The delivery of a third phase of new council homes has reached a significant milestone, with a contractor being appointed and work now starting on site.

Work begins to build more social housing in Mansfield

Administrators appointed to fish processing specialist

Nottingham City Council awaits decision on £3.4m grant to progress Broad Marsh shopping centre demolition

New CPD courses in Cyber Security showcased to businesses

Van Elle anticipates decline in first half revenue amidst challenging market conditions

Van Elle, the ground engineering contractor, is anticipating a decline in first half revenue amidst challenging market conditions.

According to a trading update for the six months ended 31 October 2024, the firm expects to report revenue for the period of approximately £65m, representing a decrease of 5% on the prior year.

Market conditions have continued to be challenging across all sectors, Van Elle noted, with workload subdued in Rail, as the sector transitions from CP6 into CP7, and Highways continues to experience project delays.

The business added that the impact of the Building Safety Act has caused delays to start dates of taller residential schemes, however encouragingly the new build housing sector has continued to recover, with a strong pipeline of work planned for delivery throughout the second half of the financial year.

Van Elle said it has also made further progress in developing a strong position in the water and energy sectors, and the recent acquisition of Albion Drilling provides additional momentum in Scotland.

Growth is also continuing in Canada, with the award of a new three-year framework agreement in November for the delivery of Metrolinx renewals projects worth approximately CAD$9m to the Group.

Van Elle’s order book at 31 October 2024 increased to £41.6m (30 April 2024: £35.1m).

2025 Business Predictions: Parm Bhangal, Managing Director, Bhangals Construction Consultants

Council plans new affordable homes for disused block of flats

Work starts on new research and development facility for food and farming sector

Work has started on creating a new research and development facility at the University of Lincoln’s Riseholme Park Campus, enabling new industry collaboration and research opportunities for the UK’s food and farming sector.

Rail firm hosts Christmas party to help young people who have left care feel less alone

Blueprint Interiors appoints commercial director

Nottingham Venues confirms commitment to being a Real Living Wage employer

Nottingham-based Inaphaea BioLabs appoints Head of Scientific Operations

East Midlands could ‘lead the country in skills’ says new Chamber President

Sale of Boots back on the table as takeover bid proposed for US owner

New student accommodation plans recommended for approval at Nottingham’s Island Quarter

Music festivals at Catton Park calling for urgent infrastructure investment

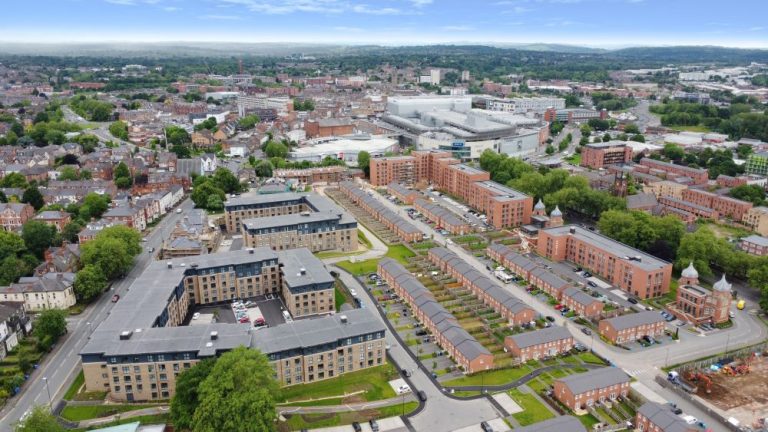

Wavensmere completes £65m of apartments at Derby’s Nightingale Quarter in 2024

East Midlands restructuring and insolvency expert joins Rothera Bray

Shorts appoints new Tax Partner

National Lift Tower revamped to boost Northampton’s innovation legacy

Barry Stubbs, Technical Training Academy Manager for Aliaxis UK, said: “We pride ourselves on delivering best-in-class training and CPDs and felt the Training and Research Centre’s interior needed to reflect that. As a result, the revamped interior now has new decor, furniture, and facilities, providing a dedicated training space and modern meeting rooms.”

With exceptional technical capabilities, the facilities housed within the National Lift Tower attract industry professionals from across the globe, including building regulation inspectors, consultants, designers, international developers, M&E contractors, main contractors, and public health engineers.

Dave Thomas, Head of Technical Support Services for Aliaxis, said: “These experts visit our centre to conduct research, development, testing, and to receive practical training and upskill their knowledge across various industries, strengthening its role as a central hub for innovation.

“We look forward to welcoming visitors who want to see it for themselves, and have the opportunity to watch high-rise drainage in action with a live demonstration or by joining a CPD session.”

Built by the Express Lift Company, the structure, previously called the Express Lift Tower, was used as a lift-testing tower. It was commissioned in 1978 and officially opened in 1982, and has been a Grade II Listed Building since 1997.

Barry Stubbs, Technical Training Academy Manager for Aliaxis UK, said: “We pride ourselves on delivering best-in-class training and CPDs and felt the Training and Research Centre’s interior needed to reflect that. As a result, the revamped interior now has new decor, furniture, and facilities, providing a dedicated training space and modern meeting rooms.”

With exceptional technical capabilities, the facilities housed within the National Lift Tower attract industry professionals from across the globe, including building regulation inspectors, consultants, designers, international developers, M&E contractors, main contractors, and public health engineers.

Dave Thomas, Head of Technical Support Services for Aliaxis, said: “These experts visit our centre to conduct research, development, testing, and to receive practical training and upskill their knowledge across various industries, strengthening its role as a central hub for innovation.

“We look forward to welcoming visitors who want to see it for themselves, and have the opportunity to watch high-rise drainage in action with a live demonstration or by joining a CPD session.”

Built by the Express Lift Company, the structure, previously called the Express Lift Tower, was used as a lift-testing tower. It was commissioned in 1978 and officially opened in 1982, and has been a Grade II Listed Building since 1997.