Trading ahead of expectations at Games Workshop

BlueSkeye AI wins another national technology award

The Range to acquire brand, website and intellectual property of wilko

Adhesives company acquires business of Nottinghamshire firm

Gould Alloys expands at Markham Vale with second 55,000 sq ft unit

Gould Alloys has expanded at Markham Vale, taking a further 55,000 sq ft on a 10-year lease.

The deal, which will see Gould Alloys expand into the MV55 unit, comes almost a decade after the business first arrived at Markham Vale, moving into a purpose-built 50,000 sq ft building and investing more than £1m in new technology and machinery.

Markham Vale is a flagship 200-acre industrial and logistics scheme in Chesterfield; a joint venture partnership between property developer HBD and Derbyshire County Council.

The new building forms a key part of Gould Alloys’ sustainability strategy, while providing additional space to deliver new contracts in the future.

The deal also demonstrates the continued demand for space at Markham Vale, with MV55 immediately let with no void period.

Tom Wheldon, head of region at HBD, said: “It’s great to see Gould Alloys expanding further at Markham Vale. MV55 is the ideal location for the business’s second base at the scheme; a best-in-class building, its sustainable features will support the company’s environmental strategy and help to minimise its carbon output.”

Jane Bradshaw of Gould Alloys said: “We’ve been at Markham Vale for almost a decade, so it’s great to be able to secure MV55 for our next chapter. The additional 55,000 sq ft is a key component of our environmental strategy, ensuring we can operate as sustainably as possible by limiting the movement of materials and reducing our carbon output, while providing additional capacity for the servicing of future contracts as we continue to grow.”

Councillor Tony King, Derbyshire County Council’s Cabinet Member for Clean Growth and Regeneration, said: “Gould Alloys is a real Derbyshire success story and we’re pleased we’ve been able to accommodate their needs and cater for their growth with additional space here at Markham to help them become more sustainable. They are an established part of our business community and we look forward to following their success for many more years to come.”

G F Tomlinson secures place on prestigious Procure Partnerships Framework

High profile property development director joins BRM Solicitors

Regional law firm BRM Solicitors has appointed a new director to its Real Estate team.

Julie Carr joins from national law firm Knights, bringing with her extensive background in handling residential property development, guiding conditional contracts for purchasing and selling development land, and managing options and overage agreements.

Julie also oversaw planning promotion agreements, joint ventures, and various collaborative arrangements, coordinating land assembly, and establishing development sites for plot sales.

BRM’s 26-strong property team now includes nine directors and counts Woodall Group, Gleeson Homes, Reef Group and Global Brands among its clients.

Adrian Sheehan, head of BRM’s Real Estate department, said: “The addition of a new director is a significant move for us and reflects our ambitious strategy for BRM’s Real Estate Department. Julie’s strong track record and breadth and depth of experience highly complement our growing residential developer client portfolio, whilst we provide her with a platform regionally and nationally.”

Julie Carr added: “BRM’s department has developed an enviable client portfolio and earned a well-deserved reputation as one of the most highly regarded in the region. I’m looking forward to being part of its future growth.”

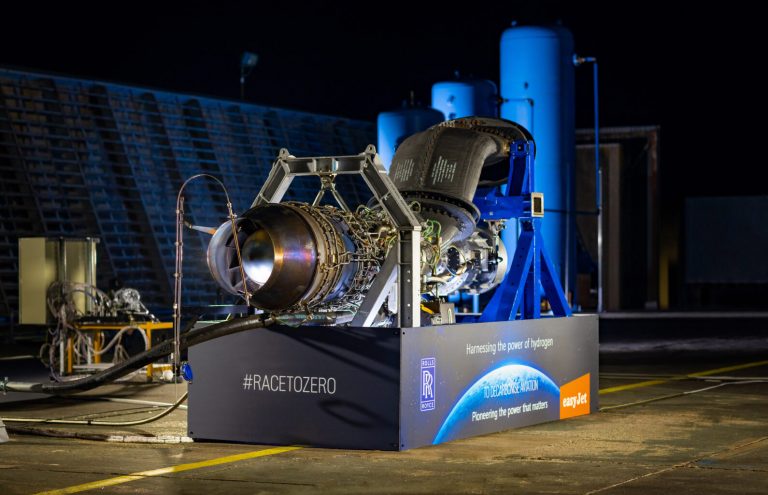

Rolls-Royce joins group to develop hydrogen as an aviation fuel

Apprenticeship Awards finalists announced

- Advanced Apprentice of the Year: Alfie Wooldridge Derby City Council; Franchescia Davies Buxton & Leek College; Jordan Pirie Brookfield Community School; Olivia Scane HM Land Registry

- Higher Apprentice of the Year, Sponsored by Nottingham Trent University: Alison Liles The Gables Residential Care Home; Sarah Westwood BWB Consulting;

- Degree Apprentice of the Year, Sponsored by University of Nottingham; Arron Faulkner E.ON UK; Connell Parker E.ON UK; Holly Johnson Derby Homes Ltd; Mia Outram No7 Beauty Company; Stuart Rendall Continental Engineering Services

- Construction Apprentice of the Year: Avikaash Manon Derby Homes; Ben Wilcox BWB Consulting; Eddy Palethorpe Crawford & Co Surveyors; Lloyd Dabell Crawford & Co Surveyors; William Thompson Dalton Roofing

- Manufacturing Apprentice of the Year: To be announced

- Professional Services Apprentice of the Year: Eleanor Ancliffe Reach Separations; Jacob Whitty Crawford & Co Surveyors; Lloyd Dabell Crawford & Co Surveyors; Megan Tuohy Crawford & Co Surveyors.

- Health and Public Service Apprentice of the Year, Sponsored by Auto Windscreens: Holly Johnson Derby Homes Ltd; Jade Smith St Albans Medical centre; Poppie Staden Blythe House Hospice Care and Helen’s Trust.

- Technology and Digital Apprentice of the Year, Sponsored by Aim Qualifications Group: Arron Faulkner E.ON UK; Connell Parker E.ON UK; Hannah Jones Experian; James Bennington BWB ConsultingJames Cox Central Technology; Joe Hawksworth Althaus Digital.

- Mentor of the Year, Sponsored by Greatest Hits FM: Janet Quinlan-Jones Sort Legal; Kiera Bailey Reach Separations; Sarah Walker BWB Consulting; Sophie Bancroft – Employee Development Manager Derby Homes Limited; Waqas Matloob Althaus Digital.

- Diversity & Inclusion Award: Auto Windscreens; Broxtowe Borough Council;

- SME Employer of the Year: Sponsored by EMAAN; Crawford & Co Surveyors; Dalton Roofing; Project D; Sort Legal.

- Large Employer of the Year: Broxtowe Borough Council; BWB Consulting; Chesterfield Royal Hospital NHS Foundation Trust; Derby Homes Ltd; Experian; Motus Commercials; Nottingham University Hospitals NHS Trust;

- Training Provider/Programme of the Year: Althaus Digital; Auto Windscreens; JTL