Principal contractor appointed to first phase of multi-unit logistics development

Why protecting your digital identity is now central to managing assets and preserving trust: by Mark Smith, chief information officer at Streets

Derbyshire industrial site to be sold for £2.2m

Business confidence returns as small firms stabilise external finance use

Small and medium-sized enterprises (SMEs) across the UK have maintained steady use of external finance in 2024, according to the British Business Bank’s latest Nations and Regions Tracker. The report shows that 45% of smaller firms accessed external finance during the year, a marginal drop of one percentage point compared to 2023, following the sharp rebound seen the previous year.

Regional performance was mixed. Northern Ireland recorded the highest proportion of firms using finance at 52%, while the North West and East of England saw modest increases. The East Midlands, North East, and Wales registered notable declines. Credit cards remained the most common form of borrowing, followed by overdrafts and leasing or hire purchase arrangements.

The appetite for growth funding has improved. The proportion of businesses open to using finance rose to 38%, with the West Midlands showing the largest regional rise. Despite this, nearly a fifth of firms still expect difficulties in obtaining finance.

Equity investment fell by 2.5% to £10.8bn, with deal activity returning to pre-pandemic levels. However, the North West, South West, and East of England showed stronger investment intensity, supported by active venture capital presence and local innovation hubs.

During 2024/25, the British Business Bank directed 84% of its new finance outside London, supporting 22,100 jobs and contributing an estimated £4.7bn in additional GVA. The Bank’s financial capacity has expanded to £25.6bn, with new regional investment funds announced for the East and South East, alongside further backing for angel networks and innovation-led businesses.

Businesses move into Derby’s new Cavendish Building

The first companies have moved into the Cavendish Building, part of the newly launched Derby International Business School. The seven-storey facility is designed to strengthen ties between academia and industry by housing commercial tenants alongside university departments.

Flexible office spaces on the second and sixth floors cater to teams of various sizes, supporting collaboration and research partnerships. Early tenants include Marketing Derby, the Cathedral Quarter and St Peter’s Quarter Business Improvement Districts, design agency MacMartin, and thermal window specialist Blind Screen.

Businesses located in the building will have access to facilities such as a creativity lab, a supply chain lab, a trading floor, and an immersive reality suite. The development also features a café, library, and shared workspaces designed to foster innovation and cross-sector engagement.

The Cavendish Building is part of the University of Derby’s wider strategy to deepen its industrial connections and create an environment where companies, students, and researchers can collaborate on skills development and applied projects.

Marketing Derby managing director, John Forkin, said: “We are particularly pleased to be strengthening our relationship with the University through this move. “Over many years, we have worked closely together for the betterment of the city. The Cavendish Building itself is a perfect illustration of the University’s commitment to Derby, particularly the city centre. We look forward to continuing our mission to make Derby the city of choice for inward investors from our new home.” Claire MacDonald, co-founder and director of MacMartin, said: “The values of the University of Derby and, in particular, the Business School’s focus on sustainability research align perfectly to the ethos and beliefs of MacMartin. “As an alumnus of the University’s Help to Grow project, I have witnessed first-hand the value of working collaboratively and we are very keen to continue to expand our relationship with the University and wider business community.” Gemma Pindard, deputy manager for the Cathedral Quarter and St Peters Quarter BIDs, said: “The team and I are thrilled to have moved into The Cavendish Building. Our new base will enable the BIDs and our team of Rangers to remain close to the city centre and continue our valuable work supporting local businesses.” Paul Cheetham, co-founder and director of Blind Screen, said: “This exciting move to The Cavendish Building is another milestone for Blind Screen. We are thrilled to deepen our partnership with the University of Derby, driving innovation and contributing to the evolving culture of the Business School.”Derby City Council’s cabinet to consider delegating highway powers for South Derby Growth Zone

Shh! PR champions female-led businesses with bold new mission to close the visibility gap

- Tailored media strategies designed for female entrepreneurs facing systemic barriers.

- Proactive positioning of clients as thought leaders across mainstream and trade outlets.

- Long-term campaigns that secure not just mentions, but influence and recognition.

GeoPura secures £27m for UK hydrogen expansion and Danish hub

GeoPura has secured £27 million in green financing from Barclays to expand its hydrogen energy operations in the UK and establish a new base in Denmark. The package includes a £16.5 million guarantee from the Export and Investment Fund of Denmark (EIFO), marking EIFO’s first international Power-to-X guarantee.

The funding supports HyMarnham Power, GeoPura’s joint venture with JG Pears, which will produce low-carbon hydrogen at a former coal-fired power station in the East Midlands. Expected to become the first project under the UK Government’s Hydrogen Allocation Round 1 (HAR1) to reach commercial operation, it will supply hydrogen for GeoPura’s zero-emission power units and other industrial uses.

The new Danish hub, GeoPura (Europe) Limited, will secure electrolyser capacity and support delivery capability across Europe, strengthening the company’s continental operations.

GeoPura’s hydrogen systems replace diesel generators in sectors such as construction, data centres, film production, and major events. Clients include National Grid, Balfour Beatty, and the BBC. Its next-generation Hydrogen Power Unit 2 is designed for higher-capacity applications, expanding its reach into new markets.

The Barclays-EIFO partnership highlights growing UK-Danish collaboration in clean energy finance, aiming to drive investment, job creation, and industrial growth in both markets.

Davies Turner reports turnover surge past £260m amid steady profits

Davies Turner Holdings has recorded a sharp rise in turnover, reaching £264 million for the year ending 31 March 2025, compared with £213.3 million the previous year. Pre-tax profits remained stable at £15.1 million, down slightly from £15.9 million.

The Coleshill-based logistics group, established in 1870, continues to operate one of the UK’s most extensive multimodal networks, providing freight forwarding, haulage, warehousing, and logistics services. Its operations span 19 sites across the UK and Ireland, including major hubs in Dartford, Heathrow, Birmingham, Bristol, Manchester, and Glasgow.

The company’s performance reflects continued strength in demand for integrated logistics and supply chain solutions, supported by ongoing investment in warehousing capacity and transport infrastructure. The group has signalled that it remains focused on expanding its market share through its global partnerships and multimodal capabilities.

Davies Turner, one of the UK’s longest-standing logistics operators, said it is positioning itself for long-term stability and incremental growth following the solid results of its latest financial year.

Quotient Sciences records annual loss amid industry slowdown

Drug development accelerator Quotient Sciences has reported an £8.8 million pre-tax loss for the year ending 31 December 2024, reversing its previous year’s £12.6 million profit. Revenue declined to £71.3 million from £74.2 million in 2023.

The Ruddington-headquartered firm operates drug development, manufacturing, and clinical testing sites across the UK and US, including Reading, Edinburgh, Alnwick, Miami, and Philadelphia. The company stated that its performance reflected weaker conditions across the broader life sciences sector.

Quotient Sciences implemented cost reduction measures during the year to address market pressures. These initiatives incurred one-off costs that limited their immediate financial impact but are expected to strengthen the company’s position in 2025.

Management said the business entered the new financial year with a lower cost base and capacity to improve revenues and margins as market conditions stabilise.

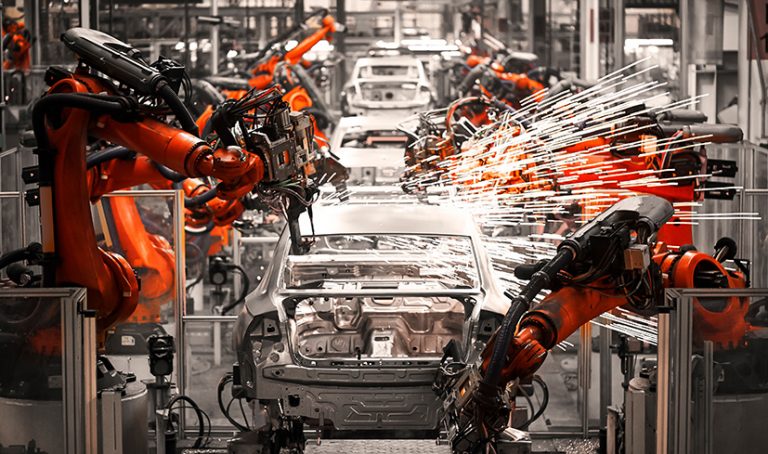

JLR prepares phased return to production after cyber attack

Jaguar Land Rover is moving towards a controlled restart of manufacturing after a cyber attack forced the company to halt operations across its UK sites. Testing has begun at several facilities, with production expected to resume shortly at the Wolverhampton engine plant.

The disruption, which began on 31 August, affected the company’s sites in Solihull, Halewood, and Wolverhampton. Manufacturing was suspended throughout September as cybersecurity teams worked to contain the breach and restore systems. The company extended its production pause until at least the start of October while coordinating recovery efforts with the National Cyber Security Centre and law enforcement.

Analysts estimate the shutdown could cost the manufacturer around £120 million, with production normally averaging 1,000 vehicles a day. The pause also placed pressure on suppliers within the UK automotive supply chain, many of which are small and medium-sized firms dependent on JLR’s orders.

To mitigate financial risks, the Government announced a £1.5 billion loan guarantee to support JLR and provide assurance to suppliers awaiting payments. The automotive giant employs around 120,000 people across its supply chain and is one of the largest contributors to the UK’s manufacturing output.

Midland Scaffolding Services’ charity challenge a runaway success

Florist takes root on Swadlincote High Street

Someone tried to clone me on Instagram — so I beat them to it: by Greg Simpson, founder of Press For Attention PR

- Start with what’s different

- Show results, not reach

- Be findable, helpful and human

- Lead with insight, not ego

- Make your soundbite your superpower

DX Group expands capacity with new site in Northamptonshire

DX Group has opened two new distribution facilities in Birstall and Wellingborough, expanding its DX-2 network to nine Super Sites across the UK.

The Birstall site, based on Norquest Industrial Estate, covers 35,000 sq ft, while the Wellingborough facility spans 10,000 sq ft at Ise Valley Industrial Estate. Both locations are part of the company’s continued investment in infrastructure to support growth in its two-person delivery division, which specialises in handling large and heavy consumer goods.

The DX-2 network now operates 19 depots, including the nine Super Sites, and runs a dedicated fleet managing over 100 daily routes. Around 450 employees support the division, which delivers to homes and commercial properties nationwide.

By expanding its Super Site network, DX aims to enhance operational efficiency, reduce travel distances and emissions, and strengthen customer service. The investment follows several years of network development across the Group, including upgrades to IT systems, vehicles, and equipment.

Ian Truesdale, Chief Executive Officer of DX Group, commented: “We are delighted to have opened these additional new DX-2 Super Sites in Birstall and Wellingborough. They will provide our DX-2 operations with greater capacity, further increase capability and get us closer to our customers’ customers. They also help to make us more efficient and reduce our stem mileage, which in turn will lower our overall carbon emissions. We continue to focus on setting market-leading service standards. We have invested significantly in our depot network over the past few years and will continue this programme across the Group, including IT, vehicles and equipment.”

Kiril Mischeff expands portfolio with Primepak Foods acquisition

Kiril Mischeff Group has acquired East Yorkshire-based Primepak Foods Ltd, continuing its expansion in the UK food manufacturing sector.

The Nottinghamshire-headquartered company, established in 1935, is one of Europe’s leading suppliers of food ingredients and products to manufacturing, retail, and foodservice markets. The addition of Primepak Foods strengthens the group’s product range in cheese, cooked meats, and sandwich fillers, which are produced under the Wolds Edge brand and private labels.

Primepak Foods, a family-run business, operates as a specialist processor and manufacturer serving retail, delicatessen, and foodservice clients. The acquisition aligns with Kiril Mischeff’s strategy to diversify its product lines and consolidate its position in the convenience food and ingredients market.

Dimiter Mirchev, Managing Director of Kiril Mischeff Group, commented: “Primepak Foods is a family owned and run business, that offers synergies with our existing products and services. This acquisition will allow us to expand and develop our offering and we welcome the Primepak team to the Kiril Mischeff family of companies. We look forward to working together for a mutually successful future.”

Advisory support for the transaction included Schofield Sweeney and Affinia for Kiril Mischeff, while Primepak Foods received guidance from DSW Corporate Finance, Bradbury and Co Accountants, and Wilkin Chapman Rollits.

The deal further extends Kiril Mischeff’s operational footprint in the UK food production landscape, reinforcing its vertically integrated supply capabilities across multiple categories.