Council plans new affordable homes for disused block of flats

Work starts on new research and development facility for food and farming sector

Work has started on creating a new research and development facility at the University of Lincoln’s Riseholme Park Campus, enabling new industry collaboration and research opportunities for the UK’s food and farming sector.

Rail firm hosts Christmas party to help young people who have left care feel less alone

Blueprint Interiors appoints commercial director

Nottingham Venues confirms commitment to being a Real Living Wage employer

Nottingham-based Inaphaea BioLabs appoints Head of Scientific Operations

East Midlands could ‘lead the country in skills’ says new Chamber President

Sale of Boots back on the table as takeover bid proposed for US owner

New student accommodation plans recommended for approval at Nottingham’s Island Quarter

Music festivals at Catton Park calling for urgent infrastructure investment

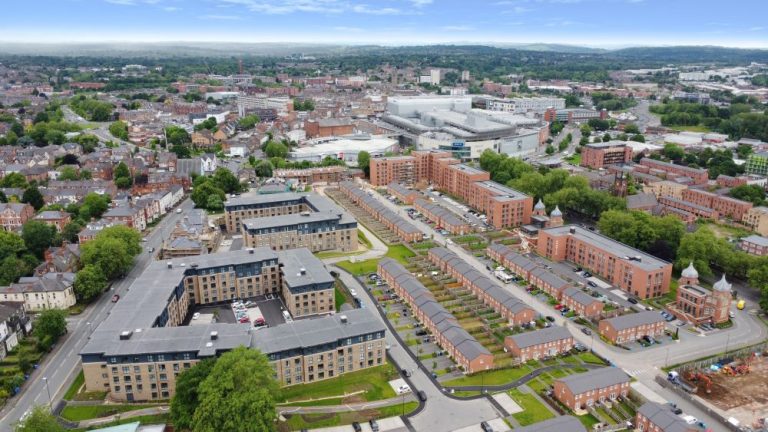

Wavensmere completes £65m of apartments at Derby’s Nightingale Quarter in 2024

East Midlands restructuring and insolvency expert joins Rothera Bray

Shorts appoints new Tax Partner

National Lift Tower revamped to boost Northampton’s innovation legacy

Barry Stubbs, Technical Training Academy Manager for Aliaxis UK, said: “We pride ourselves on delivering best-in-class training and CPDs and felt the Training and Research Centre’s interior needed to reflect that. As a result, the revamped interior now has new decor, furniture, and facilities, providing a dedicated training space and modern meeting rooms.”

With exceptional technical capabilities, the facilities housed within the National Lift Tower attract industry professionals from across the globe, including building regulation inspectors, consultants, designers, international developers, M&E contractors, main contractors, and public health engineers.

Dave Thomas, Head of Technical Support Services for Aliaxis, said: “These experts visit our centre to conduct research, development, testing, and to receive practical training and upskill their knowledge across various industries, strengthening its role as a central hub for innovation.

“We look forward to welcoming visitors who want to see it for themselves, and have the opportunity to watch high-rise drainage in action with a live demonstration or by joining a CPD session.”

Built by the Express Lift Company, the structure, previously called the Express Lift Tower, was used as a lift-testing tower. It was commissioned in 1978 and officially opened in 1982, and has been a Grade II Listed Building since 1997.

Barry Stubbs, Technical Training Academy Manager for Aliaxis UK, said: “We pride ourselves on delivering best-in-class training and CPDs and felt the Training and Research Centre’s interior needed to reflect that. As a result, the revamped interior now has new decor, furniture, and facilities, providing a dedicated training space and modern meeting rooms.”

With exceptional technical capabilities, the facilities housed within the National Lift Tower attract industry professionals from across the globe, including building regulation inspectors, consultants, designers, international developers, M&E contractors, main contractors, and public health engineers.

Dave Thomas, Head of Technical Support Services for Aliaxis, said: “These experts visit our centre to conduct research, development, testing, and to receive practical training and upskill their knowledge across various industries, strengthening its role as a central hub for innovation.

“We look forward to welcoming visitors who want to see it for themselves, and have the opportunity to watch high-rise drainage in action with a live demonstration or by joining a CPD session.”

Built by the Express Lift Company, the structure, previously called the Express Lift Tower, was used as a lift-testing tower. It was commissioned in 1978 and officially opened in 1982, and has been a Grade II Listed Building since 1997. Further expansion for Nottingham’s Promethean Particles as it adds new staff and new office space

Multi-million pound regeneration of Staveley Market begins

East Midlands accountancy firm eyes further growth with new private equity partner

£20m commitment to fund business growth projects in Lincolnshire

An investment of £20m over four years will be made by the county council to fund business growth projects in Lincolnshire.

How to guarantee* to annoy a journalist: by Greg Simpson, founder of Press For Attention PR

Nottingham City Council sets out £17.91m of savings in budget proposals

- Effective management of vacant posts through an initiative to manage vacancies more prudently.

- Reduce costs and improve efficiency by streamlining layers of management and team sizes.

- Improve productivity and manage staffing budgets by reducing sickness rates and enhancing performance management.

- Introduce commercial expertise to reduce third-party spending and improve procurement processes

- Conduct a council-wide IT review to rationalise applications, systems, licenses, and subscriptions, ensuring business continuity and cost savings.

- Improving digital access through development of the website and digital forms, shifting demand to more efficient service delivery.

- Improving early intervention and prevention.

- Ensuring the services citizens have chosen are in line with their eligible needs.

- Reviewing provision of support hours to ensure needs are met appropriately and recommissioning care to the right contracted level.

- Reviewing social care transport including eligibility, how it is charged for and ways in which it is commissioned.

- Reviewing high-cost care packages to ensure best value outcomes for citizens.

- Realigning and reviewing grant income the Council receives for adult social care.

- Operating model redesign to optimise efficiencies

- Redesigning Sport and Leisure services to reduce the Council subsidy.

- Making the museums and galleries service financially sustainable by increasing revenue, reducing costs and establishing a charitable development trust and exhibitions company.

- A revised events programme refocussed towards cost neutral or commercial events.

- Reducing the amount the Council subsidises the Theatre Royal Concert Hall through a ‘front of house’ restructure and the introduction of a new ticket insurance product for customers.

- Generating income through a new contract for bus shelters and advertising display units across the city.

- Repaying external market borrowing earlier than planned.