- Wednesday 9th October – Chasing Stars Quiz Night, Wollaton Sports Association

- Thursday 10th October – Cake Sale, Forever Stars Serenity Centre, QMC Nottingham

- Friday 11th October – Pink & Blue Day, and One Step at a Time 26-mile fundraising walk

- Saturday 12th October – Siblings Workshops and Plant a Pink or Blue Flower

- Sunday 13th October – Charity Shield with John Pye, Wollaton Sports Association

- Monday 14th October – Make Lemonade Comedy Night, Wellbeck Hall

- Tuesday 15th October – Wave of Light; light a candle at 7pm

Sunday, October 12, 2025

Nottingham-based John Pye & Sons is preparing to field what it hopes is its best ever team for an annual Charity Shield Football match, with the goal of regaining the winners title to take the lead in games won since the Forever Stars charity fundraiser began in 2022.

With the teams currently tied at one win each, this year’s Charity Shield – at Wollaton Football Club on Sunday 13th October – has all the makings of a highly competitive game, says John Pye’s Head of Client Account Management UK & Europe, Tom Fishwick: “With each team having one victory under their belt, everything is up for grabs this year.

“The 2022 and 2023 matches were both fantastic, and while Forever Stars does have some strong players, I am confident we’ve got a great team this year. It’s a tough result to call, but I predict a 4-2 win for John Pye!”

The Forever Stars Charity Shield is one of several highlights of the charity’s packed programme of fundraising events marking Baby Loss Awareness Week (BLAW), an annual event, now in its 22nd year, which runs from the 9th to the 15th October.

Tom comments: “Baby Loss Awareness Week is incredibly important, providing an opportunity to bring people together as a community. It offers a safe and supportive space for anyone affected by pregnancy and baby loss to share their experiences and find comfort in knowing they are not alone.

“As such, Baby Loss Awareness Week is an important week of the year for Forever Stars, and we thought a football match between Forever Stars and John Pye would be an excellent way to bring people together while supporting the cause.

“I, along with many others at John Pye, have a long-standing connection with Wollaton Football Club and they generously provide their pitch and clubhouse free of charge for the Charity Shield.

“The main event is the football match and this kicks-off off at 1pm. Alongside, there will be plenty of fun activities for families, including raffles, food stalls, and penalty shootouts, making it a great day out for everyone!

“Ultimately, the day is all about raising awareness of baby loss and money for Forever Stars – the two matches to date have raised a combined £7000 total, and we hope to boost this already incredible total amount in 2024.”

Michelle and Richard Daniels created Forever Stars in May 2014 following the stillbirth of their daughter Emily on 19 December 2013. The charity is dedicated to supporting families living in Nottingham and the East Midlands who have suffered a stillbirth or infant loss.

All funds raised by Forever Stars during BLAW will go towards its 10th birthday campaign project, Supporting 1 in 4. Richard explains: “Ward A23 at Nottingham’s Queens Medical Centre is where around 10 families per day visit when they are having a miscarriage.

“The demands on the ward are huge but the resources for families are very limited, so we want to completely revamp their treatment rooms, garden and waiting room, as part of our 10 year anniversary, to reinforce our core values of supporting local baby loss families from hospital through to the community.”

Tom adds: “Although John Pye & Sons now operates throughout the UK, we are proud to be a Nottingham-based company, with our Head Office located in the city. Social value is at the core of our business, and we actively support numerous charities both in Nottingham and across the country.

“Forever Stars is one of our chosen charities, and is a remarkable local organization. The story behind its founding is deeply heartbreaking, but what Richard and Michelle have built, driven by their tragic loss, is truly inspiring. We are honored to support their incredible work in any way we can.”

“I thoroughly enjoy supporting Forever Stars, and the activities during BLAW are always brilliant,” he adds. “Since the partnership started my John Pye colleagues and I have supported various activities, from helping paint one of the rooms at the Serenity Centre at QMC, to volunteering at the Forever Stars Serenity Garden, donating raffle prizes and supporting the events during BLAW.

“Our team have got to know Richard, Michelle and the Forever Stars’ army of volunteers, and listened to their personal stories, the heartbreak they have gone through, and how they have turned this into a positive. The whole Forever Stars are inspiring, and it’s an honor to be able to play a small part in helping raise awareness and funding.”

Forever Stars’ full programme of events for BLAW 2024 is:

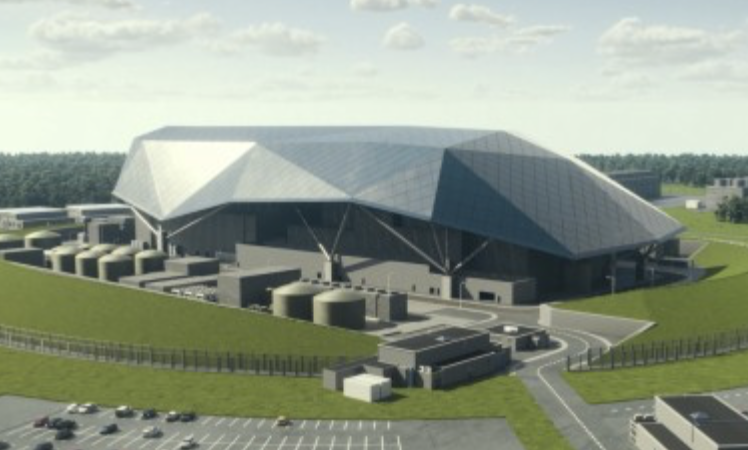

Rolls-Royce SMR has been shortlisted in the Government’s competition to select and contract providers of Small Modular Reactor technology.

The announcement by Great British Nuclear names Rolls-Royce SMR – alongside three international SMR vendors – and confirms that Rolls-Royce SMR will be invited to negotiate with GBN on the deployment of UK units.

Chris Cholerton, Rolls-Royce SMR CEO, said: “Rolls-Royce SMR is the UK’s only SMR company and is already 18 months ahead of competitors in the regulatory approvals process. Today’s news that we will progress to formal negotiation with GBN will help us to maintain this important first-mover advantage.

“Rolls-Royce SMR has been chosen by the Czech Republic to deploy a fleet of SMRs and is in the final two in Sweden’s SMR selection process. Success in the UK will further strengthen our position as the leading SMR company and ensure the UK is able to capitalise on this transformational opportunity for the domestic supply chain.”

The Czech Republic announcement came only days before the UK Government decision, and t’s said that reaching a successful outcome in the GBN selection process, at pace, will enable immediate investment in the UK supply chain, create jobs and deliver the long-term energy secure and low-carbon future that the country needs.

Projects in Chesterfield and Worksop are amongst contracts won by Leeds-based Dudleys Consulting Engineers to provide structural and civil engineering support for four new care homes.

The new contracts, which also include Bradford and Durham, follow similar care home and retirement living projects for Torsion Care in Shipley, Bingley, Brighouse, Sleaford, Lincoln, and York for which Dudleys provided full engineering consultancy support.

Torsion Care is also poised to deliver a new 72-bedroom care home in Chesterfield after securing planning consent subject to conditions. Dudleys is supporting the redevelopment of the former Walton Works, including Grade II listed mill buildings for the care home alongside new housing.

Works are also due to commence on site next month in Worksop where Torsion is building a new 70-bed care home within the expanding development at Gatefold Toll Bar in Worksop. Dudleys is delivering full civil and structural engineering support, working alongside Watson Batty Architects which is designing the scheme.

John Currie, MD at Torsion Projects, said: “It is a pleasure to appoint Dudleys on our next roll out of schemes. Their support and expertise from inception through to completion on multiply projects at the same time allow Torsion Projects to maintain its growth plan and deliver exceptional schemes on programme.”

Paul Brownlow, Director at Dudleys, said: “Our team is highly skilled in working with challenging brownfield sites that need varying levels of remediation from historic use or local environmental impact and we admire Torsions commitment to rejuvenating often difficult sites to provide much needed new community focused facilities.”

Torsion Care is a part of Torsion Group, a privately owned independent company focused on developing residential, student living, care homes and retirement living apartments. With a pipeline of more than 5,000 units in the UK, Torsion Care delivers modern care homes, assisted living, and extra care facilities for operators across the UK. Torsion Care offers a complete turn of key service from finding land, obtaining planning permission, and constructing care facilities in a partnering approach with operators and investors.

Businesses across the Harborough district have benefitted from the Harborough Rural Grant Scheme.

The scheme launched in June 2023, with grants available between £5,000 to £20,000, under four categories including Innovate and Grow, Rural Tourism, Farm Business Diversification and Green Technology.

Langton Brewery in Thorpe Langton has used its grant for innovation and growth to open a new fermenting hall. This expansion has allowed the brewery to significantly increase its production capacity, enabling them to meet growing demand and diversify their range of craft beers. It has also enabled the business to create new employment opportunities within the community.

Fox’s Furrows campground at Houghton on the Hill has introduced a new boutique cabin for holiday lets, providing a luxurious retreat in a serene rural setting. With a second cabin due to be installed shortly, this project promises to boost rural tourism and create an attractive destination for visitors seeking a countryside escape.

Little Cobblers has transformed its offering with a new outdoor play area since being awarded a grant for rural tourism. This development enhances the cafe as a destination for families, offering a safe and enjoyable space for children to play while their parents enjoy the cafe’s local produce.

A business to receive funding for green technology is Pennbury Farm in Great Glen which has installed solar panels on one of its buildings. This move towards renewable energy is helping the farm cut its carbon footprint and reduce energy costs.

The Harborough Rural Grant Scheme is administered by Harborough District Council and supports businesses to diversify, innovate and grow. A total of £350,000 has been allocated to this project which has been funded by the Rural England Prosperity Fund under the UK Shared Prosperity Fund.

Cllr Jo Asher, Cabinet lead for Culture, Leisure, Economy and Tourism, said: “We are thrilled to see the positive impact these projects are having on our rural communities. All four businesses have each demonstrated remarkable dedication to growth, innovation, and sustainability, and their success sets an inspiring example for others to follow.”

The scheme is still open for applications until Thursday 31 October 2024.

Time For You, the Northampton-based domestic cleaning franchise, has appointed Emma Stawarz as its new Operational Support Manager.

With a successful track record as a Time For You franchisee, Emma brings invaluable experience and insight to this role, where she will focus on providing enhanced support to the company’s growing network of franchisees.

Emma Stawarz’s connection to Time For You is both personal and professional.

As a successful franchisee herself, Emma has firsthand knowledge of the challenges and rewards that come with running a Time For You franchise. Her new role as Operational Support Manager allows her to leverage that experience to provide guidance and operational support to franchisees across the UK.

Emma’s role will see her working closely with franchisees to ensure they receive the operational backing and resources they need to continue growing their businesses and providing excellent service to their clients.

“I’m incredibly excited to take on this new role,” said Emma.

“Having run my own franchise, I understand the unique journey that franchisees go through and look forward to using my experience to support them in every way possible, ensuring they have the tools and resources to succeed.”

As the wife of Managing Director Sam Stawarz, Emma’s appointment further reinforces the family-centered ethos that has defined Time For You since its inception in 1997. The business has always placed a strong emphasis on supporting its franchisees as part of its extended family, and Emma’s role is key to maintaining and strengthening that connection.

“We’re thrilled to welcome Emma to the operational team,” said Sam Stawarz. “Her experience as a franchisee and her passion for helping others succeed make her the perfect fit for this role and of course, she has a unique understanding of our core family business values.”

As Time For You continues to grow, with over 220 franchises nationwide and increasing demand for domestic cleaning services, Emma’s role will be critical in maintaining operational excellence. Her main focus will be to ensure that franchisees receive consistent, high-quality support to help them grow their businesses and provide reliable services.

“I’m committed to helping our franchisees reach their full potential,” added Emma. “I’ve been in their shoes, and I know what’s needed to run a successful franchise. My goal is to provide them with the operational guidance and resources they need to thrive in this competitive market.”

A property consultancy has announced 24 promotions across the East Midlands following a strong period of success for the firm.

Fisher German has promoted staff based at its offices in Ashby, Market Harborough and Newark across several areas of the business.

In Ashby, Joanne Ziemelis and Mary McKenzie have been promoted to associate partners, while Abigail Hicklin, Maisy Moseley and Robyn Dearden have been promoted to associates.

Flo Gilman and Henry Mawhood have become senior surveyors, John Nicol and Victoria Heath have progressed to senior planners, Kay Smith has been promoted to senior architect and Rachel Lumsden to senior administrator.

Amanda Davies has been named head of people operations, Eleanor Saunders-Brant has been promoted to head of people experience and Laura Taylor has progressed to head of marketing, while Trish Wilkins has become senior talent acquisition manager and Laura Jane Taylor is now senior marketing manager.

Finally, Rob Griffiths has been promoted to finance manager, Jo Inwood to senior talent coordinator and Charlie Pook to senior systems administrator, while Dominik Michalski has become a developer and Hugh Gilmore a project manager.

In Market Harborough, Matthew Trembath has been promoted to senior associate, and James Butlin has become a senior surveyor, while in Newark, Alex Morrison has been promoted to associate.

The promotions are among 53 that Fisher German has made across all areas of the business as part of its ongoing growth.

They come after a successful 12 months for the firm which has seen it expand and relocate its offices in London and Birmingham and invest in an extensive refurbishment project at its Manchester office as it looks to strengthen its city-centre presence.

Fisher German has seen its national headcount almost double since 2017, with 806 staff members now based across its network of 26 offices.

The firm has made the latest promotions as part of its ‘Grow’ career progression framework which gives employees a clear pathway to advance within the business.

Richard Benson, Senior Partner at Fisher German, said: “This round of promotions sees more than 50 colleagues move up within the business in recognition of their hard work and consistent high performance.

“The promotions span the whole firm, with representation from all divisions and recognition for those who have been with us for anywhere from one year to 20 plus.

“Our Grow career progression framework provides colleagues with clarity on the competencies and behaviours expected at each level, aligned to our strategy and values, which has helped more people take ownership of their careers and set attainable goals.

“I would like to congratulate all of those who have been promoted for their continued hard work and support as we continue to build a more diverse and dynamic multi-disciplinary property consultancy.

“It is an exciting time for the business as we continue to invest in both our people and our premises, and we look forward to further strengthening our presence in the market going forward.”

Cyber security specialist Rob Kneller has become the third Director of the East Midlands Cyber Security Cluster.

He joins Dr Ismini Vasileiou and David Nicholls in leading the Community Interest Company, which supports regional economic growth by helping organisations to protect their digital assets from cyber threats.

Rob has spent more than 15 years in the cyber security industry and is currently the Director of KIT365 Ltd, a Cyber Security Managed Service Provider and Consultants.

He is vastly experienced in assessing organisations for Cyber Essentials and Cyber Essentials Plus certification and is also a Cyber Scheme Team Member (CSTM), Cyber Essentials Plus Lead Assessor, and NCSC-approved Cyber Advisor.

Rob joins EMCSC in committing to help organisations of all sizes achieve robust cyber security. He provides practical solutions to cyber security challenges faced by businesses today.

“My approach is to communicate complex technical concepts to non-technical audiences and businesses looking to improve their cyber security posture,” Rob said.

“Getting involved with EMCSC is a great way to raise awareness of cyber security across the East Midlands and the UK.

“In meeting new people from diverse fields – both in and out of the cyber security sector – I will be looking to share insights and ideas, offer advice to both the private and public sectors, and widen my own understanding of how cyber security contributes to the improvement of people’s lives.”

EMCSC was founded by Dr Ismini Vasileiou, Associate Professor in Information Systems at De Montfort University, in 2023.

Its purpose is to develop opportunities for networking, knowledge exchange, sharing of best practice, and identification of opportunity. Fellow Director David Nicholls is Managing Director and founder of Leicestershire-based IT company Better-IT.

Dr Vasileiou said: “It’s fantastic that someone of Rob’s experience has joined Dave and I and we are really pleased to have him on board for some of the big plans we have in the pipeline for the next 12 months.”

EMCSC works across public and private sectors, as well as academia, promoting business cyber-resilience and cyber security careers, with partners including the national UKC3 cyber cluster network and the Cyber Resilience Centre for the East Midlands.

East Midlands accountancy firm Cooper Parry (CP) has completed two deals, welcoming UHY Hacker Young Manchester and Haines Watts Thames Valley/Reading to CP.

The acquisitions are CP’s ninth and tenth since 2023, and have seen the business quadruple in size since partnering with Waterland Private Equity in 2022.

The deals see CP expand into the Northwest powerhouse and the UK’s ‘Silicon Valley’, two key geographies for fast-growing mid-market businesses. They also add 200 people across Audit, Tax, Outsourcing and Deals, including 17 Partners, taking CP’s headcount to over 1,400.

The news comes hot on the heels of CP’s recent acquisition of fast-growing London-based Salesforce consultancy, Cloud Orca, and the launch of ATLAST, the global professional services firms’ community CP co-founded.

Ade Cheatham, CP CEO, said: “Two landmark deals over the last couple of days confirms our ambition to create the UK’s next gen professional services group. Acquiring UHY Hacker Young Manchester allows us to establish a powerful presence in the Northwest.

“In the same way, the Thames Valley deal accelerates our growth down the M4 to create the #1 advisory firm in the UK’s ‘Silicon Valley’ and Southwest.

“Our presence at the centre of every key UK business powerhouse – as one iconic and rebellious brand – is key to supercharging the next phase of our expansion and market leadership.

“What Dave Kendrick, Ben Loveday and their talented teams have created gives CP two perfect platforms from which to launch further UK acquisitions, strategic hires and specialist team lifts.”

Dave Kendrick, UHY Hacker Young Manchester CEO, said: “I am hugely proud of what we have achieved over the last few years as a team and taking our amazing 160+ strong team into the Cooper Parry business feels the perfect fit.

“Our growth ambitions, culture, team ethic and industry specialisms feel very much aligned and we now have the platform to dominate the Northwest region as the leading advisory firm.”

Ben Loveday, Haines Watts Thames Valley Managing Partner, added: “I’m really proud of what our team has been able to build here over the years. Looking ahead – and having seen the success of the recent Haines Watts London and Southeast integration – we see Cooper Parry as an ideal fit.

“Culturally and commercially, we’re perfectly aligned to take advantage of the enormous opportunity the Thames Valley presents.”

Experian, the data and technology company, has completed its A$820 million acquisition of consumer and commercial credit bureau, illion, in Australia and New Zealand.

The acquisition and integration of illion’s 500 strong team, data, software and intellectual property into Experian will create a unified business that brings together complementary capabilities, assets, people and customers. The combined organisation is set to enhance market choice and deliver powerful, data-driven solutions for businesses and consumers across the region.

Malin Holmberg, CEO Experian EMEA and Asia Pacific region, said: “Having successfully led the Australia and New Zealand business for the past seven years, Andrew Black, will take leadership of the combined organisation, overseeing the strategic integration and growth plans, leveraging our global innovations.”

Experian A/NZ CEO Andrew Black said Experian’s five-year strategic plan will quickly unlock value of the combined team and capabilities, with the first phase balancing speed and service continuity for customers.

“This is a historic day for our business, our people and our customers – and it’s just the beginning,” Black said. “Through this acquisition we aim to continue our growth trajectory in Australia and New Zealand, significantly expand our market and bring new capabilities to redefine what a data-driven technology business can be.

“illion has built an impressive product portfolio, data assets and customer base that are diverse and complementary to Experian’s strengths and we have a robust integration plan that will enable our customers to quickly realise the benefits of the combined entities.

“One of the big wins here is the combined data assets which will provide more choice for our customers. This is going to supercharge our product and service capabilities, in alignment with Experian’s global strategy, in a way that simply hasn’t been possible before.”

Black confirmed that the new combined entity will be rebranded to Experian, likely within the next 12 months, although some of the illion product names that have gained credible market awareness will continue.

Experian confirmed that John Banfield, CEO of illion, will be stepping down following the successful completion of the acquisition. Banfield played a pivotal role in transforming illion’s performance and culture, culminating in the company’s acquisition by Experian.

Rothera Bray LLP, the East Midlands law firm, has merged with Massers. The merger is a key part of the firm’s ambitious growth plans and marks a significant step forward in expanding its team and service offerings.

The newly merged firm will continue under the name Rothera Bray LLP, with an expected turnover of £20 million for the 2025-2026 financial year.

As part of the merger, all 30 Massers employees have joined the Rothera Bray team. The Massers office in West Bridgford will remain open, while staff from Massers’ Nottingham office will be relocating to Rothera Bray’s Nottingham office in the Lace Market, centralising services and strengthening the team.

Christina Yardley, CEO at Rothera Bray LLP, commented on the merger: “We have a mutual commitment to grow the firm, which represents a fantastic opportunity for everyone to progress in their careers.

“By combining the best skills and abilities from both teams, we can continue to deliver the highest level of service to our clients. People-driven values, which are fundamental to both firms, are at the core of this merger.

“Together, we look forward to continuing our shared commitment to excellence and driving our firm’s future growth, while creating more opportunities for our teams and delivering exceptional results for our clients.”

Massers Director Tim Brooke stated: “From our initial discussions, it was clear that Massers and Rothera Bray share a strong commitment to the same core values and a focus on exceptional client care.

“The entire Massers team is enthusiastic about the opportunities this merger presents. In addition to continuing our excellent service, we are excited to offer our loyal clients access to a wider range of services that we previously could not provide.”

As part of the merger, key members of the Massers team will assume prominent leadership roles within Rothera Bray, contributing to the growth and enhancement of the firm’s services across the East Midlands.

Litigation Director James Carley will oversee and expand the firm’s Litigation services in Leicester, while Conveyancing Director Tim Brooke joins forces with Conveyancing Partner Michelle Young to further develop the firm’s conveyancing services across the counties.

Wills and Probate Director Richard Jackson will lead Rothera Bray’s Private Client team in Derby, and the Commercial Property team in Nottingham will be under the leadership of Corporate and Commercial Director Russell Thompson.

Additionally, Wills and Probate Director Martin Witherspoon, formerly of Sharp & Partners, returns to Rothera Bray to head the Private Client team in West Bridgford.