Andrew + Ashwell makes leadership team promotions

Manchester Airports Group seek planning permission for new manufacturing park

Gain exposure amongst the property & construction industry at the East Midlands Bricks Awards 2024

- Most active agent

- Commercial development of the year

- Responsible business of the year

- Residential development of the year

- Developer of the year

- Deal of the year

- Architects of the year

- Excellence in design

- Sustainable development of the year

- Contractor of the year

- Overall winner (this award cannot be entered, with the winner, and recipient of a year of marketing/publicity worth £20,000, selected from those nominated for the event’s other awards)

Nominations end Thursday 5th September

Tickets can now be booked for the 2024 awards event, click here to secure yours.

Taking place in the Derek Randall Suite at the Trent Bridge Cricket Ground on Thursday 3rd October, from 4:30pm – 7:30pm, connect with local decision makers over nibbles and complimentary drinks while applauding the outstanding companies and projects in our region.

Attendees will also hear from keynote speaker Paul Southby, partner at Geldards LLP, chair of the Advisory Board to Nottingham Business School, chair of Broadway independent cinema, trustee of Clean Rivers Trust, chair of Nottingham Partners, board member of Marketing Nottingham and Nottinghamshire, and former High Sheriff of Nottinghamshire.

Dress code is standard business attire.

Thanks to our sponsors:

Tickets can now be booked for the 2024 awards event, click here to secure yours.

Taking place in the Derek Randall Suite at the Trent Bridge Cricket Ground on Thursday 3rd October, from 4:30pm – 7:30pm, connect with local decision makers over nibbles and complimentary drinks while applauding the outstanding companies and projects in our region.

Attendees will also hear from keynote speaker Paul Southby, partner at Geldards LLP, chair of the Advisory Board to Nottingham Business School, chair of Broadway independent cinema, trustee of Clean Rivers Trust, chair of Nottingham Partners, board member of Marketing Nottingham and Nottinghamshire, and former High Sheriff of Nottinghamshire.

Dress code is standard business attire.

Thanks to our sponsors:

To be held at:

Global Brands expands spirits portfolio with Irish acquisition

30,000ft² of warehouse space let on Sherwood Park

Refurb will have pub open again by end of next month

Start-ups aiming to help the elderly and support disadvantaged young people secure funding

East Midlands educators and employers address People and Skills challenges at summit

Small firms need Government to reduce cost of international trade

Stud Brook Business Park takes shape with lead construction contractor appointed

Local partners celebrate completion of new homes in Blaby District

Coalville Town FC scores big with donations from Aggregate Industries

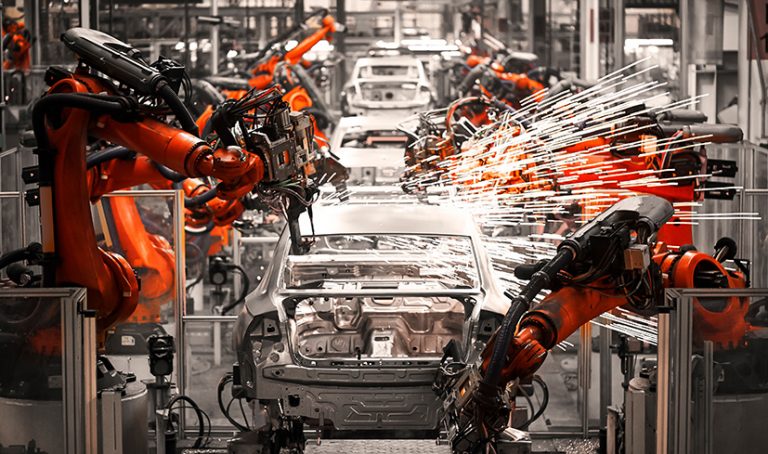

Government clears funding for TfL to order ten new Elizabeth Line trains to be built at Derby

“We are delighted to now have a confirmed workload for Derby Litchurch Lane and our supply chain across the UK,” said Nick Crossfield, Managing Director UK and Ireland at Alstom.

He added: “The UK remains one of Alstom’s most important global markets.”

East Midlands Chamber Chief Executive Scott Knowles said: “The base at Litchurch Lane has been a powerhouse of UK train manufacture for decades and is a key driver of both Derby’s economy and the country when you consider the wider supply chain. “With the continued uncertainty the factory has been facing for so long, due to a gap in orders, news of this multimillion-pound order for the Elizabeth Line is welcome, especially as the new trains will be built at the site itself.”