Monday, October 13, 2025

A group of entrepreneurs from Northamptonshire have graduated from the first cohort of an incubation programme facilitated by the team at Vulcan Works.

The inaugural Vulcan Creatives, a six-month programme funded by West Northamptonshire Council and the UK Shared Prosperity Fund (UKSPF), commenced in January and saw 10 businesses work with business growth manager Darren Smith to either turn an idea into a viable business or grow their fledgling enterprise.

The entrepreneurs who took part in the programme were selected from tens of applications with a preference given to those working in the creative or digital sector – emerging industries in the county that Vulcan Works was created to support.

Those who completed the programme attended a Vulcan Creatives Showcase event to mark their graduation. During the event, each participant gave a presentation about their journey to the specially invited guests.

Nabil Abbas, who has developed a decentralised instant messaging app, found the programme “really helpful and really useful,” saying that the sales training provided helped him to find developers in the same way he would find customers and Darren introduced him to people in his own network. He was also able to work on his networking and presenting skills, with Vulcan Works loaning him space to hold his own networking events too.

He said: “I would really recommend this programme, regardless of the industry you are in. The biggest challenge I had was finding the right people. The technology I am developing is really new and that limits my talent pool in terms of other developers I can work with and my options in moving the business forward.

“I’m happy to report that I now have a small team of developers and we are working together on some really exciting projects that are going to be integral to what I want to build. Being surrounded by other like-minded entrepreneurs gave me the chance to bounce ideas off people who weren’t in my tech bubble and Darren really has gone above and beyond to help me.”

Emma Colton, a brand photographer who works with female business owners, had never done networking or presenting before and has now delivered workshops, including a branding workshop for her fellow Vulcan Creatives. In doing this, she realised her background in graphic design was of huge added value to potential clients and has added this to her service offering and developed logos and branding for some of her Vulcan Creatives counterparts.

She said: “I didn’t expect there to be so much camaraderie and for us to build such a strong network between us. I have come away from this with friends, which I didn’t expect to happen.”

Chelsea Henry joined Vulcan Creatives as an experienced interior designer who had been made redundant from a role working in show homes. She didn’t have a business when she started the programme in January and launched Knook Interiors in May.

She said: “I joined Vulcan Creatives with nothing. I didn’t have a name, logo or business plan, just a vision to empower people through interior design and make it attainable for all. Through Vulcan Creatives, I have been able to collaborate with some amazing people. Emma did my branding, I have designed a space for Vulcan Works and Roddy has done my photography. Having Darren to go to – a person I can trust for business advice – has been invaluable.”

Musician Matt Lewis wanted to develop his band, Party Beats, into a collective, ‘Pick and Mix’ option that enables clients to create their own band from a group of musicians for events.

He said: “I had been operating as a business for six months and got to a point where I was getting frustrated and didn’t know what the next step was. Then, through luck or the universe, I found Vulcan Creatives. I have learned a lot and had tons of breakthrough moments. Our four-piece band is now a collective with more musicians on board and we can do more than one event on the same night under the band name.

“The workshops have been fantastic and the help from Darren has been mindblowing. I started thinking about my cash flow after a workshop with Natwest and realised I had made a fatal mistake of not planning ahead in what, it turns out, is a seasonal business. I had a breakthrough in the sales workshop too and realised I had been approaching it all wrong. I feel I know so much more about sales funnels, branding and marketing, which is great.”

Roddy-Lloyd Jones, a retired teacher who created a portable photography studio in a decommissioned ambulance, had a similar experience. He said: “I was a teacher for 37 years and it has been amazing to collaborate and work with other people that help you to learn continually. I launched LJPhotostop in October.

“Workshops from Barclays and Natwest have provided me with so many insights that, coming from the world of education, I just had no experience of. Like Matt, I noticed the seasonal element to my business and have started doing property photography and weddings. Rather than a jack-of-all-trades photographer, I now own a business in photography.”

Gary Morgan created Enable AI, an artificial intelligence assistant, weeks before being accepted onto Vulcan Creatives. He said: “I arrived at Vulcan Creatives with an idea. Emma has helped with my branding. I have a website about to be launched and I just want to say thank you to Vulcan Creatives.”

Gavin Prior runs Pixli, a business that produces virtual reality and augmented reality apps. He said: “Pixli was essentially an idea in my head in January and I came to Vulcan Creatives to see how I could turn that into a business. I’ve met a really good network of people and everyone has just helped each other, which I didn’t realise I also needed.”

Tamara Holland, founder of Dot & Stripe, already had a successful marketing consultancy but wanted to niche down and specifically work with children’s activities providers. She said: “Vulcan Creatives gave me the confidence to push the imposter syndrome to one side and go ‘all-in’ with targeting my niche of children’s activities providers.

“This year I have had a huge boost in revenue and some incredible opportunities to host training and workshops to my ideal customers. With the support of my fellow cohorts, Darren and the additional training and support, I have been able to smash my goals.”

Hairdresser Aprille Russell and make-up artist Aveline Rust run Glam-Start, a hair and beauty academy. Aprille ran a hair salon from home and Aveline also ran a permanent make up and beauty clinic from home. Both felt there was a demand for a course in the industry that taught you how to run a beauty business, rather than just training in the various beauty and hairdressing qualifications.

Since joining Vulcan Creatives, the duo have run taster days of their courses, launched a website and have taken on workspace in Vulcan Works that they are in the process of moving into, ready to commence their courses in September.

Aprille said: “Since January, we have dedicated every Wednesday to coming into Vulcan Works to work on the business and meet with Darren. He has been a huge help to us – the contacts he has, the information he has given us – we just can’t thank him enough. The taster days also led to sales, which we wouldn’t have had if Vulcan Works hadn’t lent us the space to host them.”

Darren said: “Vulcan Creatives was a brand new idea and has been helped by so many individuals and businesses who have put on clinics, workshops and masterclasses which has been appreciated.

“We wanted to guide entrepreneurs with an idea through a process to create a business and make use of the great facilities at Vulcan Works and it has been great to see the success stories of those who have taken part. I’m also really proud of the fact that we have been able to help these businesses with grant applications too, resulting in all of them being awarded a £1,000 grant from the UK Shared Prosperity Fund.

“One thing that has been key and a great part of this programme has been the way that everyone has collaborated together. Some have even been each other’s first customer.”

Vulcan Creatives is now open for pre-applications for the next cohort, which begins in September.

Knaresborough pest control manufacturer and supplier Pelsis Group has acquired Nottingham-based garden care product manufacturer, Doff Portland, strengthening the group’s portfolio of retail, agricultural and professional brands.

Established in 1946, Doff Portland manufactures a number of leading brands and private label products for major retailers in the UK and EU. These brands include Doff, Portland Garden, Power Up and Green Fingers.

Speaking about the acquisition, Pelsis Group CEO Alex Ashmore said: “In Doff we have found a strong partner to complement our own well known retail brands and channels. The combined strengths of Pelsis’ distribution network and Doff’s product portfolio in the UK and Europe will make a powerful combination of brands and channels for our customers,” he said. “We are excited to welcome the Doff team to the Pelsis family.”

Doff Portland becomes a wholly owned subsidiary with its 85 employees, customers and suppliers welcomed into the Pelsis Group.

The deal follows Pelsis’ acquisitions of Brandenburg (2022) and Sanitrade (2021) which focused on the Professional Pest Control categories. Doff Portland provides a good balance to Pelsis’ portfolio, with its well-known retail brands and commitment to offering sustainable and environmentally responsible products and solutions to pest management issues, ahead of increasingly stringent global regulatory requirements.

Commenting on the sale, Doff CEO Ben Shapiro said: “This acquisition presents a phenomenal opportunity for Doff. There is a great fit in terms of our vision and values. Both businesses have been focused on investing in their portfolios of environmentally responsible products for amateur and professional users.

“This will continue and the combination will hugely benefit our employees and our customers as we find new opportunities for growth.”

Pelsis was advised by Alvarez & Marsal and DLA Piper. Doff Portland was advised by Hill Dickinson and Cavendish.

A Clowes Developments employee is to run the Robin Hood Half Marathon in support of Fairham’s charity partner, Lincolnshire and Nottinghamshire Air Ambulance (LNAA).

Last year, representatives from Homes England and Clowes Developments, the delivery partners bringing forward Nottinghamshire’s brand-new 606-acre neighbourhood, Fairham, committed to raise funds for Lincs & Notts Air Ambulance.

To boost fundraising efforts Lucy Bloor, Marketing Assistant at Clowes Developments, who is involved in the marketing of Fairham, has pledged to lace up her running shoes and take on the challenging Robin Hood Half Marathon in September 2024.

Lucy said: “I’m thrilled to be taking part in the Robin Hood Half Marathon as part of #teamhelimed29 supporting Lincs & Notts Air Ambulance, one of the UK’s leading Helicopter Emergency Medical Service (HEMS) charities, funded purely by the generosity of people within the community.

“They are not part of the NHS and are not funded by the Government. Instead, they rely on the generous support of the community to fund the £13m need to keep the charity operational this year. Having visited their headquarters and hearing first-hand from the crew the amazing work they carry out every day, I will be wearing the Lincs & Notts t-shirt with pride throughout the event, and I hope to raise as much as I can for them.”

LNAA Corporate Partnerships Manager, Joe Harper is delighted that Lucy has chosen to raise vital funds for the air ambulance charity and said: “Every year we are called to more emergencies and with an average mission costing £4,000, it is only through the generosity and goodwill of supporters like Lucy that our crews can be by the side of patients when they need us most.”

The Robin Hood Half Marathon is one of the longest established and most popular city centre road events in the UK. It is also the largest charity fundraising event in the city, raising over £330,000 for charity in 2019. Taking place on Sunday 29th September, the event starts and finishes at Victoria Embankment. The undulating 13.1-mile loop sees runners pass famous landmarks such as Nottingham Castle and Wollaton Park.

Fairham is in the process of becoming a whole new neighbourhood for Nottingham with 3,000 new homes, one million sq ft of employment space and 200 acres of open green space. There will also be a neighbourhood centre and new educational, community, sports and leisure facilities.

Due to Fairham’s locality and the vast amount of construction work taking place on site to deliver this new neighbourhood, it became apparent that in the event of an emergency, it would likely be the LNAA that would play a vital role in saving someone’s life. HSE reported that in 2022 to 2023 out of 135 workplace fatal injuries, 45 happened within the construction industry.

The LNAA offers a vital life-saving service providing pre-hospital emergency treatments to seriously ill or injured patients at the scene of an incident. Whatever the time of day, they are at the side of patients when they are most in need.

Additionally, its Leonardo AW169 helicopter is one of the most modern helicopters flying today and can reach a top speed of 216mph and has a cruising speed of 180mph; three times faster than a land ambulance, which means its team of highly skilled clinicians can reach anywhere in the counties of Lincs and Notts, including Fairham within 20 minutes.

Fairham delivery partners, Clowes Developments and Homes England, selected the local charity to benefit from any funds raised at the development during the 10–15-year lifespan as they deliver the brand-new neighbourhood. Lead infrastructure contractors, O’Brien Contractors Ltd contacted Clowes Developments about supporting a local charity with a generous donation of £2,000 which Clowes will be matching, bringing the total donated so far, to £4,000.

LNAA brings the equivalent of a hospital emergency department to patients at the scene, giving those with the most severe injuries and medical conditions the very best chance of survival when minutes matter.

Its iconic yellow helicopter is a top of the range (HEMS) aircraft offering head to toe access to patients in flight. Crew also carry blood on board, allowing them to deliver potentially life-saving blood transfusions at the scene. A typical call out costs around £4,000.

To support Lucy and Lincs & Notts Air Ambulance you can donate here: https://www.justgiving.com/page/lucy-bloor-1720173839869?utm_medium=fundraising&utm_content=page%2Flucy-bloor-1720173839869&utm_source=copyLink&utm_campaign=pfp-share

Private equity firm Endless LLP has announced the sale of Kennelpak’s retail business, Pets & Friends, to family-owned PSR Trading Ltd (PSR), owner of retail chain Just for Pets.

This strategic move allows Kennelpak, the pet specialist wholesaler, brand owner and distributor, to accelerate the growth of its Wholesale & Distribution division.

Following initial investment in July 2017, Endless has supported the Kennelpak management team in transforming Pets & Friends into a successful service-led retail proposition offering pet parents an array of pet care services underpinned with a carefully curated range of products and accessories, to satisfy all pet needs.

Pets & Friends includes 19 stores, 17 grooming salons, a website and subscriptions service, a dog training centre and The Grooming Academy with locations predominantly across Nottinghamshire and Derbyshire. Pets & Friends will continue under its existing trading name, operating alongside Just for Pets. All Pets & Friends store and salon colleagues will transfer to PSR ensuring that the expertise that Pets & Friends stands for remains.

James Woolley, Endless Partner, said: “Pets & Friends has grown exponentially during our period of ownership and, after investing in a high-quality management team led by CEO Claire Bayliss, we have worked with them to reposition and transform the retail business at every level, creating a platform for growth which we are proud of. We extend our best wishes to the team at PSR Trading as they take Pets & Friends into the future.”

Claire Bayliss, Chief Executive Officer, Kennelpak, said: “Under our management and the investment from Endless, Pets & Friends has undergone a significant transformation at every level, evolving from a Midlands-based retailer to a much-loved multichannel pet specialist brand with national reach.

“I am immensely proud of the market-leading brand we have built together, and the exceptional service that our colleagues deliver to customers. Their hard work and dedication have been crucial in making Pets & Friends the success it is today, and I thank them all for being part of our transformation journey.

“Our Wholesale & Distribution division has been the cornerstone of Kennelpak’s heritage for the past 50 years. Our aim is to strengthen its position as the trusted pet specialist, with an even greater emphasis on supporting our distributor partners’ plans for growth and continuing to deliver exceptional service for our customers.

“We wish the team at PSR Trading all the very best for the continued growth of the Pets & Friends brand.”

New Engineering, an engineering business which operates sites in Worcester, Derby and Kidderminster, with around 120 employees across the three sites, has entered administration.

The company was formed in March 2023 following the acquisition out of administration of the business and assets of Neos Superform Limited and Neos Composite Solutions Limited.

Mike Denny and Mark Firmin of professional services firm Alvarez & Marsal Europe were appointed as Joint Administrators of New Engineering on 1 August 2024.

Mike Denny, Joint Administrator, said: “New Engineering has been experiencing significant cash pressures in recent months, exacerbated by project delays, cost inflation and limited availability of trade credit.

“As Joint Administrators, our priority is to explore all the available options for the business at pace, and we encourage any interested parties to contact us as soon as possible.”

Rolls-Royce SMR has completed Step 2 of the Generic Design Assessment by the UK nuclear industry’s independent regulators – the Office for Nuclear Regulation, the Environment Agency and Natural Resources Wales – and will move immediately into the third and final Step.

The GDA process assesses new nuclear power plant designs for deployment in the UK, demonstrating they can be built, operated and decommissioned in accordance with the highest standards of safety, security, safeguards and environmental protection.

This announcement confirms Rolls-Royce SMR’s position ahead of any other Small Modular Reactor in Europe. Rolls-Royce SMR will further exploit this significant advantage by moving immediately to Step 3 ‘detailed assessment’.

Helena Perry, Rolls-Royce SMR’s Safety and Regulatory Affairs Director, said: “The completion of Step 2 of the GDA is the most important milestone to date in advancing deployment of Rolls-Royce SMRs in the UK.

“We have built fantastic momentum, and the team will move directly into Step 3 of this rigorous independent assessment of our technology – ideally positioning us to deliver low- carbon nuclear power and support the UK transition to net zero.”

Rolls-Royce SMR will be the first new nuclear power station to be designed and built in the UK for more than a generation and offers a radically different approach, delivering new nuclear power based on proven technology. Each ‘factory-built’ nuclear power station will provide enough affordable, low-carbon electricity to power a million homes for more than 60 years.

Rolls-Royce SMR is currently engaged in the Great British Nuclear SMR technology selection process. A successful outcome from that selection process, this year, will create and sustain thousands of high-skilled, long-term jobs and unlock enormous export potential.

Students from Parkside School were challenged to create a new logo to be used by the Chesterfield Town Board, which is driving forward almost £20 million of investment over the next ten years.

More than 80 designs were submitted by students from the school, and from these Cindy Lin’s design was chosen as the winner by a panel of Town Board members. Cindy Lin, aged 15, said: “I can’t wait to see my design attached to some really exciting projects!”

The logo will be used to help promote initiatives being spearheaded by the Town Board over the next ten years.

Chesterfield Town Board is made up of local business and community representatives, together with public sector organisations, and is responsible for deciding how to spend almost £20 million of funding announced as part of the Government’s Long Term Plan for Towns.

Dominic Staniforth, a Partner at BHP LLP Chartered Accountants and Chair of the Chesterfield Town Board, said: “I want to thank all the students who submitted their designs for the Town Board logo, there were some fantastic entries, and it was a difficult job to select one winner. Cindy’s design reflects our town and will help identify the projects led by the Town Board.

“Chesterfield is already a great town full of wonderful people and organisations that share a common purpose to make it even better – a place to live, work, invest and study – and this funding will further bolster our ability to deliver on that collective ambition.”

The winning design includes the town’s most iconic landmark, the Crooked Spire, and will now be turned into a digital logo that can be used throughout the programme.

Andy Kelly, Headteacher at Parkside Community School, said: “We are delighted that Cindy’s design for the Chesterfield Town Board logo was chosen as the winner. She is an incredibly talented artist who has done a fantastic job in capturing an iconic image that shows our town moving from strength to strength. We look forward to seeing Cindy’s design across Chesterfield over the next 10 years!”

Regional housebuilder Allison Homes has hired three new team members, to grow its marketing team and further develop the company’s brand.

Michael Hudson, Dan Bursnall and Connor Nottingham have been appointed as Group Marketing Manager, Regional Marketing Manager and Digital Marketing Executive respectively. The trio will all be based at Allison Homes’ head office in Peterborough, with Michael and Connor working on the company’s Group marketing and Dan covering its East region.

Michael has worked in marketing for more than a decade and in 2022 made the move to housebuilding, spending time at both Avant Homes and Miller Homes. Dan has been in the property sector for 13 years and began his career in sales, and Connor joins Allison Homes with five years of experience from working in digital marketing agencies.

Michael, now living in Chesterfield, said: “I joined Allison Homes as I wanted the opportunity to work for a trusted housebuilder at an exciting time of growth and development. I’m thrilled to be in a business that has a genuine culture of friendliness and offers support for its all employees.”

Dan, from Cambridgeshire, added: “I was looking to build my career with an organisation where I could make a difference. Being local, I knew a lot about what Allison Homes was doing in the area and was blown away by the quality of homes and passion of the staff. When this role came up, I applied immediately and was thrilled to secure the position.”

Connor, from Peterborough and now living in Deeping St James, Lincolnshire, said: “I wanted to join a company where I could fully commit myself, and work with a team that truly believes in its goals and cares about its customers. Having heard great things about Allison Homes, I knew I had to apply.”

Michael’s role as Group Marketing Manager includes making strategic brand decisions, analysing data and creating attention-grabbing campaigns.

Michael said: “There’s no such thing as a typical day and that’s why I love working in marketing. From HR and sales, to technical and commercial, getting to know people in different walks of life makes my job fun and varied, and helps me to create marketing materials and brand documents that are more effective.

“I’m looking forward to supporting Allison Homes through its exciting growth plans. As we grow into more sites and regions of the UK, I’m keen to ensure our brand stays consistent and that the incredible work we do achieves high levels of success.”

In his role as Regional Marketing Manager, Dan covers the marketing for upcoming and active developments and campaigns in the East region, as well as assists with the company’s Partnerships division.

Dan said: “The needs of the developments drive the priorities, so I could be working on a brochure for an exciting upcoming site, creating a new campaign to promote a particular home, or out on site looking at signage opportunities.

“Everyone at Allison Homes has been incredibly welcoming and supportive, and it is a genuine pleasure to be part of this outstanding team. Property marketing is my passion, and I am excited to establish myself at Allison Homes and make a meaningful contribution to the company’s success.”

A farmer-led cooperative has secured the funding needed to initiate trading opportunities for sustainably-minded farmers in North Lincolnshire, with the support of Lincolnshire and East Yorkshire’s largest law firm, Wilkin Chapman.

The firm joins agricultural machinery supplier Peacock & Binnington as the first sponsors of the Northern Lincolnshire Environmental Farmers Group (EFG), which aims to deliver positive environmental change, funded through natural capital trading.

The organisation aims to increase biodiversity in North Lincolnshire, improve water quality, achieve net carbon farming by 2040 and generate new trading opportunities for farmers.

The Northern Lincolnshire EFG is the 10th group of its kind to be established across the UK since 2020, with the EFG network now comprising 433 farmers, covering around 3% of England’s farmed area and a trading pipeline worth c. £10 million.

The Northern Lincolnshire group – which covers areas surrounding Grimsby, Scunthorpe, Immingham, Louth, Crowle and Epworth – has been set up by local farmers Andrew Jackson, from Pink Pig Farm, and William Sowerby, from Farming Forward. The group is now appealing for more members in the area.

Catherine Harris, head of the agriculture sector at Wilkin Chapman, said:

“When farmers work together, they can have a great deal of power. While there are groups that represent farming as a whole, the EFG is a rapidly growing voice for farmers who are particularly mindful of their sustainability, as well as their financial success.

“Farming plays a major role in the care of our ecosystem and I know environmental custodianship is very important to a great many farmers, so we hope that supporting the establishment and growth of this EFG will help farmers to work together to achieve this.”

The first Environmental Farmers Group was officially launched in May 2022, after a group of farmers came together in the Avon area to build on their local Farmer Clusters to strengthen their position to deliver environmental goods and services for fair reward.

It was convened by the Game & Wildlife Conservation Trust (GWCT), which founded the Farmer Cluster concept and whose scientific research is behind many of DEFRA’s ELM scheme agri-environment options. Against a backdrop of the transition away from the Basic Payment Scheme (BPS), the group grew in numbers and expertise, eventually forming a cooperative two years later.

The EFG acts as a trusted navigator for farmers and landowners in industries that focus on natural assets such as soil, air, water, plants and animals (known as the ‘natural capital sector’). Its goal is to use scale and member cooperation to secure the best environmental results and financial returns for a wide range of natural capital goods and services.

Members of the EFG get access to trading opportunities in natural capital markets, guidance on how to trade and benefit from farmer buying power in natural capital markets.

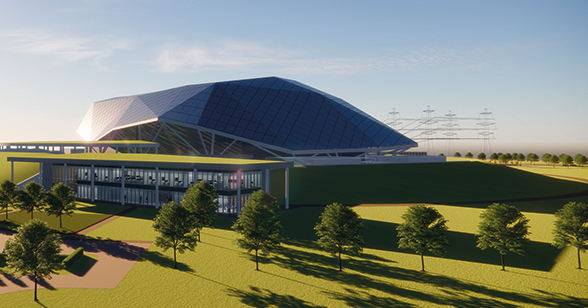

Bricks Group, development and management specialists in the student and co-living sectors, has secured £84.5m in funding from London Wall Lending to support the delivery of high-end Purpose-Built Student Accommodation (PBSA) on a former Royal Mail site in Nottingham.

The landmark new scheme will see the transformation of the former Bendigo Building site in the center of the city, which lay vacant for nearly two decades before its demolition in 2023. Once complete, the scheme will contain 752 beds over 13-storeys, with the potential to rise to 781 beds subject to planning permission.

The accommodation will be managed by Bricks’ in-house operating brand, true student, building on its brand portfolio of more than 7,000 beds across the UK. It will also provide a range of indoor amenities and landscaped gardens as well as commercial units on the ground floor for residents and the neighbouring community.

The 28-month loan facility will fund the two-stage transformation of the building by Graham Construction, with potential for a further £5.5m of funding to be unlocked if planning permission is achieved.

The deal represents the latest collaborative venture between the two firms, with London Wall having funded the development and disposal of Bricks’ Discovery Quays 1 and 2 schemes in Salford Quays, as well as providing a further £4m gross facility to assist with the purchase of a 355-bed PBSA plot in Leeds.

John Graham Construction has been selected to deliver Bricks’ vision for the scheme, with Fladgate providing legal support and Knight Frank providing valuation services.

Lev Loginov, Partner at London Wall, said: “This is our first investment in Nottingham, and is illustrative of our strategy to support ever-growing residential demand across the UK’s regional markets.

“With a strong student population spread out across two top-class universities, the city is going from strength to strength and presents exciting opportunity for development. Having worked extensively with Bricks in the past, we’re confident in the business’ ability to seize on this sentiment and provide a top-quality option for the area’s student community.”

Peter Prickett, Founder and CEO of Bricks Capital, said: “We have a well-established relationship with London Wall built over a number of successful projects, so when the chance arose to deliver much-needed student accommodation in such an iconic Nottingham building, we knew that it was one we needed to take.

“The UK remains an attractive proposition to both home and international students, and we’re continuing to experience surging demand for the services provided through our true student brand. We look forward to meeting the students of Nottingham and working to allow them to make the most of their university experience in the years to come.”