Administrators appointed to construction company

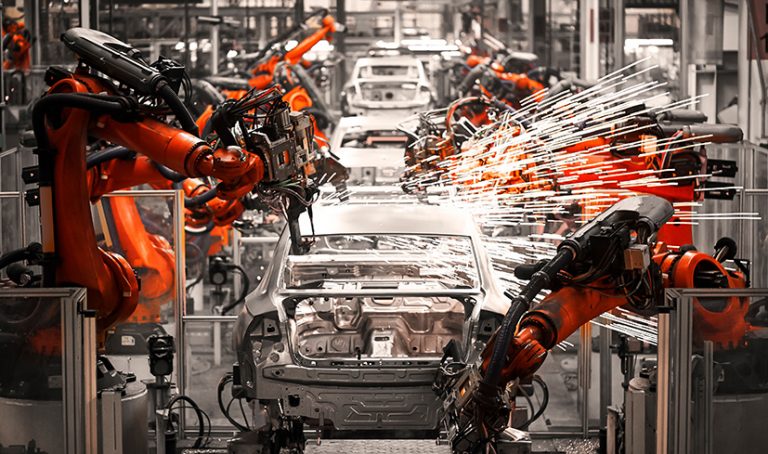

Manufacturers cut back investment as output and orders weaken

- Output volumes fell in the quarter to January, after being unchanged in December (balance of -10% from 0% in the three months to December). Firms expect volumes to rise marginally in the next three months (+7%).

- Total new orders fell at their fastest pace since July 2020 (balance of -13% from +2% in October) and manufacturers expect orders to remain unchanged over the next three months (-1%).

- Growth in average costs per unit of output accelerated in the quarter to January, with the pace of costs growth standing well above average (balance of +43%, from +29% in October, long run average of +18%). Cost growth is expected to remain elevated in the quarter to April (+43%).

- Domestic selling prices were reported as broadly stable over the three months to January (balance of +2%, from +5% in October), the weakest balance in over three years and matching the long-term average. Export price inflation accelerated from October (+14%, from +10%) and stands above the long-term average (-4%). Domestic price growth is expected to pick up in the next three months (+9%), while export price growth is expected to ease (+6%).

- Investment intentions for the year ahead were mixed. Manufacturers expect to raise spending on training & retraining (+6% from +5% in October). Investment in product & process innovation is expected to fall (-5%, from +6%, the weakest since the quarter to January 2021). Investment in tangibles is expected to fall rapidly, including buildings (-29% from -31%) and plant & machinery (-15% from -11%, also the weakest since January 2021).

- The main constraint on investment was uncertainty about demand (cited by 58% of manufacturers, the highest since January 2021). Other factors include: inadequate net return (40%, the highest since July 2020); the cost of finance (22%, the highest since January 1991 – excluding the pandemic period) and labour shortages (20%, down from a record 37% two years earlier – excluding the pandemic period – but still above the long-term average of 11%).

The Access Group makes appointments to lead on customer experience, people and sustainability

Working across various countries, she has helped firms identify opportunities and mitigate risks, improve cost-cutting programmes and influence buy-ins across multidisciplinary global teams.

She most recently worked at RWS Holdings plc where she led a three-year framework with four ESG pillars. The strategy included setting up a system to capture carbon emissions data and a carbon reduction plan in line with science-based targets, and client and investor expectations.

Welcoming all three new leaders to the business, The Access Group CEO Chris Bayne said: “These new hires each bring with them an impressive array of experience and track record of success that will be pivotal in supporting our teams as they continue to develop as we grow.

“We are committed to employee wellbeing, exceptional customer experience and sustainable practices across The Access Group. I am confident that Caroline, Mark and Carla will each play a vital role in delivering this as we start the new year.”

Over £475,000 set to be invested in Burbage and local area as part of new homes development

Loughborough expertise to help tackle problems in UK fruit production industry

Developments at Loughborough University are helping tackle problems at the heart of the UK’s fruit production industry.

Sales dip at Eurocell against challenging market backdrop

NAHL in “robust position” following “year of solid progress”

NAHL, the marketing and services business focused on the UK consumer legal market, is in a “robust position with cause to be optimistic for the future,” following a “strong financial performance” in 2023.

In an update on trading for the financial year ended 31 December 2023, the Kettering-based business revealed that revenues for the period are expected to be £42.2m, 2% ahead of the prior year.Meanwhile, profit before tax is anticipated to be in line with market expectations at £0.6m, holding steady with the same figure in 2022.

James Saralis, CEO of NAHL, said: “2023 represented another year of solid progress and I am delighted to be reporting a strong financial performance for NAHL.

“Whilst the personal injury market remained subdued, we have successfully completed our transformation into an integrated law firm with improved cash generation and NAL increased cash from settlements by 73% to £6.0m. Critical Care has delivered a strong financial and operational performance and there is an exciting opportunity to deliver further market share growth.

“The Group continued to generate high levels of cash and this led to a 27% reduction in net debt to £9.7m, which was well ahead of market expectations. The steps we have taken in recent years to enhance the Group have borne fruit and NAHL ended its financial year in a robust position with cause to be optimistic for the future.”

Revenue slips at Van Elle

Revenue has slipped at Van Elle, the Nottinghamshire ground engineering contractor, according to interim results for the six months ended 31 October 2023.

At £68.2m, revenue was 16% below the same period of the prior year (£80.8m), with the comparative period benefitting from stronger housing, construction and infrastructure markets. Meanwhile pre-tax profits dipped to £2.5m, from £3.5m.Mark Cutler, Chief Executive, said: “These results represent a resilient performance in the face of expected challenging market conditions throughout FY2024, reflecting the benefits of the Group’s diversified end-market exposure.

“Despite the anticipated lower revenues, operating margin has been maintained at FY2023 levels, our balance sheet is stronger, and our future prospects are more compelling. We are very pleased with the acquisition of Rock & Alluvium shortly after the Period end.

“The Group is developing a strong market position in the energy and water sectors and is well placed to benefit from a recovery in activity levels in housing, construction, rail and highways in FY2025.”

Revenue drops at Forterra

Revenue has dropped at Forterra, the manufacturer of clay and concrete building products, according to a trading update for the year ended 31 December 2023.

With weak demand, full year revenue totalled £345m, down from £455m in 2022.

Despite challenging market conditions, however, the business does expect to report full year adjusted EBITDA slightly ahead of expectations.

During the year, faced with increasing inventory levels, Forterra made reductions to production, with the mothballing of factories, shift reductions and production breaks. The business has also looked to deliver savings through restructuring commercial and back-office functions. Such management actions during the year are set to deliver annualised fixed costs savings of over £20m.

Looking ahead Forterra said: “The outlook for our industry remains subject to considerable uncertainty and, with a general election expected in 2024, demand is anticipated to remain subdued in the near term.

“However, with the long term under supply of housing in the UK continuing to worsen, and UK brick despatches now running at levels last seen in 2009, the Board remains confident in the Group’s ability to benefit as our key markets recover.

“Recent reductions in mortgage interest rates will improve the affordability of new homes, thus increasing demand for our products.“