sufficient funds for essential capital replacements to ensure Curve thrives into the future.”

Nearly one-third of audiences were first-time visitors, and 1,000 free tickets were distributed through community networks, reinforcing Curve’s commitment to accessibility and community engagement.