Awards to celebrate tourism and hospitality excellence in Nottinghamshire

Multi-million redevelopment works progressing well for Sutton on Sea Colonnade

NAHL pleased with first half performance despite a volatile personal injury market

The CEO of NAHL, the marketing and services business focused on the UK consumer legal market, is “pleased with the first half performance of the Group,” with the business profitable, cash generative, and making further progress in reducing net debt.

According to unaudited interim results for the six months ended 30 June 2024, revenue was £19.4m, 7% lower than last year, due to a reduction in revenues from NAHL’s Personal Injury business in what it says was a “challenging and unusually competitive market.”

Profit before tax, however, increased to £0.5m and was almost as high as for the whole of the previous year (FY 2023: £0.6m). Moreover, net debt at the Kettering-based firm was £9.0m, down 7% from £9.7m at 31 December 2023 and down 22% from 30 June 2023. The news comes as NAHL negotiates terms with a number of parties for the potential sale of Bush & Co, with discussions hoped to be concluded before the end of the year.James Saralis, CEO of NAHL, said: “I am pleased with the first half performance of the Group. Despite the challenges presented by a volatile personal injury market, the Group was profitable and cash generative and we made further progress in reducing our net debt. In Critical Care, Bush & Co. performed very strongly in the first six months delivering double digit growth in revenue and profits.

“NAH faced a more difficult, highly competitive market in the Period but we continue to take steps to improve performance in this area and we expect to make progress in the second half. As a result, the Board is confident in delivering a full year outturn in line with market expectations and I would like to take this opportunity to thank our fantastic team for their continued hard work and commitment.

“The Board is encouraged that negotiations for the potential sale of Bush & Co. are progressing well and it believes now is the right time to consider the potential strategic options and future strategy for the remainder of the Group. While this is at an early stage the Board will keep shareholders updated with further announcements as appropriate.”

“Excellent” first half for Yü Group

Bobby Kalar, Chief Executive Officer, said: “Once again, my team has delivered an excellent performance, and I’m in no doubt that this continued momentum will deliver a strong full year performance and further enhance our contracted forward order book. Our simple yet effective strategy to build strong foundations has resulted in the continued delivery of our rapid and sustainable growth.

“I believe the numbers should do the ‘talking’. Revenue is up 60%, adjusted EBITDA is up 49%, cash in the bank up 137%, meter points on supply up 82% and contracted revenue increased by 70%. I’m delighted and rightly proud of the performance of the business against a challenging period of extreme volatility in the market.

“Yü Smart continues to go from strength to strength. Like all new startups, we’ve experienced growing pains and building teams who share our values and habits has required management attention. However, I’m satisfied good progress has been made and we have positioned ourselves for significant meter installation growth. Smart meter installations are up by 125% and engineering headcount is up 300%.

“Our February 2024 new trading deal with Shell Energy remains strong and their mature and collaborative approach is already leveraging opportunities not available to us before. I look forward to further strengthening our relationship.

“The lack of Institutional engagement has been disappointing, despite management delivering colossal value year on year. Many AIM companies are questioning the market’s future and the desirability of remaining listed. This has been reflected in the reduction of quoted companies.

“The AIM market’s future is delicately balanced and won’t be helped if the current government further punishes and disincentivises entrepreneurial high growth companies. This lack of recognition is frustrating; however, we remain focussed on delivering FY24 forecasts and positioning the Group for another record-breaking performance in 2025.

“I would like to thank my fantastic team and in particular the Board who continue to challenge and encourage the executive team.”

RedTree PR MD to complete 75 mile cancer charity running challenge at Nottingham half marathon

Construction of new roadside retail development completes in Rutland

£24m loan provided for Wavensmere’s £75m Friar Gate Goods Yard redevelopment

Microlise Group delivers “solid performance in the first half of 2024”

According to unaudited results for the six months ended 30 June 2024, the business saw an increase in total revenue to £39.1m, up from £33.9m in the same period of 2023, driven by strong recurring revenue growth and contributions from the acquisitions of Enterprise Software Systems (ESS) and Vita Software.

New customer acquisition, meanwhile, was “particularly strong” with 202 new direct customers added during the period.

Several major, multi-year, contract wins included WooliesX, GSF Car Parts, Foodstuffs North Island, STAF, Romac & One Stop, demonstrating execution of international expansion and company cross-sell and up-sell strategies.

Multi-year renewals signed in the period included Goldstar, DPD and M&S. Further, Microlise recently signed a five-year contract renewal with JCB covering recurring SaaS software licences and hardware sales.Nadeem Raza, CEO of Nottingham-based Microlise, said: “Microlise delivered a solid performance in the first half of 2024. Market conditions have greatly improved following the resolution of component supply issues, and localised delays in new vehicle rollouts are expected to resolve by year-end. Ongoing market consolidation is also expected to benefit Microlise as our solutions are tailored toward larger companies which now dominate the sector.

“The positive reception to our new products, coupled with the continued integration of our recent acquisitions and the increasing interoperability of our solutions, has enhanced the appeal of our offering. As a result, we are seeing improvements in our sales pipeline both in the UK and in target geographies where our brand is becoming increasingly recognised.

“With the appointment of a new Chief Revenue Officer, we hope to be able to accelerate the growth of our pipeline while improving its conversion into contracted business. The Company looks to the future with confidence and expects to meet market forecasts for the full year.“

New MP tours Siemens Mobility

Alfreton warehouse let by customised packaging specialist

Earthworks and ground improvement contractor expands with South Normanton office

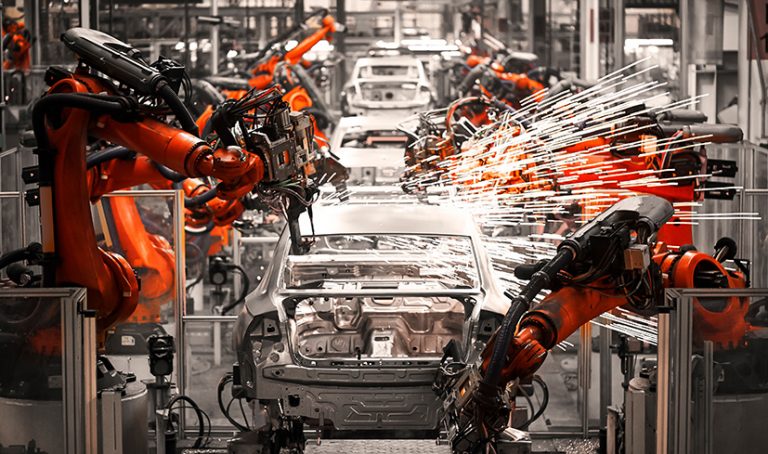

Manufacturing output falls in the three months to September

- Output volumes fell sharply in the three months to September, following a more modest decline in the quarter to August (weighted balance of -20% from -9% in the three months to August). Looking ahead, output is expected to fall in the three months to December (-7%), the first-time expectations have been negative since November 2023.

- Output decreased in 14 out of 17 sub-sectors in the three months to September, with the fall driven by the motor vehicles & transport, metal products and paper, printing & media sub-sectors.

- Total order books were reported as below “normal” in September and deteriorated relative to last month (-35% from -22%). The level of order books remained significantly below the long run average (-13%).

- Export order books were also seen as below “normal” and deteriorated considerably relative to last month (-44% from -22%). This was also far below the long-run average (-18%) and left export order books at their weakest since December 2020.

- Expectations for average selling price inflation softened in September (+8% from +15% in August), with the balance standing close to the long-run average (+7%).

- Stocks of finished goods were seen as more than “adequate” in September (+11% from +15% in August), broadly similar to the long-run average (+12%).