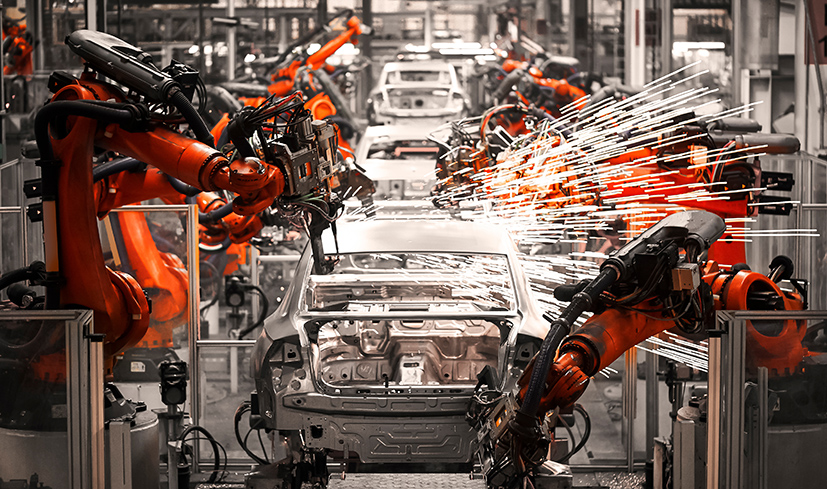

UK industrial companies are set to face a £685 million increase in property taxes, which could offset the recent reductions in energy bills aimed at improving their competitiveness. A new business rates levy, affecting approximately 4,300 large industrial properties in key sectors such as automotive, aerospace, and chemicals, will take effect in April 2026. This levy is part of the broader business rates revaluation, which aims to fund tax breaks for the high street retail, leisure, and hospitality sectors.

This move follows the government’s recent announcement of energy cost cuts for energy-intensive businesses, including the removal of green levies, which is expected to benefit over 7,000 firms. While some sectors, such as steel and chemicals, will receive additional support through reduced network charges, the new property tax increases are expected to offset these benefits.

Experts argue that the UK’s industrial strategy lacks cohesion, with one hand offering energy savings and the other imposing higher property taxes. The country already has some of the highest property taxes in the developed world, and critics warn that this could undermine the effectiveness of the government’s energy support plans.

The government maintains that its approach will create a fairer system for businesses, but industry leaders are calling for a more unified strategy that addresses the full cost burden faced by industrial firms.